The Long Vol Report

Just some quick updates in this post today. As many of you know my Dad has been battling some health issues the last few years and this Summer it progressed a bit with multiple surgeries. Last week he unexpectedly caught an infection post-surgery and was rushed to the ER where he was sent to the ICU for the last four days hence me being absent with the video-cast/article this week. The positive news this weekend is that he is off the breathing machine and talking and, if all goes to plan, will be moved out of the ICU into another floor here tomorrow or sometime this week. I have a little downtime this morning as I go through some work so I want to get this quick note out to start this week and do a quick recap of some earnings last week.

Once things clear up I should be back and I appreciate the messages from those of you that took the time to reach out.

Earnings Season:

Earnings are a big deal for me because they let me not only get the updates on some of the portfolio positions we own in the fund but also to find dislocations that we can start to do work on for eventual new longs. I told readers here back as we started Q3 that there would be “no shortage of ideas” and that was the title of PDF report 29.

And there has not been a shortage with earnings being a big week last week for readers and it’s going to get busier as some names have dislocated a bit….like Paypal.

We’ve covered this in the report as of Q3 and I own a position in this personally and in the fund for our partners, sold off -10% last week from earnings. Adjusted FCF came in lower YoY which was the soft-spot here and that’s all the market needed to drop this and the sell-off was NOT a slow-down in the business but other issues in working capital. They RE-AFFIRMED FY FCF guidance of $6-$7B.

But then again, most don’t read the report and act off impulse which dropped it. Am I mad at it? No, it’s part of this business and you get ebbs and flows plus I run a portfolio not an “eggs all in one basket” approach so while this dropped last week others were up big.

There are improving fundamentals there and price is not showing it which is good for us because we can buy it lower and then get paid out well as others panic….plus management is still planning to buyback $6B in shares this week.

But people panic and that panic presents opportunities and speaking of that we found one of those in Generac a few months back when nobody wanted it…..

Then we had $GNRC: We talked about this in DeltaOne and from what I saw a lot of members put up some serious gains which I am sharing below but this is an example of doing the real work on a Company months ago then sticking with that investment and getting paid off handsomely as it pressed more than +30% since earnings

Sandy

Matt E

+650 on LEAPS

Congratulations to those of you that were in $GNRC ( ▲ 3.39% ) and to those in $PYPL ( ▲ 6.74% ) it’s part of the game - the position was positive into the event then pulled back because of it and that has happened plenty of times in my career and will happen again so if you expect to find “no pain” with investing then I’d suggest you make this one change:

Don’t hold positions for long, switch to a 1-21 day trading window and leave the investing to those that can stomach the ebb-and-flows. One, you’ll feel better and two, I won’t have to hear you complain 😃

Moving on….

I am going to get into an idea from the “Best Ideas” section of the PDF report and explain what I look for when I short an index like the Nasdaq, why I am looking at it in the first place and then break down how that generates other stock shorts from that. For those that are readers you know that I don’t really talk about broad market trading topics like this or really worry about the broad market direction unless it relates to larger moves, likes this, that we might be on the verge of getting soon.

So, I am going to explain this:

Why the high-time frame analysis process matters to me

How to look at the major index and generate ideas off of that index

Anticipating larger moves and why that matters for filtering ideas

Shorting the Nasdaq:

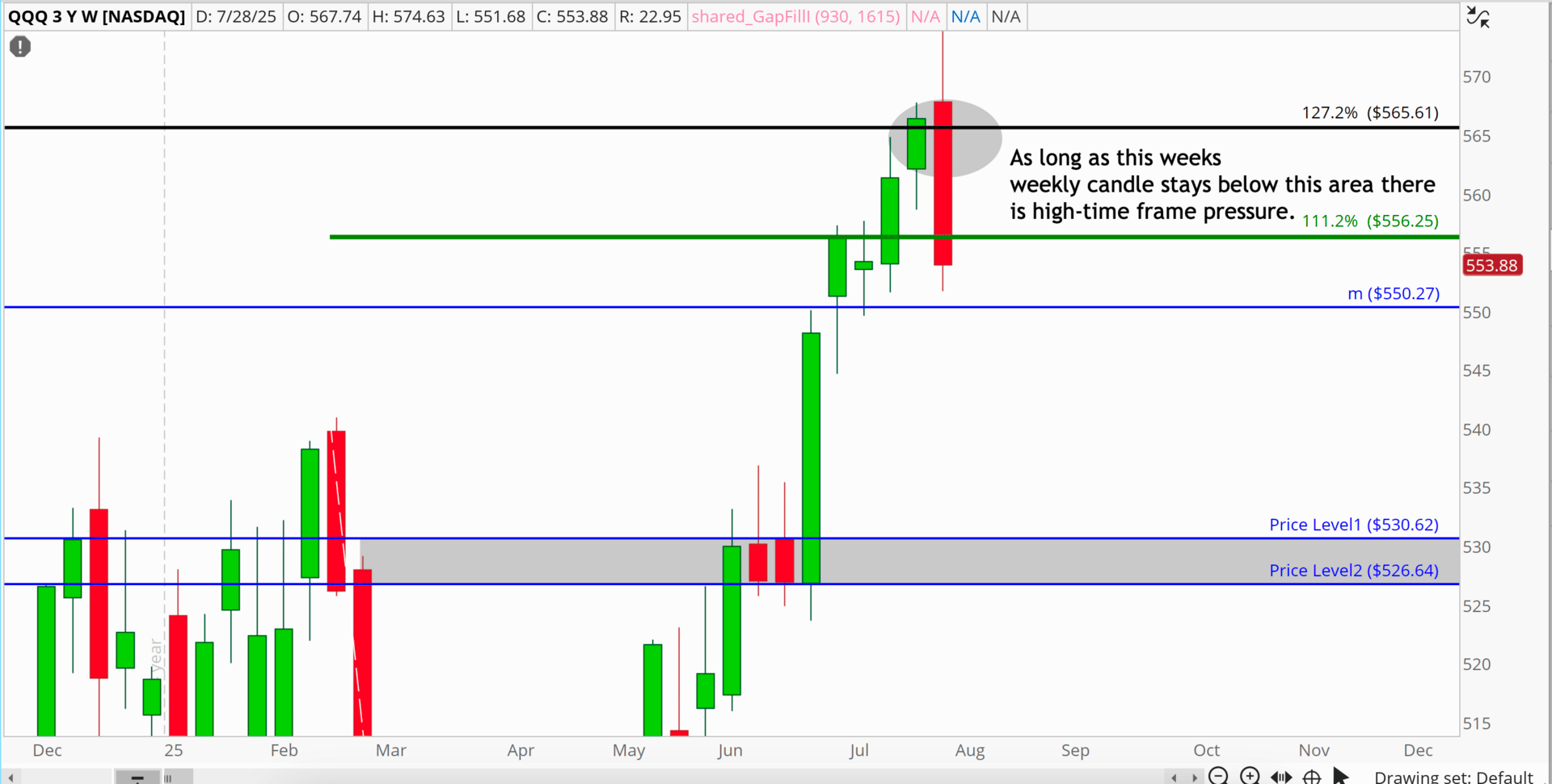

You never really hear me talk about the market highs/lows or any of that because my framework is not focused on that even though I spent the earlier part of career trading those markets as a futures trader. Right now you have a situation where the Nasdaq can open-up, meaning, the sell-off can happen quick and lead to a lot of points.

For me, that style of trade, where there is asymmetry, always catches my attention - for those new here, I can’t give you a lesson on technicals/price action in one post to expect you to get it but you can get through the market-timing lectures, read old posts on this site and then use the other resources in chat to talk with others.

For those of you that have taken the FOPT/are in DeltaOne then you know most of this already as it’s part of the framework to generate idea flow (even fundamental ideas) but it’s also part of the approach to have soft-targets.

The fact that the soft-targets are so much lower here should catch everyone’s attention but if they did not then maybe this post helps to do that.

Then the high time frames, all of them, are bearish. (If you are new here and this concept of time frames is new then I’d suggest the market-timing lectures - I am not selling you and it’s a small amount of money to do it but it’s explained there)

Add in sentiment (jobs, Trump tariffs, Russia and who knows what else) and you have a recipe here to let this get bad in a hurry.

Can we rally to start the week? Yes, and this is where some of you lose the plot because you see a rally as the buying opportunity and not as a chance to sell as it rallies or think of it as a “fake rally” - why? Because you don’t see the potential short-set up given the high time frames - you don’t anticipate it.

Weekly

The daily is near a support, $550, that can bounce - but if we bounce that area there is where I want to see what happens with this. Does it get met with sellers? Does it just rally hard and go? Those are questions I ask today, not at 10am on Monday morning when the market is open.

Daily

If that $550 breaks then I know I want to push the short hard. Inversely, if it rallies to $560-$565 I know I want to see if sellers come in….and if they do, then maybe I start to short this and see where it goes.

Do you see what I said there? I have two scenarios to look at shorts, NOT JUST A BREAK of $550 - because I anticipate that this area above will be weak.

The point here is that you have expectations this week to look for which is what sets apart those that you see on the P&L leader board from those that are not.

Q: But what if it rallies and does not become a short?

A: Then it rallies and there is no short.

Looking at potential asymmetric ideas like this is part of the idea generation process and it doesn’t EVER mean it has to pan out but at least you’re doing the work to look for it which is better than 90% of most arm chair “traders” who wake up Monday morning and start to pretend to do work at 10am.

Generating Ideas from This in Stocks

Some of you know this framework already because I’ve taught you in the SAT Tactics Course on using the indices and other high-beta stocks as a correlated trade idea tool but a quick reminder never hurts.

For those new here this is a quick way to generate trade ideas and given the fact that the Nasdaq can get extremely bearish it’s probably a good time to look.

Most of you that are aware know that the Mag 7 drive the majority of the ETFs out there so when those names move, as do the ETFs. There is a correlation.

If this Nasdaq sells off hard then what happens to those Mag 7 names? You guessed it. They are going to go with it as well.

The idea is that whenever you get these extremes that your thinking should go to: “What can I short in the tech, high beta space or others that follow the indices?”

I don’t care what their fundamentals are, how good their earnings were or that you use their products.

What matters is the correlation to the indices and when panic ensues (or enthusiams’s - look at April lows) then all of these follow naturally.

NFLX Monthly

Meta Monthly

There are plenty more out there but the point is this: If this market decides to roll over then you have your free-reign at shorts on these tech names so it then becomes a question of “what short looks the best?” v. what do I do?

This is how I tend to anticipate things like this because I am forward-looking and if you read last weeks report in detail I said to watch for bearish-outside day reversals as a clue, which we got.

That’s it for this weeks post. I won’t be too active in the Discord this week but there may be a video-cast this week pending my Dad’s situation.

Have a good week.

The AST Swing Alerts Portfolio - updates for members here each week.

Two new positions opened this week

One closed position - $HIMS ( ▼ 0.32% )