Ever wondered why managers can’t beat the S&P500? Because they’re sheep and sheep get slaughtered. - Gordon Gekko

That’s why we created a new approach: The LongVol Report - a report that delivers actionable idea flow to empower investors them instead of confusing them with macro ramblings that make no sense. We cover over +30 long/short ideas each week with a market outlook, best ideas section and updates to price-action and material company info each week.

🚨 Here’s What’s Happening This Week

This week in our PDF Report titled “Rate Cuts So Hot Right Now” we talked about our views on the broad market and Mag 7 names and why the divergence at these highs was something to watch as we head into this rate cut.

25bps is expected but maybe we get 50bps and I don’t see that happening but my concern, as I said for readers this week of the report, were that this has all been priced in hence some of the divergences and distributive price action you’re seeing in the Mag 7 names.

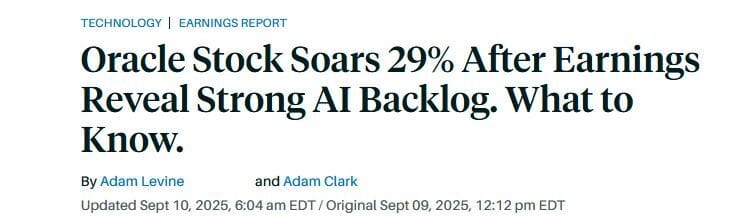

That was a big point this week in the report and while $ORCL ( ▲ 3.34% ) ripped aiding $NVDA ( ▲ 0.68% ) and some other names you saw laggards in $META ( ▲ 0.32% ) $AMD ( ▲ 8.81% ) and $AAPL ( ▲ 2.27% ) with $MSFT ( ▲ 1.18% ) putting in a bearish outside day reversal on Wednesday.

This is not the type of price action you want to see at all time highs.

This chart above makes sense - retail bought the lows in April and they bought the lows in what names? The same ones that are always bought and trick works, until it doesn’t.

I shared a paper here on that idea a few months back when we had the tariff sell-off.

If you read it, those are still my views today which is why we treat the “shiny-object” stocks as trading-sardines more than we do investable companies.

The $SPY ( ▲ 0.73% ) is up +36% from the April lows and I highlighted this measured move completion in this weeks report which likely coincides right into the Fed rate cut where everyone expects a big rally to ensue - I don’t.

But then again, that’s not what we do here. I am not a forecaster of the broad-market and would rather focus on balance sheets, income statements then tactically trade the momentum names across the board.

What was important for this chart to me was this: Price action tends to become distributive, you start to see more bearish outside day reversals and divergences increase - that’s my takeaway, not that the market will “crash”.

I’m aware that the doom and gloomers out there love that idea which is why most tend to buy SPY puts that never pay out, or when they do, tend to run and tell everyone “I told you so!”

For the readers of The LongVol Report you know that this just means a few things:

More active-trading opportunities arise

Expectations of rallies on momentum names start to dwindle

You have a plan for what to trade before the week starts

SPY Monthly Chart

This is not a name we cover in the report and while it’s up I don’t have FOMO on it - in fact, I am happy it was up because it dragged up $NVDA ( ▲ 0.68% ) for us this week near $180s on a gap up on Wednesday. Initially, I was bearish $NVDA ( ▲ 0.68% ) last week but had to reverse the short I had and get long yesterday afternoon which turned out to be the move.

Active trading book

This was the talk of X this morning and I read some of the comments from Doug Kass and others expressing skepticism on the name. To be fair, I just could care less because it brings us full circle into the idea of talking about investments v. actually acting on them and my views are that most like to talk rather than actually trade risk.

Plus, we don’t cover the name in the report and as Van Wilder once said….

🚨 Best Ideas From This Weeks Report

Our best ideas section takes a few ideas that I personally like from the +30 names of coverage in the report and highlights them. For readers, this gives you a quick-read view of what is of interest so you can get through the report in 10-minutes or less.

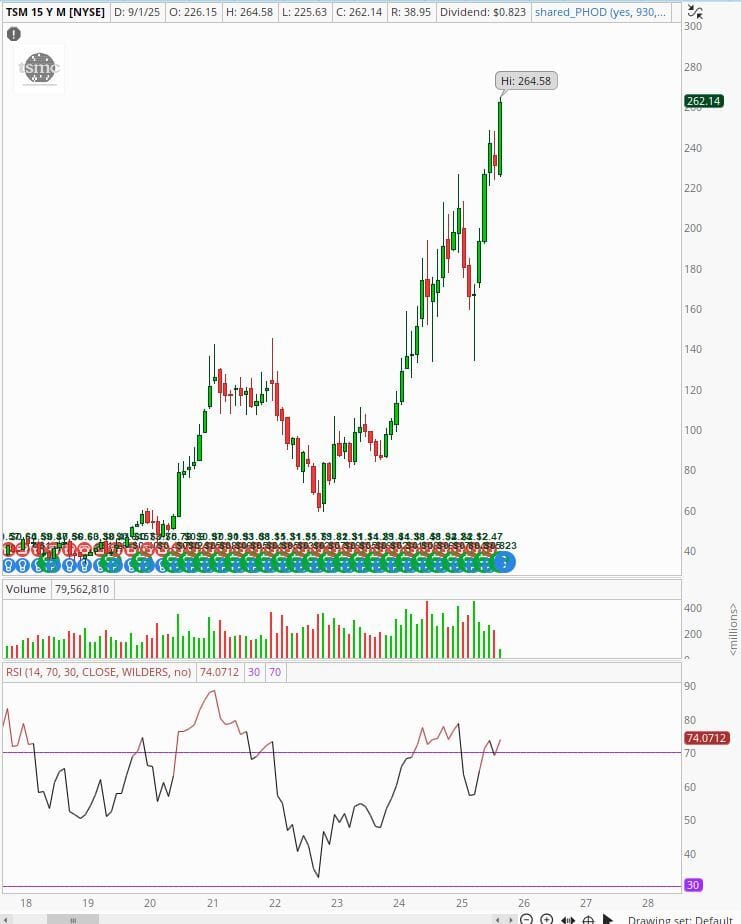

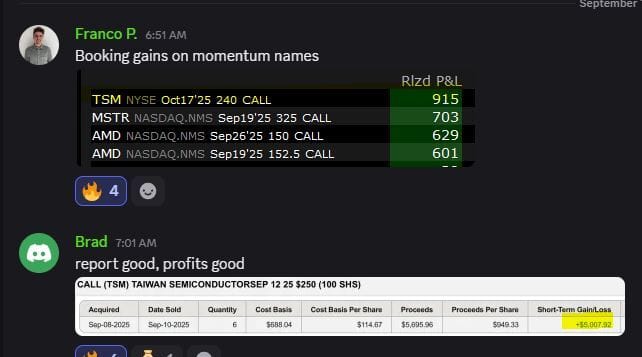

This week we had about 5 names in this section but it was $TSM ( ▲ 4.25% ) - Taiwan Semiconductor that has been the standout with new all-time highs on the week up nearly +10%.

I’ve been covering this name since it was trading sub $100 in this report years ago and we’ve traded it from the long and short side throughout but this move this week was expected and nice.

Many readers of The LongVol Report PDF cashed in this week on the name which is good to see. Personally, I had been long this for a few weeks with equity and various strikes on the name but sold it yesterday - unfortunately. Congratulations to those of you that stayed patient on this idea this week.

$AFRM ( ▲ 1.57% ) was another name from the best ideas section (from a few weeks ago while I was in Japan) and many of you cashed 5-figure trades on that as well. The move post earnings on this was incredible, but, short-lived and likely has to rest and trade back into $80s.

📈 Rotation Nation: Small & Mid Caps

If you recall I talked about this name Astronics a few months ago then posted the write-up on the website for subscribers on why we could see a double into Q226 - so I do like talking about this!

The stock is up nearly +40% since that article and is trading 3x the normal volume as of today meaning we’re only +60% away from the double! #Winning

The Big Picture

Given the turnaround in Boeing and their 737 max production, among other lines, Astronics will continue to benefit.

A record sales backlog of $645 million with $574 million attributed to the aerospace division.

Gross profit margin expansion makes this a turnaround to growth story into 2026 and a potential double from these levels, even being up from where it is this year already.

You’re already seeing flows come into select names and the big part is picking the right names or, trading them via ETFs, like the Russell 2000 which is having a great year despite the negative views of the index at large.

We’ve been pounding the table on small & mid-cap exposure for portfolios the last 3-quarters and honed in on a few names like $ATRO ( ▲ 4.05% ) and others in The LongVol PDF Report.

My views are that we are just getting started and that investors who seek to continue to buy AI-driven names and tech will be left in the dust in coming quarters.

The Russell 2000 $IWM ( ▲ 1.09% ) ETF looks poised to want to attack new highs as we approach $244 and the divergence on RSI reading for this compared to the $SPY ( ▲ 0.73% ) is something of interest to me hence my views on owning select small and mid caps.

I also am a big fan of the $CALF ( ▲ 0.83% ) ETF which I’ve owned in client portfolios all year long and plan to continue to hold as we get into the heart of this cycle. The great thing about this name is the blend of the holdings and it’s not as volatile as select small caps tend to be.

From a portfolio manager view I like that because it allows me to express a larger dollar view on a name while having individual equity names that will give us the upside we want (like an $ATRO ( ▲ 4.05% ) ) making this a great fit.

📮 In Case You Missed It

The Fall 2025 conference is officially closed to new registrants. We will be opening up tickets for the Friday dinner/bar event in Phoenix to those who want to attend - it will be an open bar and food until 11pm, please message us for info.

This is last weeks video and podcast: Small Cap Investing which is probably worth a watch again as we get into the rate cut cycle.

🌐 New Here? Here Are Some Ways I Can Help

The LongVol Report PDF, Sent out each Sunday - 21 Day Trial & Free Copy

Educational Lectures - Coming Soon

Bustamante Capital Management: An Unconventional Asset Manager