🌐 New Here? Here Are Some Ways I Can Help

The LongVol Report PDF, Sent out each Sunday - 21 Day Trial & Free Copy

Educational Lectures - Learn Trading & Investing Frameworks

Follow on YouTube: YouTube.com/TheLongVol

🚨 Here’s What’s Happening This Week

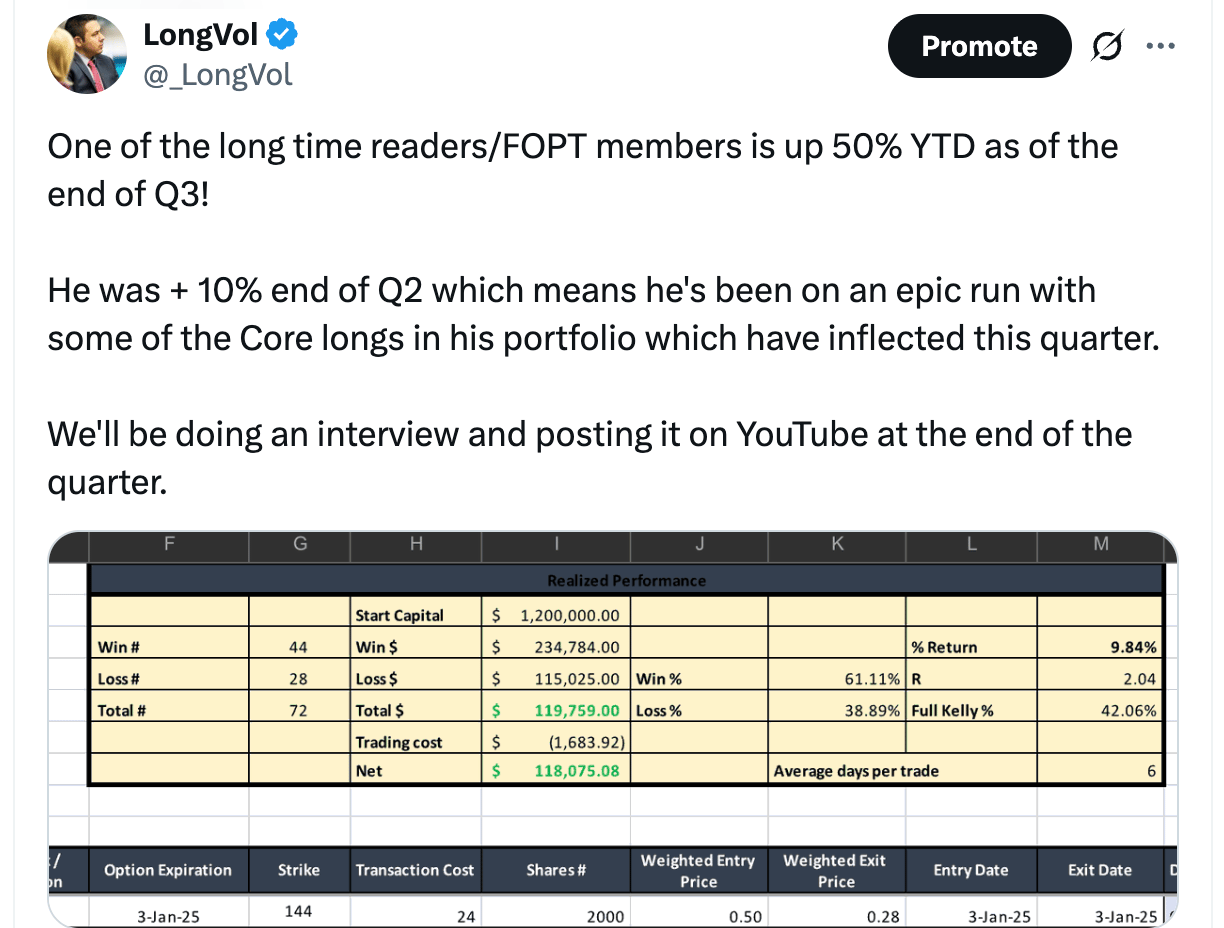

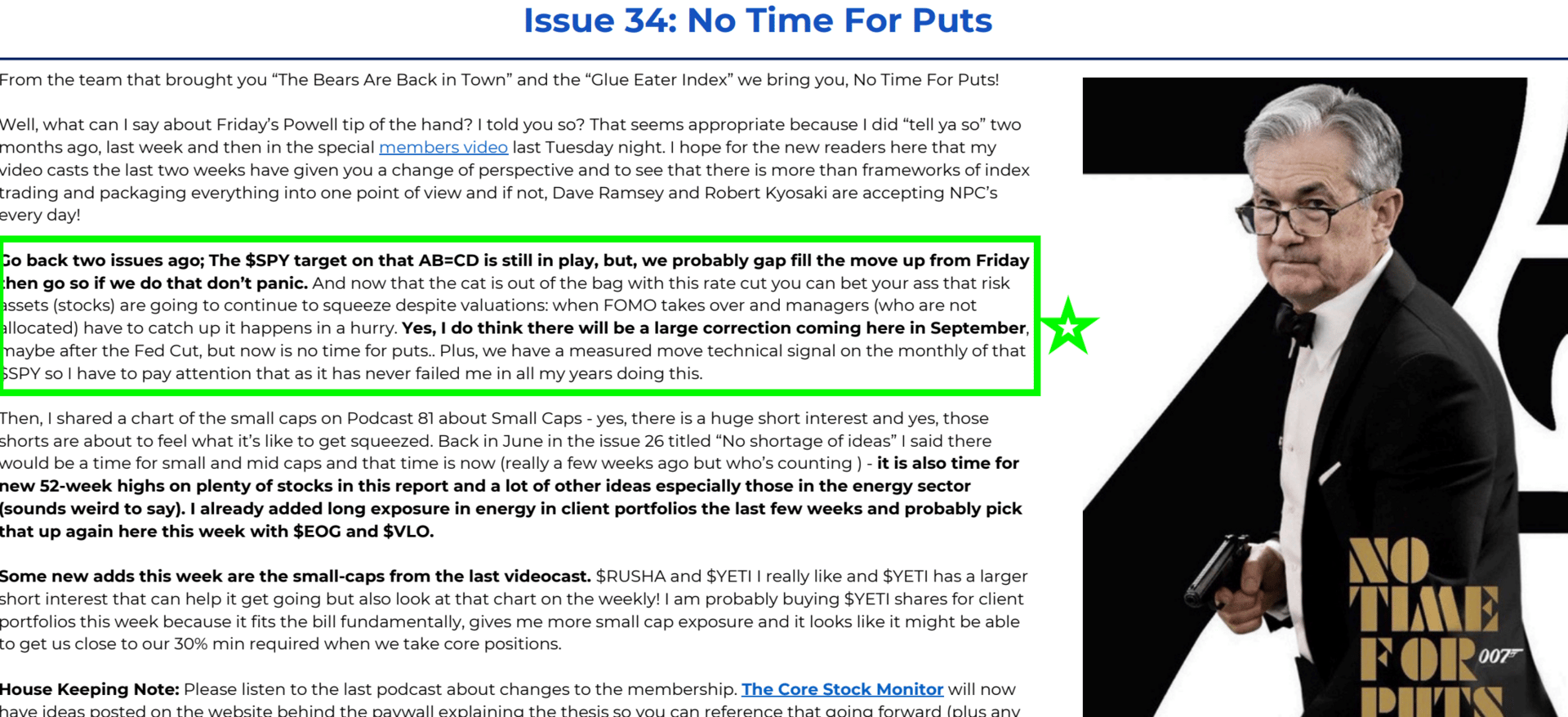

This markets hit new highs again this week but the price action mid-week here and yesterday specifically, looked weak on the broad market. In issue 34 of The LongVol Report PDF titled “No Time For Puts” I talked about my views on why it wasn’t exactly time just yet to be shorting the broad-market or other Mag 7 names which we’ll get to later - and for good reason.

This was posted this week from the White House and if that’s not a read on sentiment for investors then I am not sure what is.

In that issue No Time For Puts I did say that I did expect a broad-market check back here in September and you’re starting to get that as financials yesterday started to lead that with $GS ( ▲ 1.12% ) down pretty bad. Now, I don’t subscribe to the idea as many of you know, of trying to ‘read the tea leaves’ for the broad market but I have talked about the $SPY ( ▲ 0.73% ) specifically in the last few reports and videocast this week.

In, fact this was one of the charts I posted here for readers of this site then and as I put this out Thursday morning the SP E-Mini futures don’t look great.

SPY Monthly Chart

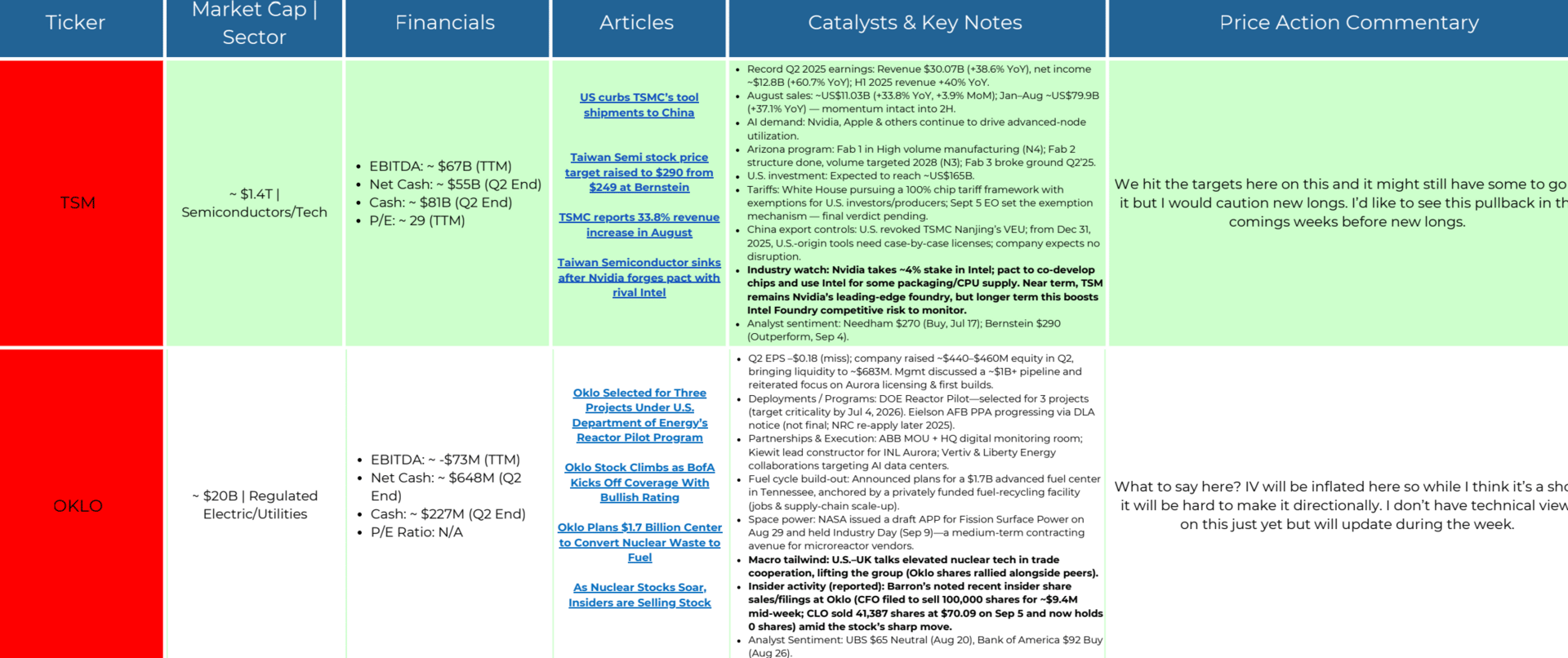

For the first time in a long time we issued holds/targets met in the report on quite a few names - we highlight the cell with a red cell to caution readers. $OKLO ( ▲ 3.12% ) which we’ve been bullish on since $70s this summer and $TSM ( ▲ 4.25% ) were just two of many.

Both are off their highs this week and looking weak as we end this weeks trading.

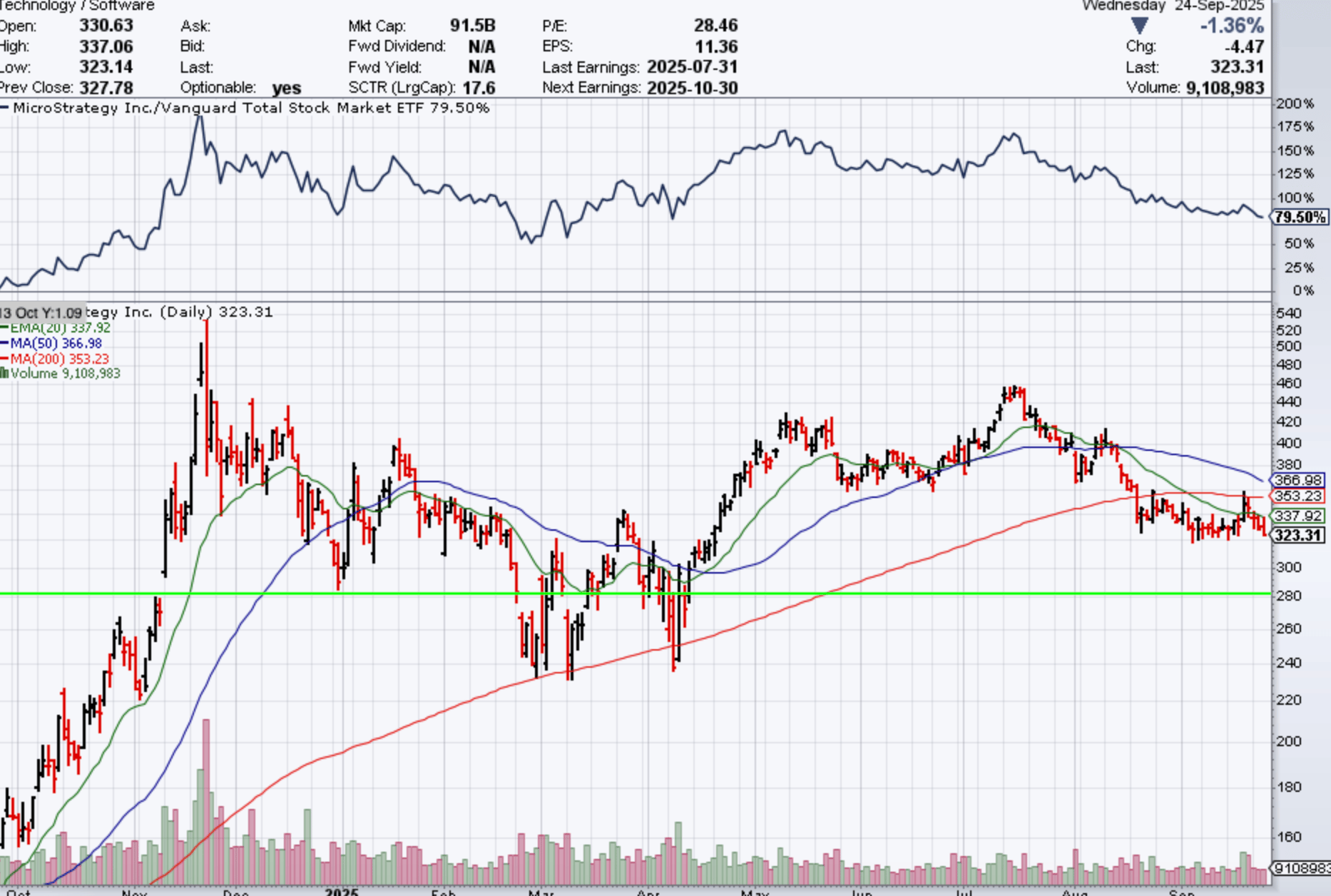

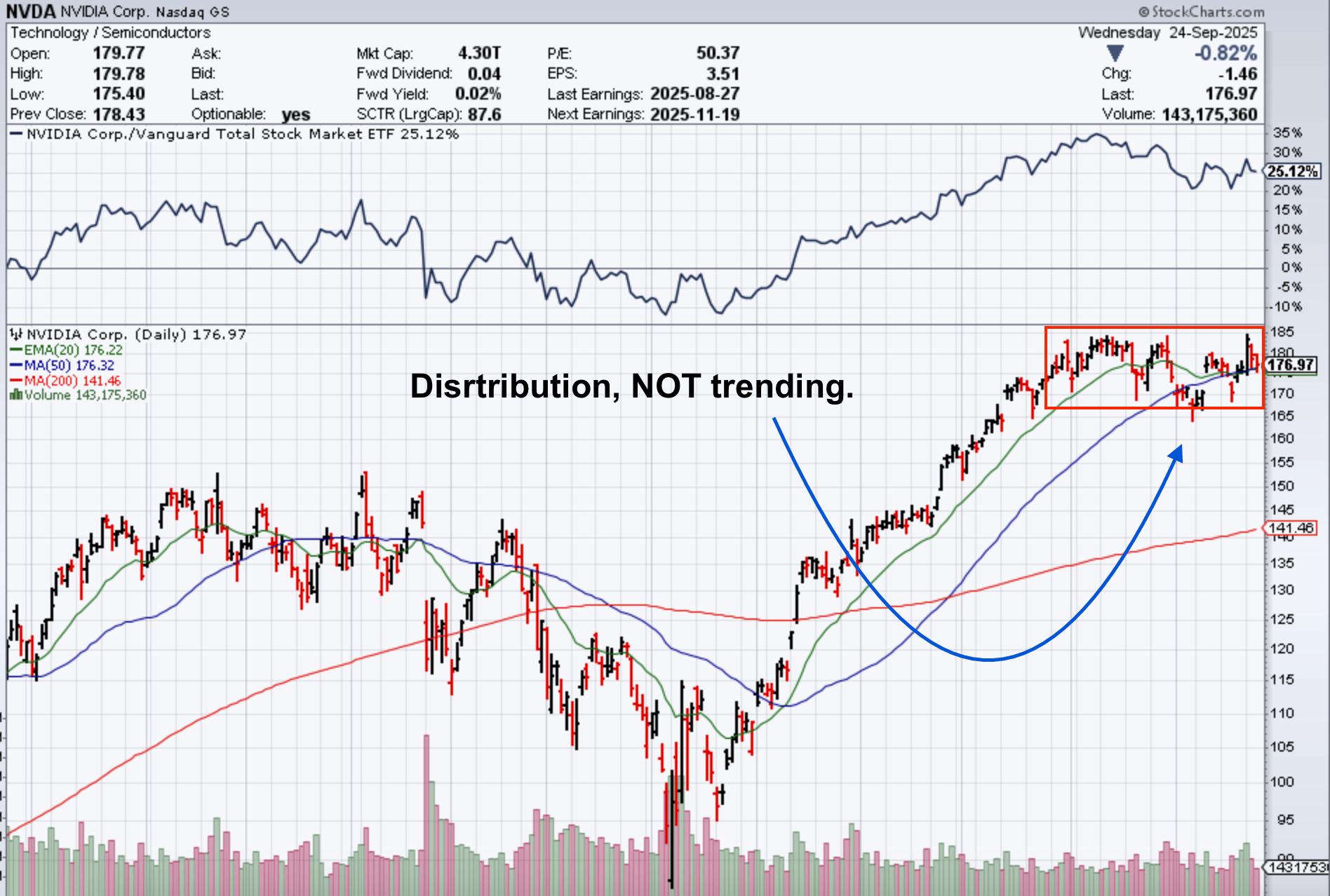

Speaking of shorts, I began building out my short-book last week and added into some more names this week. One of the short-term ideas is $MSTR ( ▲ 0.73% ) which I had been stalking for a few weeks and finally was able to position into yesterday for what’s expected to be a 2-3 day move lower.

MSTR Daily - $300 is Key support

MSTR

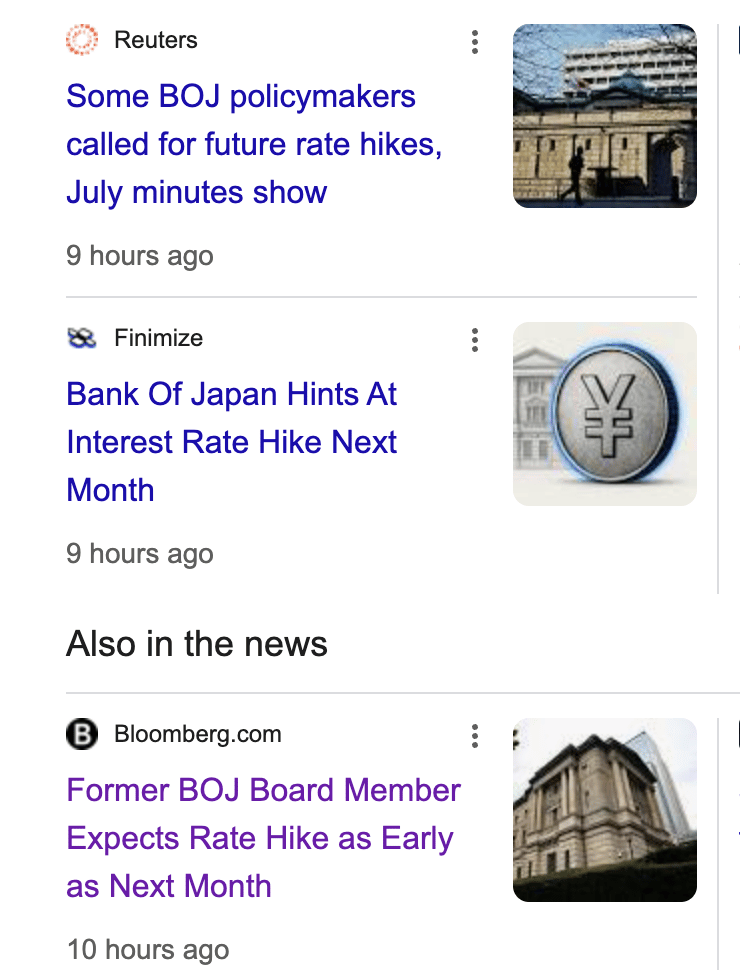

This morning news broke on the Bank of Japan and potential rate hikes coming next month which won’t be good for US equities, specifically Mag 7. I talked about this back Q1 this year and the sell-off with their hike was masked by tariffs.

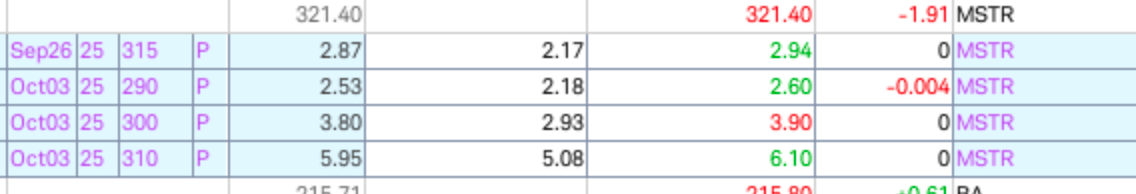

While all of that just adds headwinds to Mag 7 it’s their CapEx spending, and ultimately, the price-chart that has me concerned. For readers of the report I’ve shared my concern on some of them and it’s a story as old as time….

When you get vertical moves in any asset class the inevitable correction comes hard and fast because everyone is all drinking the same kool-aid and nobody wants to leave the proverbial party….it’s not until the hangover comes that people remember that “maybe I should have left sooner”.

NVDA Daily

The obvious question is always timing these things and for those who are initiated then you understand that it’s time to start looking for your short-sided opportunity.

I fully expect many of these high-flyers to come off the highs here to end the week.

🚨 Best Ideas From This Weeks Report

Our best ideas section takes a few ideas that I personally like from the +30 names of coverage in the report and highlights them. For readers, this gives you a quick-read view of what is of interest so you can get through the report in 10-minutes or less.

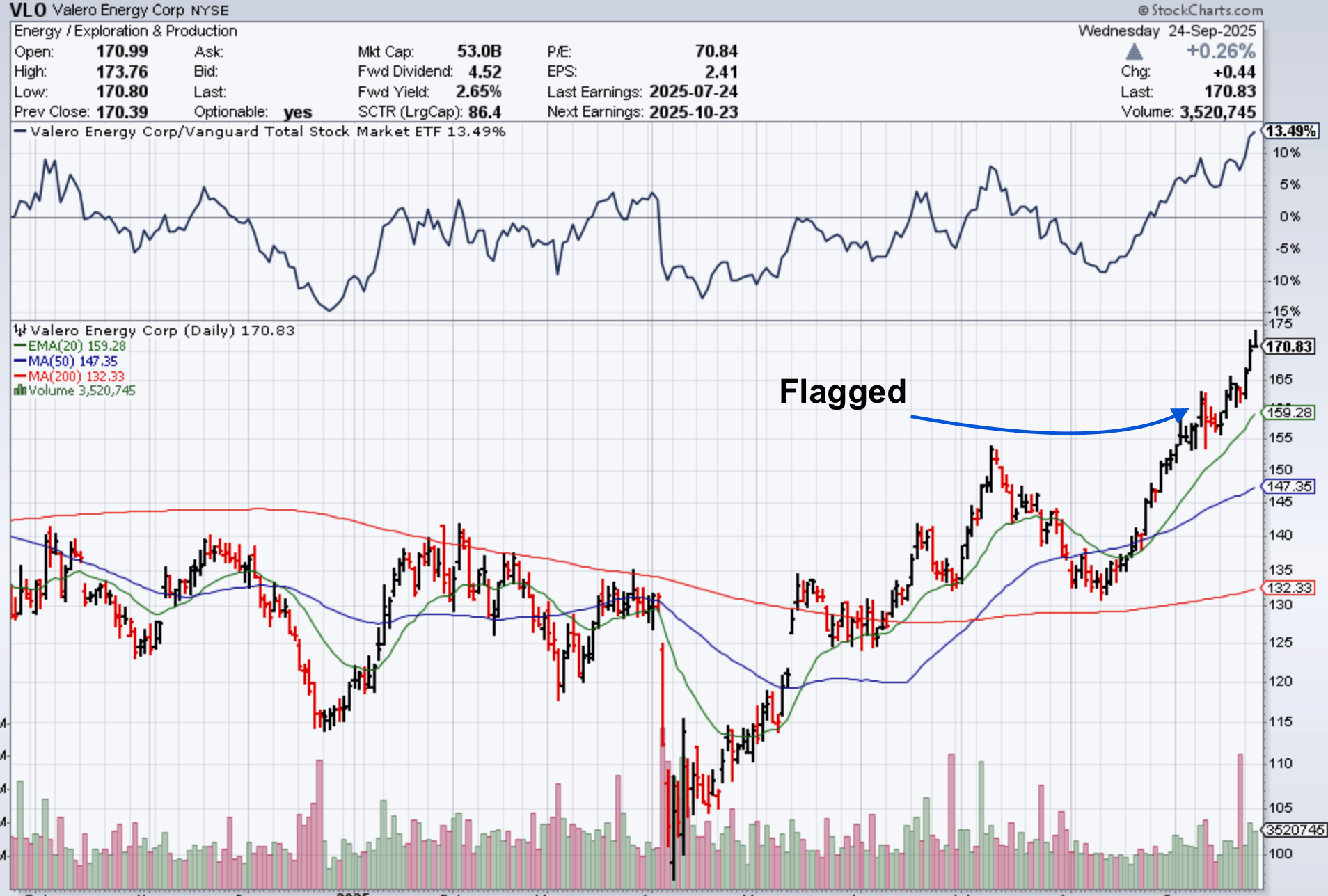

Energy has come alive this week and in issue 35 titled “Rate Cuts & Energy Stock Breakouts” we flagged some of those ideas and $VLO ( ▲ 0.96% ) was a best idea this week.

Valero

There were a few other ideas as well but they have yet to trigger so I am still waiting.

📈 Everyone Loves AI Until They Don’t….

Early on in my career I had a mentor who taught me about the “3 F’s” - Fads, Frauds and Failures. To keep the story short, the idea was that you could always generate ideas through the “3 F’s” and that’s been true for about 15 years though what we do today is really turn-arounds, special situations and event-driven. But when markets get euphoric I always come back to these because the opportunities, on both sides (think $OKLO ( ▲ 3.12% ) long) are just too dam good to pass up.

While I am not saying that AI is a fad, there is a big future here and there will be big winners. However, there will be some frauds and failures both in the short-term as trades and then in the long-term as potential “big shorts” similar to that of what I did on Carvana in 2022.

And that’s what we’ve been doing through this bull-market run and are starting to do now as I think some of them are going to suffer and given that I run a long/short portfolio and am in need of short-exposure I am looking at this sector for shorts only.

🚨 Names I am watching short

$OKLO ( ▲ 3.12% ) - For obvious reasons, no revenue, negative FCF and the price chart is just ‘ridiculous’. It makes it a bit tougher given the implied vols on the options chain now to go directional but there are ways to express this view accordingly.

$SMR ( ▲ 6.59% ) - Similar to Oklo but a little better (and not but much) balance sheet. The $35 level is key for me and if we can close below that here soon I think we are trading back down into mid $20s.

Mag 7 Basket - Dealers choice here but a few of these names should be good short-term ideas given their CapEx spending and concerns starting to bubble up a bit. While I do not think it will be similar to 2000-2002 (I dislike that comparison for many reasons) I am short a basket here small.

To be clear - there are other winners in this space that will emerge, the ‘arms dealers’, so to speak and I am interested in longs there so if you are a reader of this website and want to share your ideas use the community or send an email.

📮 In Case You Missed It

The Fall 2025 conference is officially closed to new registrants. We will be opening up tickets for the Friday dinner/bar event in Phoenix to those who want to attend - it will be an open bar and food until 11pm, please message us for info.

Look for some interviews coming to the YouTube channel in the next month or so with some of our readers and FOPT members. We’ll be diving into some of their idea flow from this Summer and then discussing more of the FOPT principles they apply.