I’ve been working on Wall St. since I was 20. I’ve see almost everything under the sun when it comes to research and trading services and most of it is designed to benefit them, not you — And the truth is most of them suck.

That’s why we created The LongVol Report - a platform created by an actual money manager and former prop trader to give you the insights your financial advisor & Wall Street won’t.

📊📈The Weekly LongVol Report Stock Market Report - Get a 21 Day Trial Here

🎯Options Flows w/ Trader X: Get 3 Trade Ideas Each Sunday - FREE 7 Day Trial

▶️Watch our Bi-Weekly Video/Podcast on YouTube - Watch Now

🚨 Market Headlines This Week

And we’re back! Usually, earnings season is a time where we get surprises but for the most part you know what the print should be and this week was anything but that as many names beat, rallied in pre-market, then rolled over.

For me many of our portfolio names reported this week which made it complex to watch (and I am still listening to calls) and try to trade around which I don’t like to do but that’s whats called for as of late. What it seems to me is that the markets are frothy and that can be for a number of reasons, but, they are frothy.

What’s the reason you ask? Look, I wish I had an answer and I think as investors we always seek answers which is needed but in this instance all I can really come up with is that the markets are frothy and a bit concerned about the underlying economic data. Maybe I am wrong.

What I can saw is that from the lens of price-action this is not what you want to see (good names beating then selling off) and that alone is enough for me!

I saw this earlier in the week and it made sense because many names we were involved in experienced this:

Just to name a few. Is this cause for concern? I think it is and I have to say it again here as I always do; I am NOT a broad market generalist and the portfolios I build out have very little ties to the overall direction of the $SPY ( ▲ 0.78% ).

However, since the markets are frothy (to me) as of now my views are still to hold off on any new longs at these highs until we check-back.

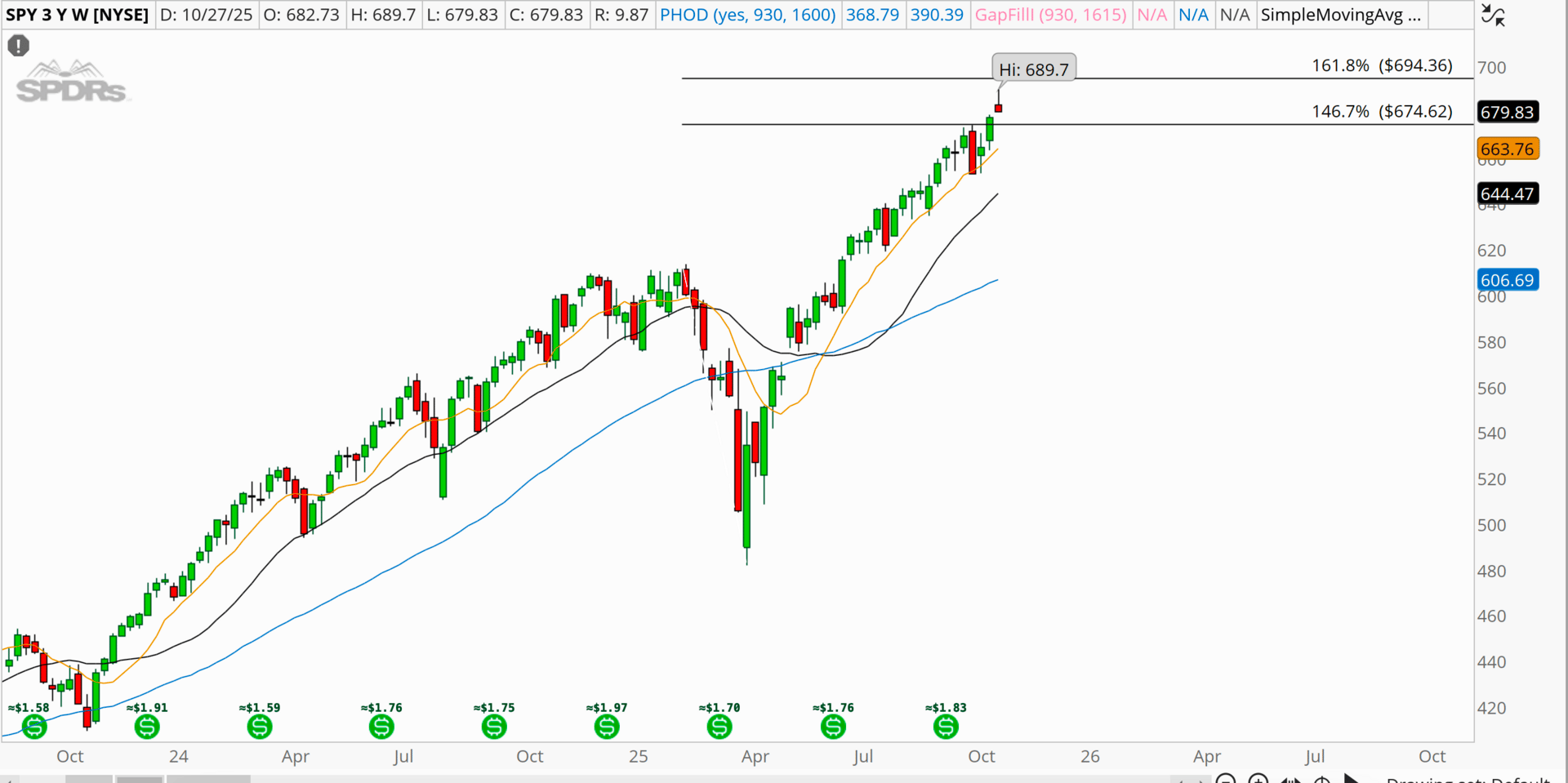

Fib Extension Area

Whether you believe in star-signs, MACD or Fibonacci OR can just read the tea-leaves and see the price action, none of it screams buy.

Michael Burry posted this week and while I don’t really follow him personally, I thought his views were interesting and ones I agree with.

💰 NextEra Energy: Google Partnership

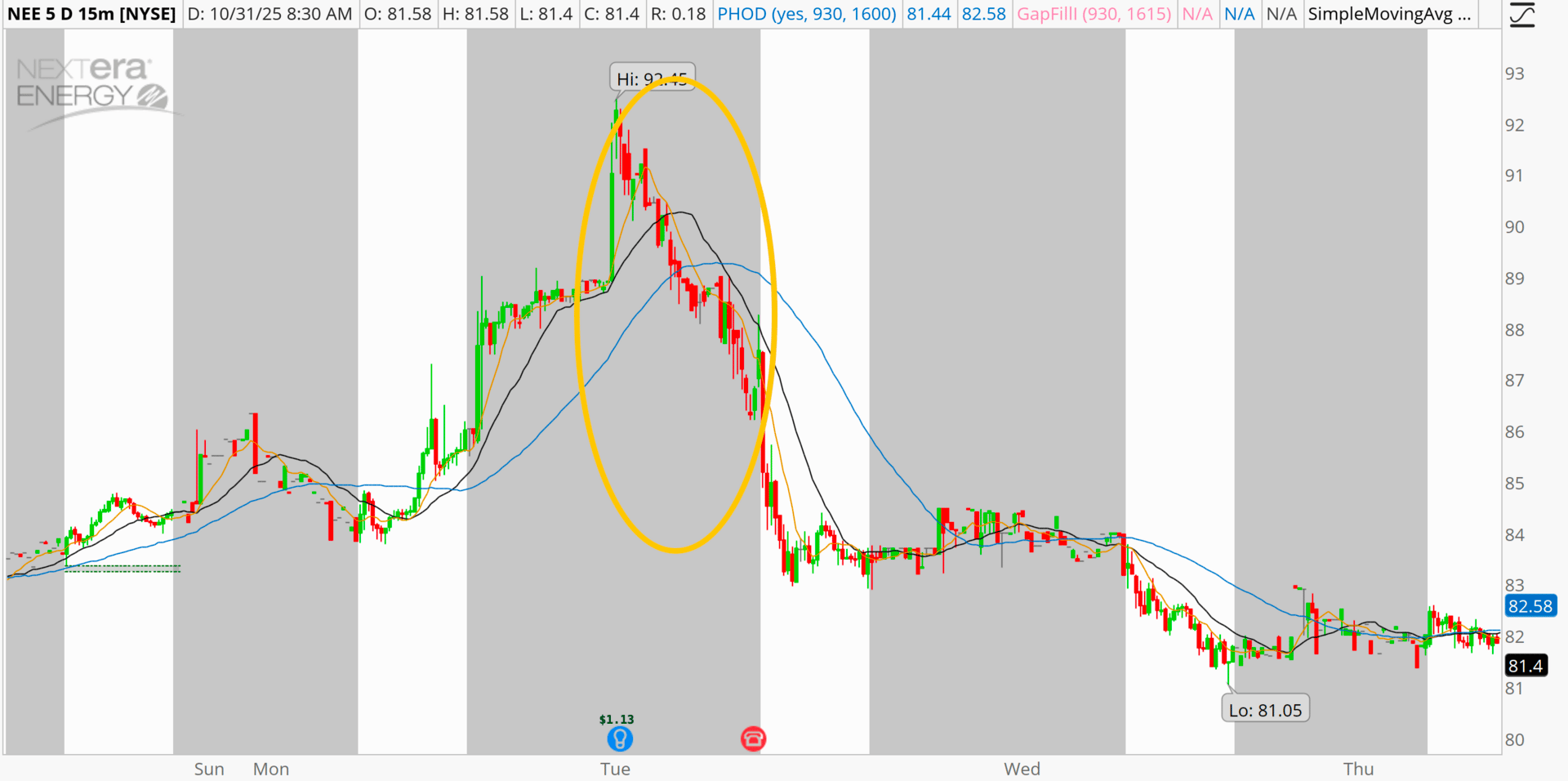

We added this name to the report last month and it’s a name that I like to play the nuclear energy theme we’re in right now - $OKLO ( ▲ 3.12% ) was the other one this Summer. The stock had great news this week with Google partnering with them to revive an old facility in Iowa.

You can see the price-action on the name this week rally, then fail as if they just announced that they were fraudulent!

We need to hold $75-$80s and look for a base to be built.

💰Boeing Earnings: Opportunity

On a positive note (we like that this week) Boeing is selling off a bit giving those of us that burden ourselves with the facts an opportunity to buy it, once again, at levels that are ideal as we get into 2026. I am likely waiting this out a bit (a few weeks) then probably build into some LEAPs positions and a small equity stake mainly because I’d like to wait until this broad market shakes out, which I still think it does.

✅ Options Flows w/ Trader X

If you missed it. This week was the first week of an old mentee of mine “Trader X” and his new service where he gives you his 3 Best Trade Ideas each Sunday as well as market posts — he’s already done two this week and is showing his real trade logs for transparency. Personally, I like that he’s doing that because every guru out there loves to talk about their macro and market calls but very few of them actually trade the risk.

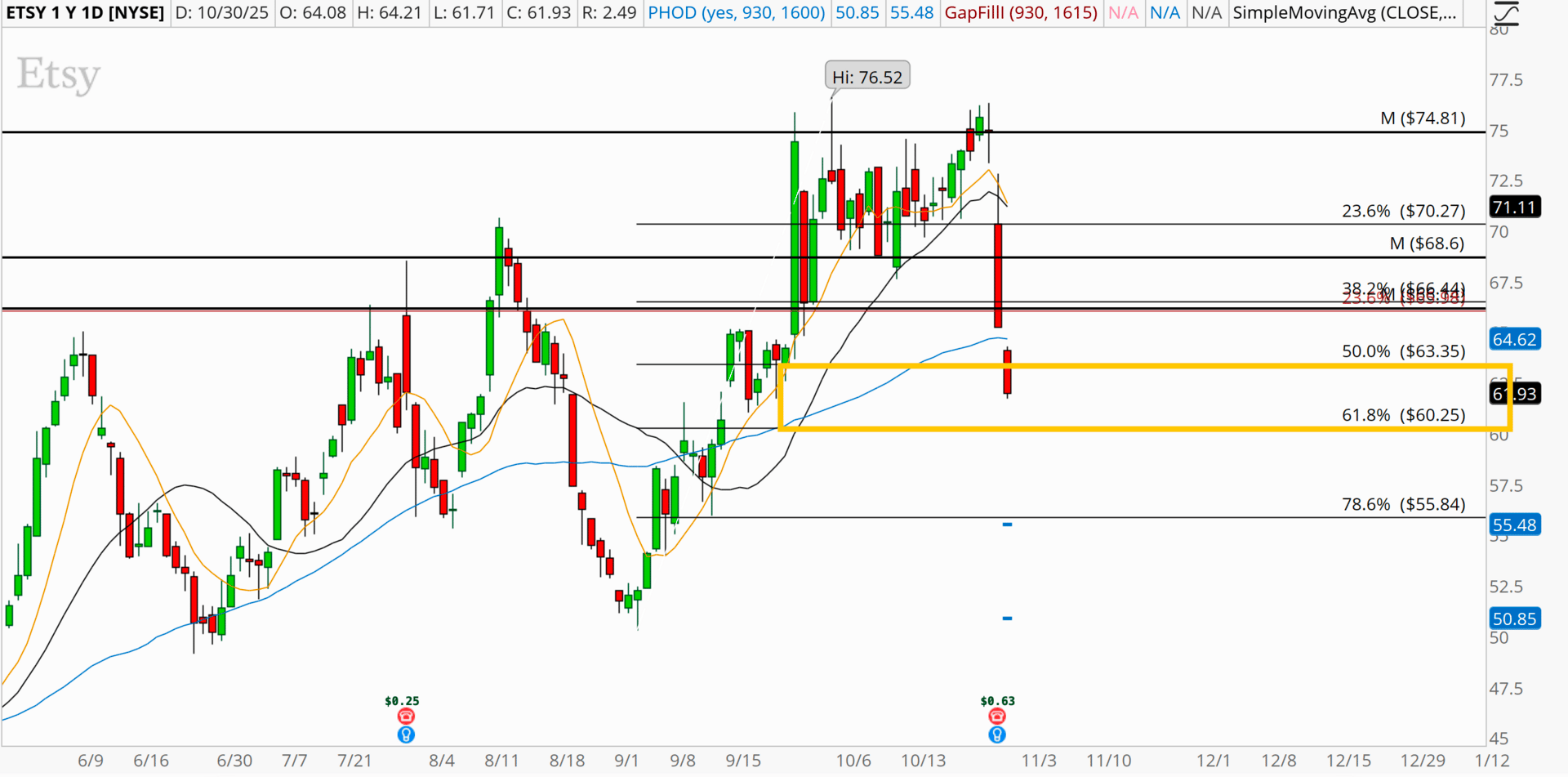

💰 $ETSY Earnings: Double Beat and Sell Off

Earnings Per Share (EPS): Reported $0.63, beating analyst estimates of $0.52 (positive surprise of +21.15%).

Revenue: $678.0 million, up 2.3% year-over-year from $662.4 million and surpassing consensus estimates of $660.3 million by 2.69%.

Net Profit: $75.5 million for the quarter.

New CEO coming in

Everything is in place here and we’ve had a great recovery in the name leading up to this but the price-action has failed and we need to hold this area of price - base for a few weeks then look to rally again.

💰Carvana: Two Lessons I am Reminded Of

I am not much of a short-seller anymore (but may become one pending the markets here) and Carvana was a name I flagged in March 2022 before it dropped to sub $5.

My views on it this go around were around their ABS, valuation and general private credit market concerns and there’s a lot to dig into on this earnings that I am going to save for the videocast/webinar next week.

What I want to discuss are my trading views on it as I was reminded of two lessons:

Take your profits or someone else will: I was short this name for the last 3 weeks or so and was up significantly last week on that brutal selling but since it was put into portfolios as a “big short” I elected not to cut. Am I mad about that looking back? No. But, I did cover the short yesterday on the miss and took my profits then, albeit less, I still booked them.

I want to trade this name going forward: my views are that this is not going to magically gap down -50% one day, that’s not probably. However, what I think is probable now that we have seen earnings is that their marketability for their loans starts to weaken and that creates bearish trading flows here that can be used as a trading sardine and that is my plan.

I do have some stuff to cover on earnings but as I said I will cover it briefly in the webinar/videocast next week.

🔔 Conclusion

I am still cautious on the broad markets here and expect more choppy style price-action v. the smooth trend move higher we saw last quarter which means, for me, waiting it out and picking my spots on short-term ideas. As we get through the heart of earnings and can find new names trading at new multiples and price areas there should be opportunity presented but as of now doing little is the play.

The Fall Conference is in 2 Weeks!

Webinar/Videocast out next week

This is not a solicitation to buy or sell securities.

The LongVol Report is not an Investment Advisor

For full disclosures click here at:

https://longvolreport.com/terms

Futures, Options and Stock trading involves a high degree of risk and may not be suitable for everyone.