Trading Sardines 2.0

For those of you who listen to the weekly Podcast/video we talk about trading sardines, a term made popular by Linda Raschke who’s work I am a fan of.

The idea of trading sardines (also know as ‘shitcos’) is that you trade the momentum that they provide and nothing more.

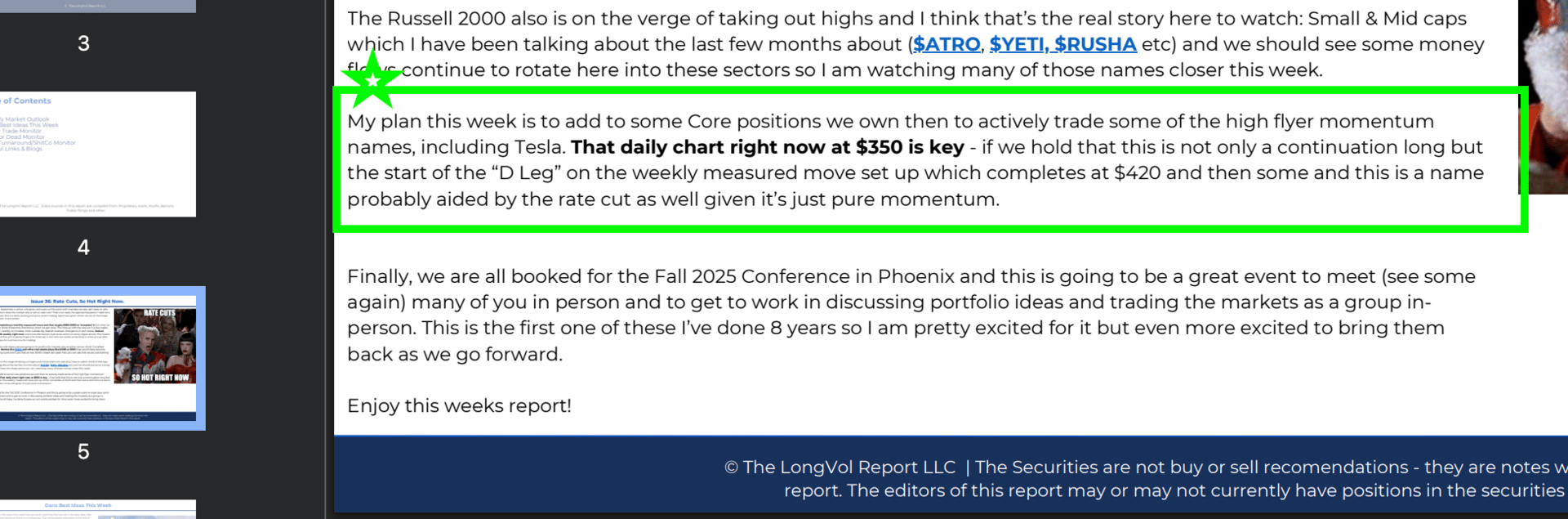

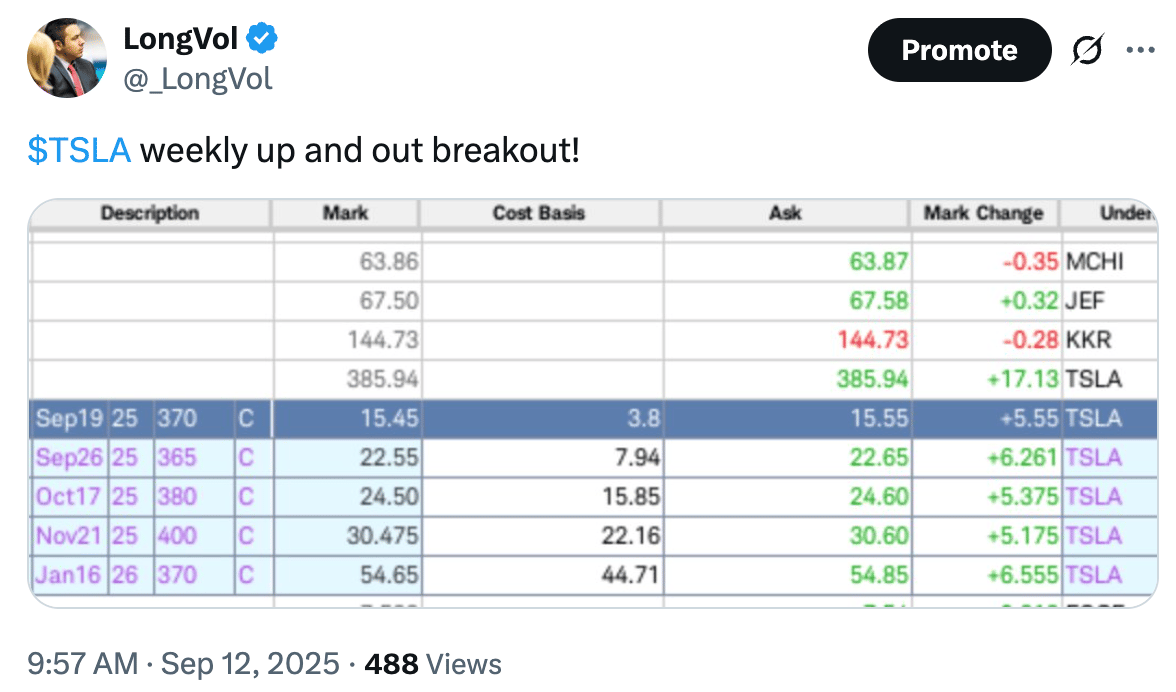

This week $TSLA ( ▲ 3.33% ) broke out and so did $OKLO ( ▼ 7.46% ) (and likely more) and they’re nothing more than trading sardines to me.

Not investments. Not long-term holds. Not ideas to watch for unusual call flow.

Just trading the momentum and price-action.

Back in issue 72 of the weekly video-cast I talked about this for those new here.

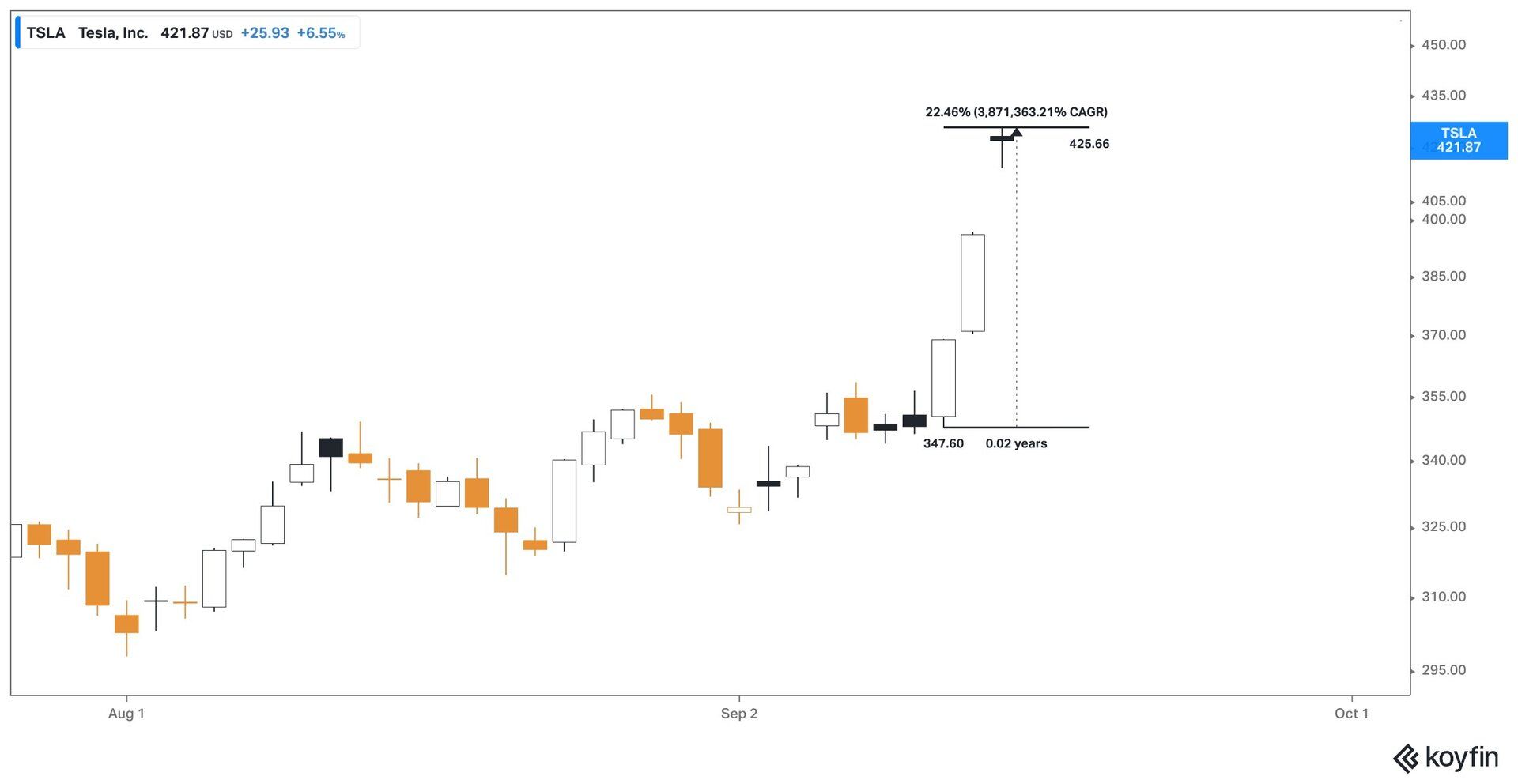

These past few days you’ve had a 22% move or $71 in dollar terms move which means it remains a trading sardine to be traded, not invested in - but that’s my view and this view goes at odds with those who’s only view is that everything has to be an investment but some still have a hard time getting past their own mental roadblocks.

Tesla Move

We talked about this move last week in report 36 then again in this Sunday report but added in $OKLO ( ▼ 7.46% ) which is up about +9% today as well.

Do I think the name has a future? I really don’t know. Do I like their balance sheet? No, not really. Do I like the price action and the P&L it provides me? As Sarah Palin once said; “You betcha!”.

And that’s what matters. The P&L.

That’s been the same approach to how I’ve treated this stock and others like it since 2014/2015 when I first released this lecture series back in the day called SAT.

In fact, $NFLX ( ▲ 0.4% ) has been one of those as well and there’s a video from 2015 - I treated that name the same way I do a lot of these names today.

This move last week confused some of you readers who were knew to the report and I replied to one of those question on the Saturday video-cast but I’ll expand on it here.

Not every idea has to have a fundamental reason behind it, sure, Elon bought but the market knew today, not last Sunday when we posted the idea of the breakout to $420 and not when I was acquiring my longs on the name.

Report 36

This is where most get lost - they can’t separate the frameworks of investing v. price-action/momentum trading. Not everything has to be an investment but for whatever reason there’s this idea that it has to be and that idea is a fallacy. There are those out there that want to make you believe that “trading” is no good and that it is beneath them but the reality is most are saying that because they want to complicate the process of generating returns - that and they’re not actually doing this themselves.

I am not here to convince you but to clear up the idea of trading momentum and price-action v. investing which are two different views/

In the past, I talked about separating this as trades v. investments.

You can do both, I do both, but this idea that each idea needs a “fundamental reason” is not how you trade momentum & price-action, those are NOT part of the process.

Last month we highlighted Astronics which subsequently went up +40% since the post and we’ve highlighted other ideas, that’s not a trading sardine nor a momentum-driven idea.

Conclusion:

What’s the takeaway here? One, you should be subscribing to our research report because you get a trial for 21 days.

Two, trading sardines serve a purpose and for those that can harness this concept they can serve a very big purpose in generating P&L.

And finally, none of this has to do with macro, you know why? Because it doesn’t generate returns it just makes people pretend to sound smart while they talk about things nobody really understands, whether you admit it or not.

Thanks for reading.