- LongVol Report

- Pages

- About Us

The LongVol Report

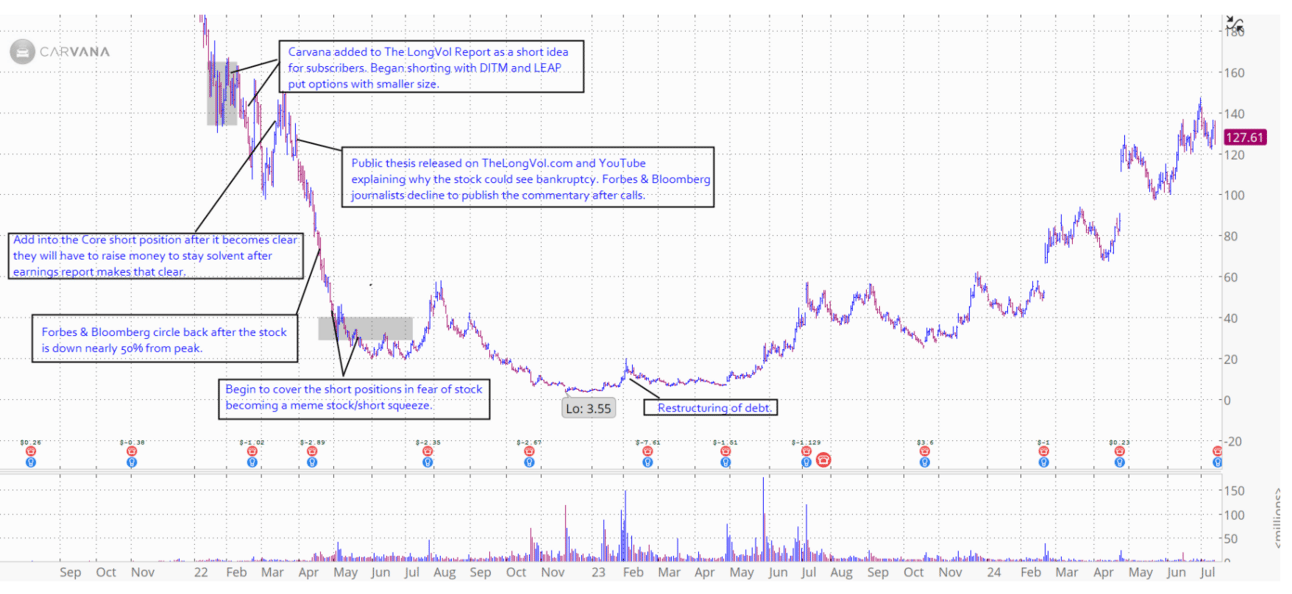

Dan started The LongVol Report in 2020 as a platform to share actionable insights, tips and research for hedge funds, advisors and independent investors to benefit from based on his years of experience in the business. We have had notable research calls such as Carvana short in 2022 which was featured in Bloomberg, Boeing long in Q225 featured in OpeningBellDaily.com and are frequently quoted in financial media as seen below.

We have two memberships, both with 21-day trials:

About Dan

Daniel X. Bustamante is the founder of The LongVol Report and CIO of Bustamante Capital Management - a long/short equity money manager. He has over 18 years of experience in the industry specializing in long/short equity and event-driven trading. He became a portfolio manager at the age of 29 running a L/S strategy and building out the firms index futures trading business before retiring from Wall Street at 31 to pursue his own investment partnership and invest in distressed companies.

Dan started The LongVol Report in 2020 as a platform to share actionable insights, tips and research for hedge funds, advisors and independent investors to benefit from based on his years of experience in the business.

On a weekly basis, Dan publishes his stock market commentary, “The LongVol Report Show” which covers highlights from the weekly PDF report, commentary on market headlines, Q&A on companies and member Q&A.

He has been featured in Bloomberg, Arizona Business Journal, Reuters, Forbes, Yahoo! Finance, Business Insider, Opening Bell Daily and more financial publications.

Full resume & professional experience on LinkedIn here.

Carvana Short in 2022 clearing over $1.5 Million

Media Appearances

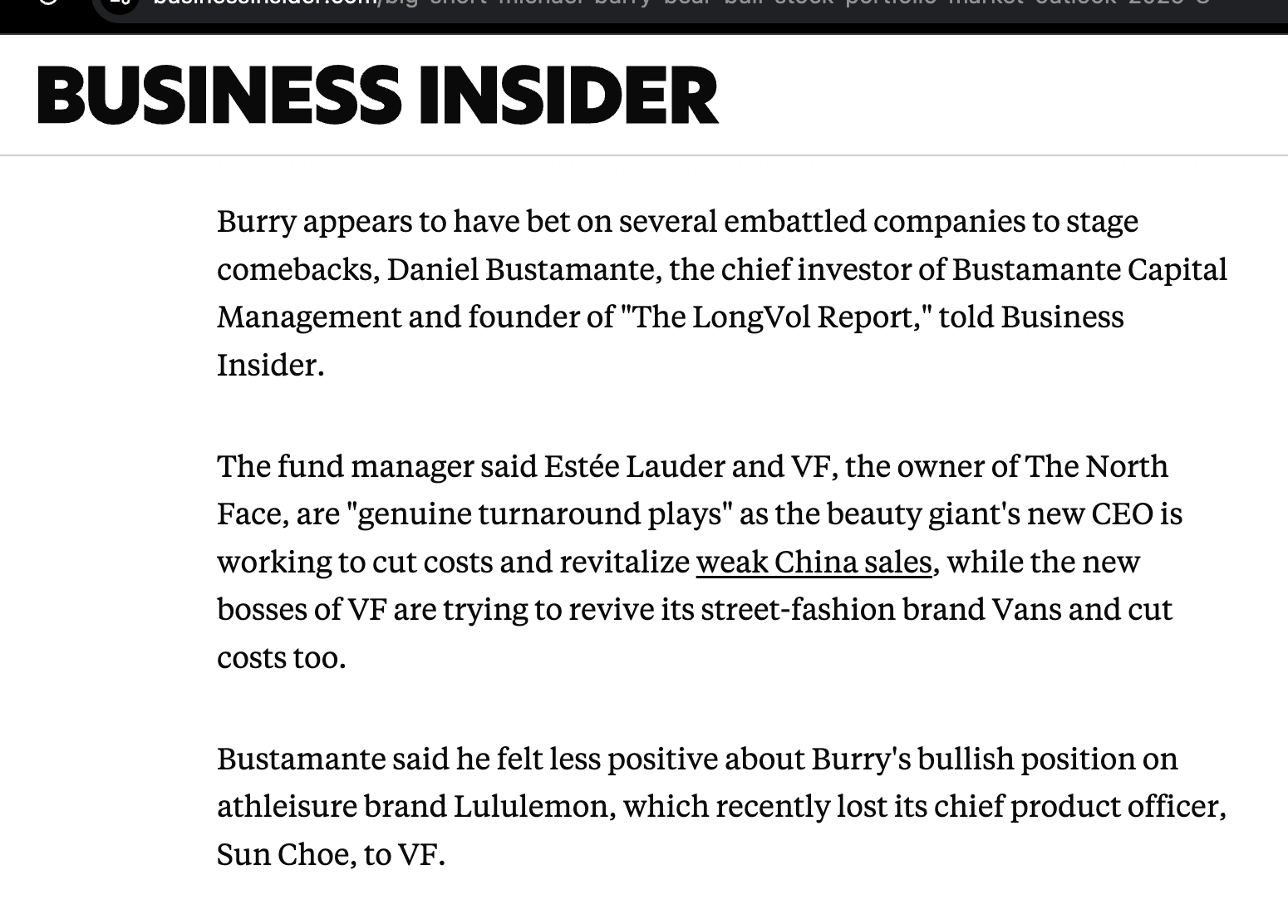

Business Insider Comments on $VFC ( ▲ 1.54% )

“Losing her is the equivalent to losing Steph Curry to another team”

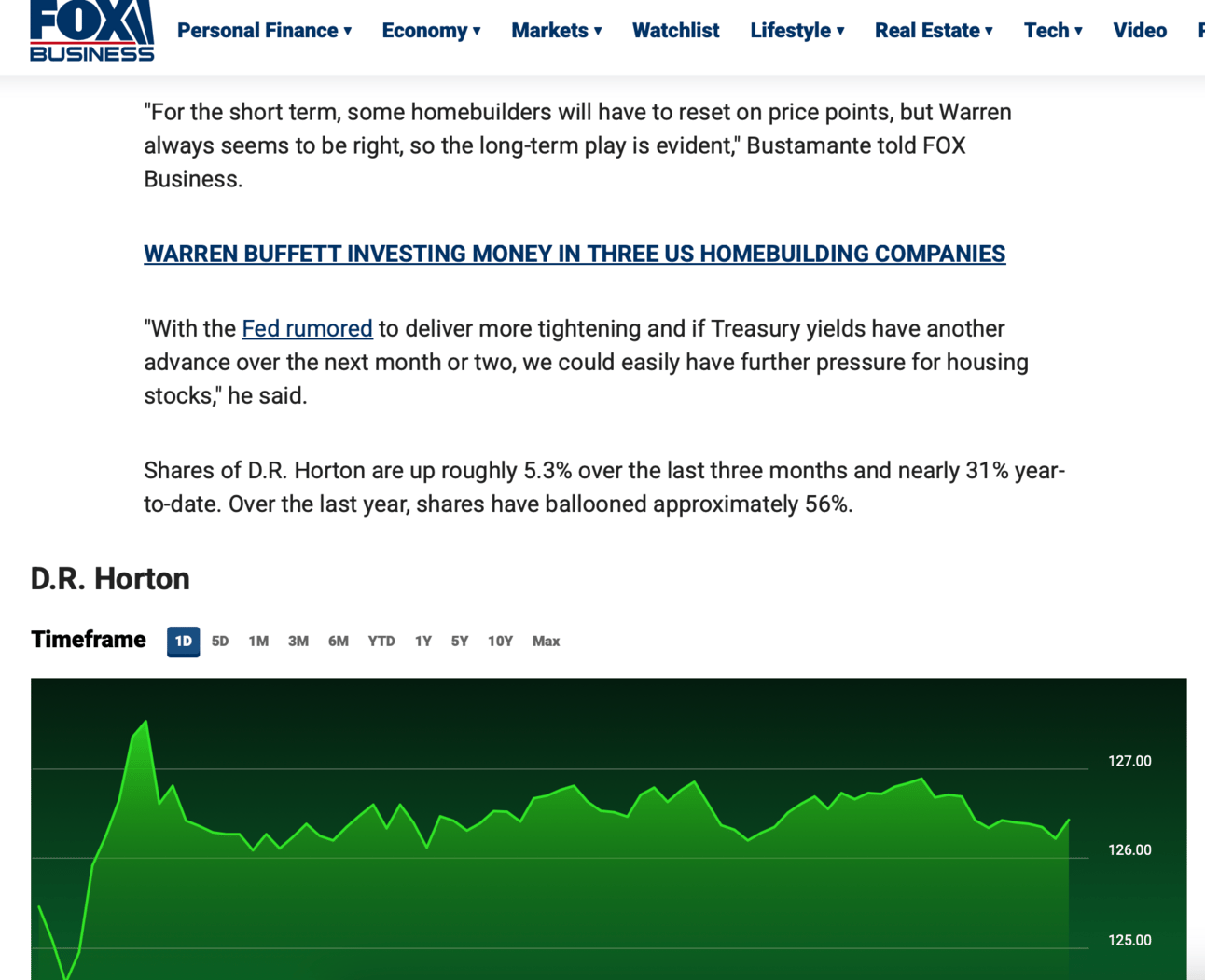

Fox Business Interview

US World Report & News Interview

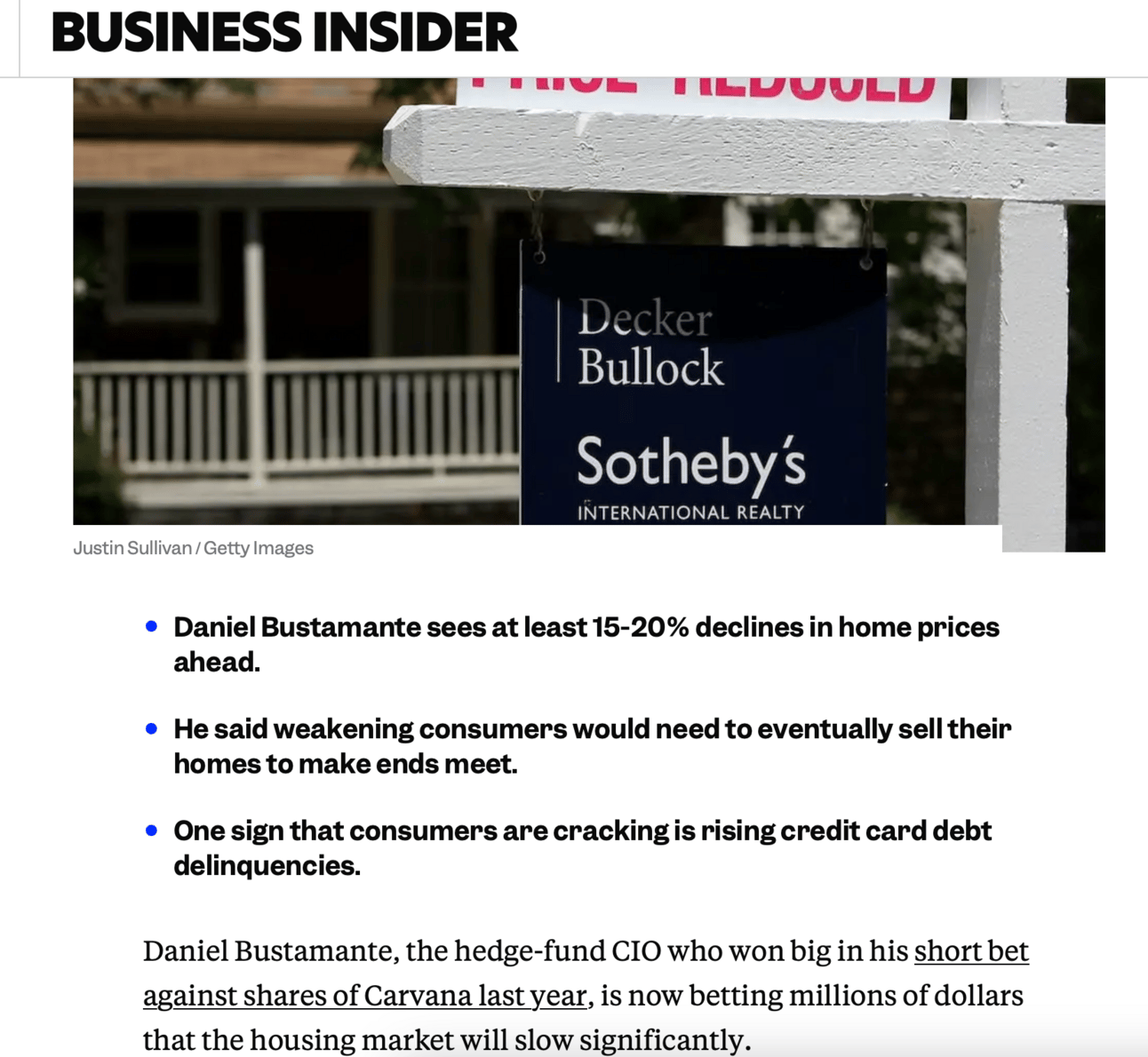

Business Insider Interview

Forbes Quote on Carvana

Jack Grace USA - Post Bankruptcy Turnaround

Beck Personality Juice

Why Subscribe?

You get a curated list of idea flow covering over +30 tickers each week with actual research notes, catalysts driving the idea and price-action commentary that is updated weekly and can be read in 5 minutes or dug into for more data.

This saves investors time on searching for ideas by kick-starting that process with a curated listed of idea flow.

This is NOT just report that covers one type of trade we trade a variety of ideas that you can pick from such as: breakouts, swing-trades, momentum-driven flows, technical setups, value plays, turn-arounds and more.

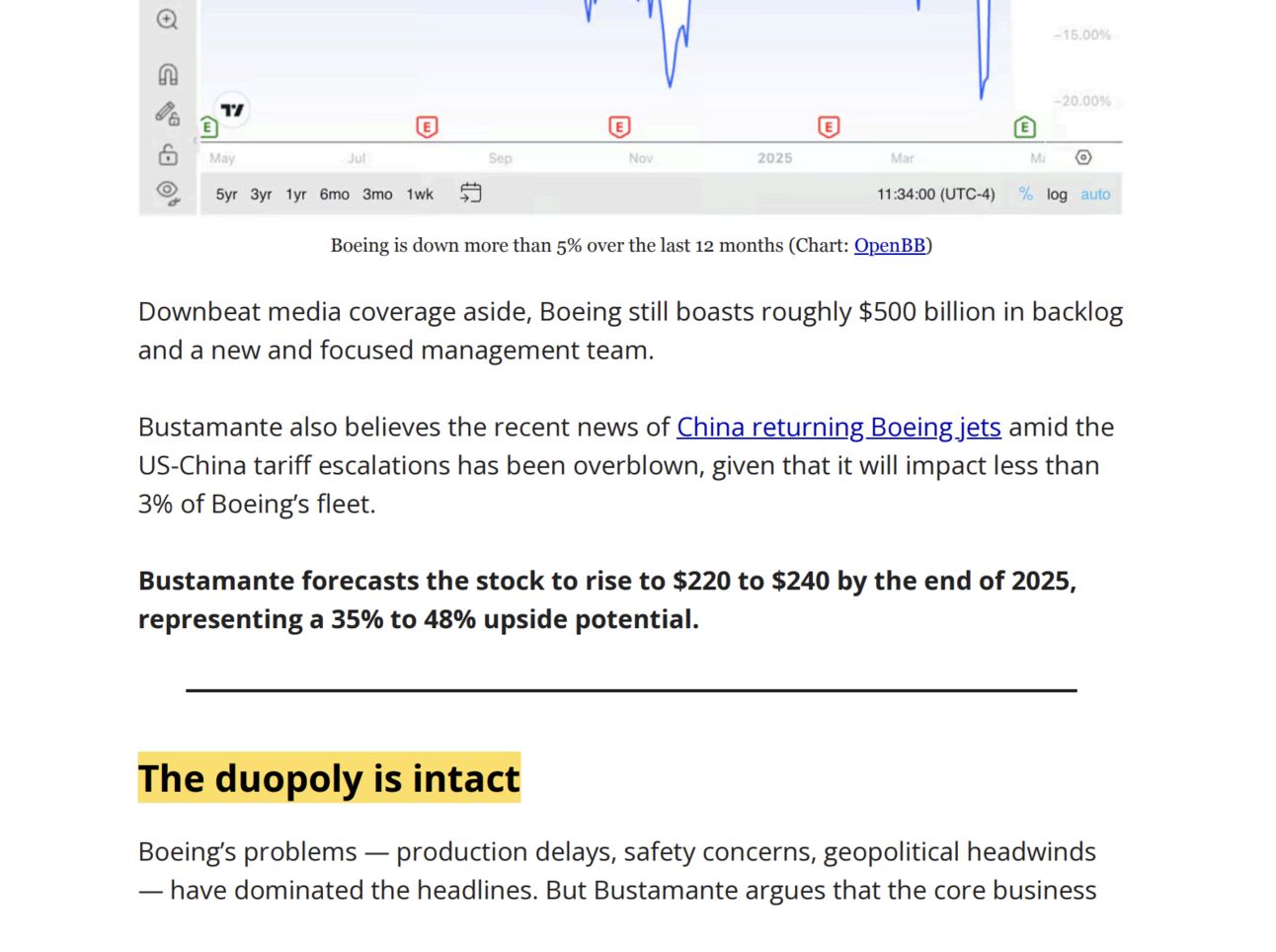

This is a recent Boeing call that was in the report when it was trading $140s and rallied +40% in two months. Dan gave an interview to this site Opening Bell Daily with 250K readers before the stock proceeded to inflect higher in the following months.

And this is part of the process on how ideas are screened to make it into the report. We pay attention to key catalysts, financials and then overlay a price-action model to provide readers with a curated list of ideas that have BOTH fundamental and technical notes.