INTRODUCTION

This year has kicked off and we’re seeing new headlines as expected almost every other day that are moving markets. But, if you are coming into 2026 with a roadmap (like we provided in our 2026 webinar) then you can invest with a state of mind that’s a bit more relaxed.

Investing cycles are usually the same and history often repeats — and for those that are paying attention you know the playbook ahead.

Of course, there will be hiccups along the way (Trump taking shots at credit card companies and Defense firms) but the overall themes are in tact.

Some of those theme’s we’ve talked about here for the last year or so and they include major turn-arounds in:

As well as other short-term tactical trading ideas like we produce in our Swing Portfolio — by the way 3 ideas have been opened already this month. We use deep in the money options to express these views for the new readers here.

One of the big things the market is waiting on right now is the Supreme court decision on tariffs and many stocks like:

$RH ( ▼ 3.16% ), $VFC ( ▼ 2.37% ), $SWK ( ▼ 3.57% ), $NKE ( ▼ 1.83% ) and many others are dependent on this ruling to reprice which creates opportunity for the short-term traders.

NEWS OR NOISE: MARKET HEADLINES

Warren Buffet Indicator

I have to be honest with you all, there are so many indicators to predict turmoil in the market (and world) that I think more people spend time worrying about what could go wrong v. focusing on what COULD GO RIGHT. I mean really, think about it, everyone is a critic, and a few years ago it was the SAHM indicator and then I am certain we’ll get another one soon talking about market highs.

The good thing about our investment approach is that our concern is never really with what the overall market is going to do and for our loyal subscribers you know that and you returns show that.

However I would be lying to you if I said I was bullish on the broad-market here, I am not but I shared those views in that 2026 Market Outlook Webinar and the themes we wanted to focus on.

The play for us is to focus on:

Mid & Small Caps

Energy, Consumer Staples, Healthcare

Credit spreads have fallen to levels not seen since 1998.

This is a positive sign but when I look at the price-action on the major indices, the history of mid-term election years and other items it makes me cautious on the broad market.

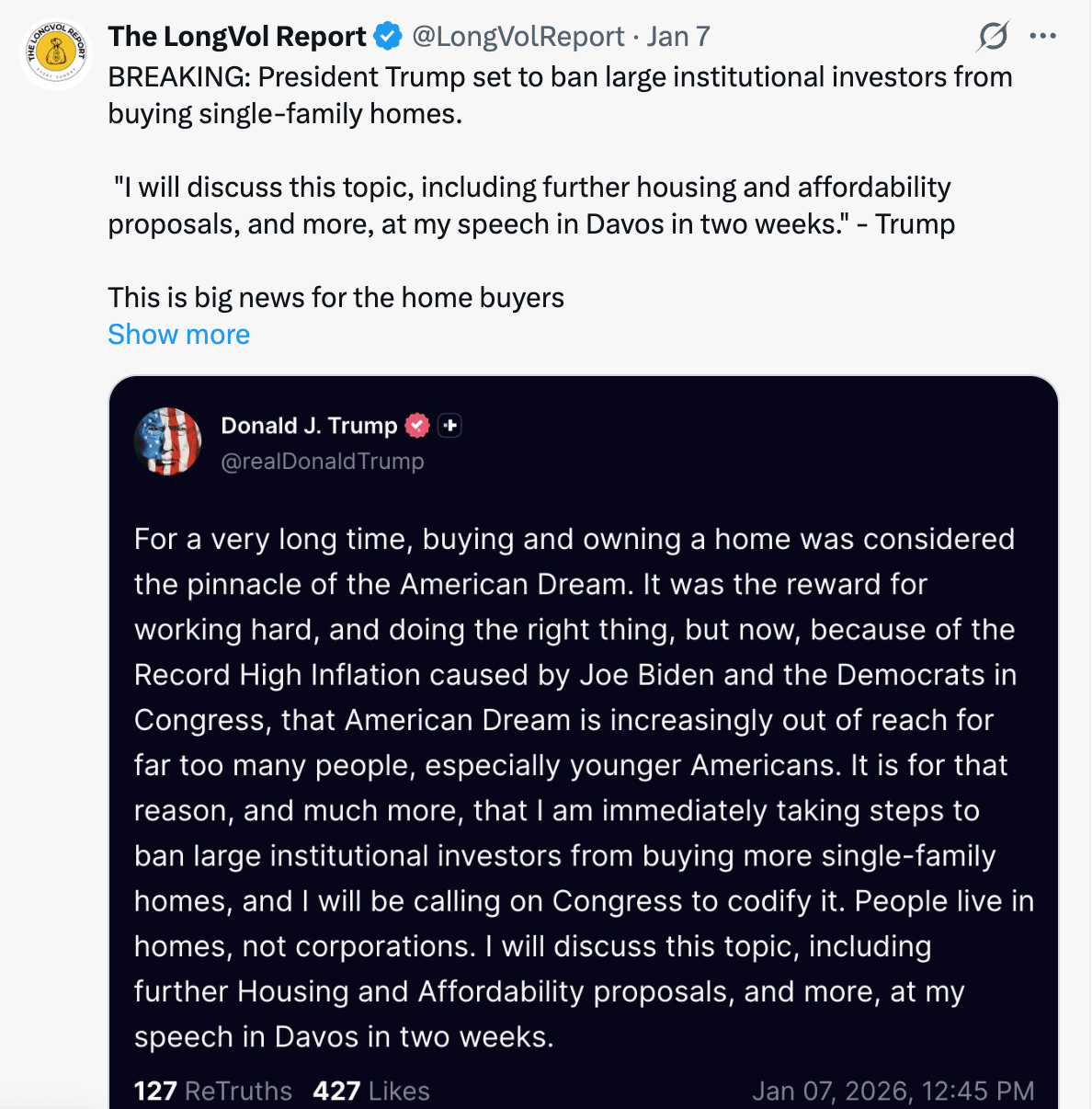

This has been a long-time coming and I suspect there’s more to come surrounding this because Bessent has made comment to it last year that they were going to try to do “something” to free up housing, one way or another.

Home builders like $KBH ( ▼ 3.84% ), $TOL ( ▼ 2.71% ), $XHB ( ▼ 2.21% ) remain great trading sardine names just not investable names for me

Still a fan of ancillary names in the home builder space, one of those was/is $RKT ( ▼ 5.77% ) which we have in the newsletter and which some readers made money on in the past few weeks.

Shout out Brad and the rest on that play!

Metals rally like the rapture is coming.

I don’t think this is noise and the market has been signaling this for a while but it doesn’t really come into play for what we do. Is there a short coming on them to take advantage of?

Maybe, but with so many longs this year to be had I’d just as soon skip that idea and move into other ideas.

And by the way, if you don’t have any ideas, get our newsletter here.

At least with that we won’t waste your time talking about hypotheticals or pointless macro but give you actionable flows to trade on.

NEWSLETTER HIGHLIGHTS

$BA ( ▲ 0.92% ) - Ready for Takeoff (Again)

For those that have been here we’ve talked about this over and over and now we’re +40% off that recent pullback and making highs again. Free cash flow is turning positive, they’re getting new orders (Alaska Air recently) and delivery delays are improving.

We like legacy brands like this with material changes. We’re not out here predicting geo-political issues, worrying about whether or not some drug will get FDA approval (though that’s fun), we’re buying good names and riding the trends.

We like cash-flow which seems to be a relic of the past in today’s era investing (see $OKLO ( ▲ 1.73% )) and Boeings cash flow is about to make a turn for the positive here this year and next.

$DECK ( ▼ 2.7% ) notes from our weekly newsletter

But those are just words. What about the price-action as we head into earnings? Where is the move?

One, I think the move already happened and the late-to-the-party buyers are going to get burned here on these highs.

Two, I think we get another pullback and then that will be the final one for the rest of the year (minus smaller ones) and our hockey stick begins.

I talked about this in a video this week on our YouTube.

$CELH ( ▼ 5.99% ) - Alani Nu

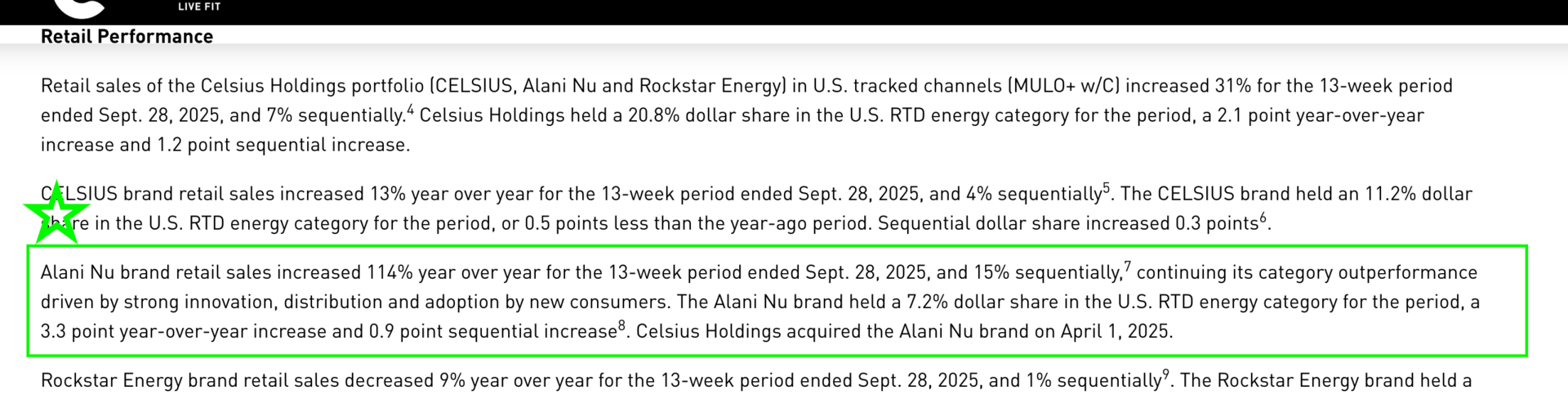

I normally avoid companies like this but I am open to all money making ideas to generate returns and their acquisition of Alani Nu made great business sense by the firm and this is the main catalyst in my view to watch going forward this year in the business.

Of course, the Celsius brand matters itself but Alani Nu is all the rage.

The termination of the prior Alani Nu Distribution was something that was done and the market punished the stock in the short-term with the $247 million in costs, which, were covered by Pepsi.

The distribution integration is 80% done according to the company last month and we’re seeing that reaction in the stock price off the lows in the last 3-4 weeks.

So, what’s next? We’re looking for continue growth on Alani Nu as we head into the next earnings report and there are big expectations for this name given the recent growth they showed.

This is not a solicitation to buy or sell securities.

The LongVol Report is not an Investment Advisor

For full disclosures click here at:

https://longvolreport.com/terms

Futures, Options and Stock trading involves a high degree of risk and may not be suitable for everyone.