The LongVol Report Article & Podcast

New Reader?

Welcome. We publish this each and every Thursday with a free & paid section for members covering stocks, broad market news and a weekly Q&A session for readers.

Premium members get access to the following each week:

✅ Premium member posts with Company breakdowns/analysis

✅ Access to Educational content archive (all the way back to 2020)

✅ Ask questions each week on the Podcast/Video cast

✅ Use Our Trading TidBits Playlist Here (NEW)****

There is also podcast/video cast goes out each Saturday and we answer member Q&A at the end each week.

The Swing Trade Alerts are a tool we use with our DeltaOne Membership. We take ideas and structure longs using Deep In The Money Calls as stock replacement.

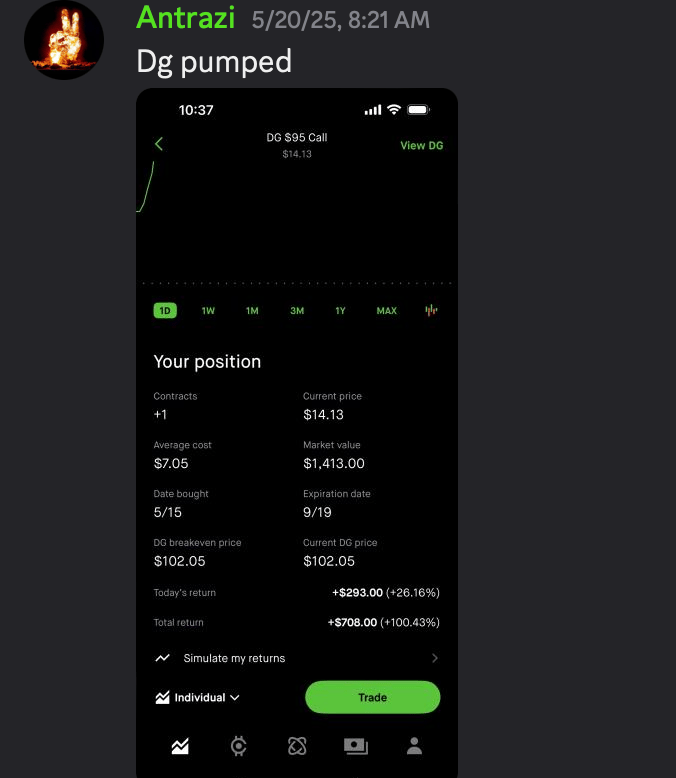

Swing Trade CLOSED: $DG at $6.50, Exit at $14.00

🎟️ You can get access to The Alerts & DeltaOne here Free for 15 Days here.

About me:

✍️ I’m Dan Bustamante, founder of The LongVol Report and Bustamante Capital Management LLC - a L/S hedge fund and investment firm. I began in this business at the age of 20 with Charles Schwab and became a Portfolio Manager by the age of 29. Today I live half of the year in Puerto Rico and half in my hometown, Phoenix. I’ve invested in private companies and even was the CEO of a post-bankruptcy turn around called Jack Grace USA.

Me and my team publish our flagship LongVol PDF Report each Sunday and have done so since 2020. In fact, we were the team that called for Carvana short at $160 in March 2022 before anyone would listen plus many more market calls & research.

Want to connect? Follow us on X @TheLongVol or on LinkedIn here.

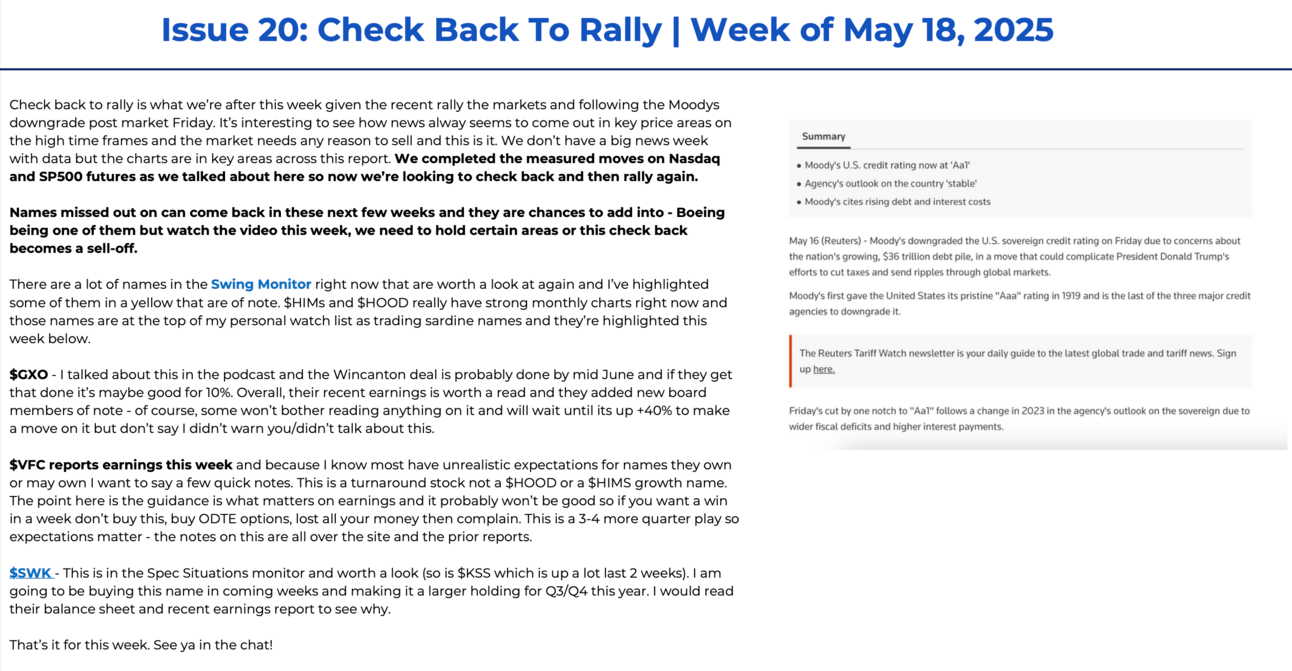

Check Back To Rally

Issue 20

This week was quiet for the most part aside from a little risk off on Wednesday afternoon with an overall sideways market. The US downgrade didn’t seem to phase the market that much but we’re also not getting bids on the indices to breakout of this sideways range.

Check back to rally is the theme right now and that is still the house view for now but this is nearing the end of earnings season and a new month in just a week so we’ll see if we break out of this sideways range.

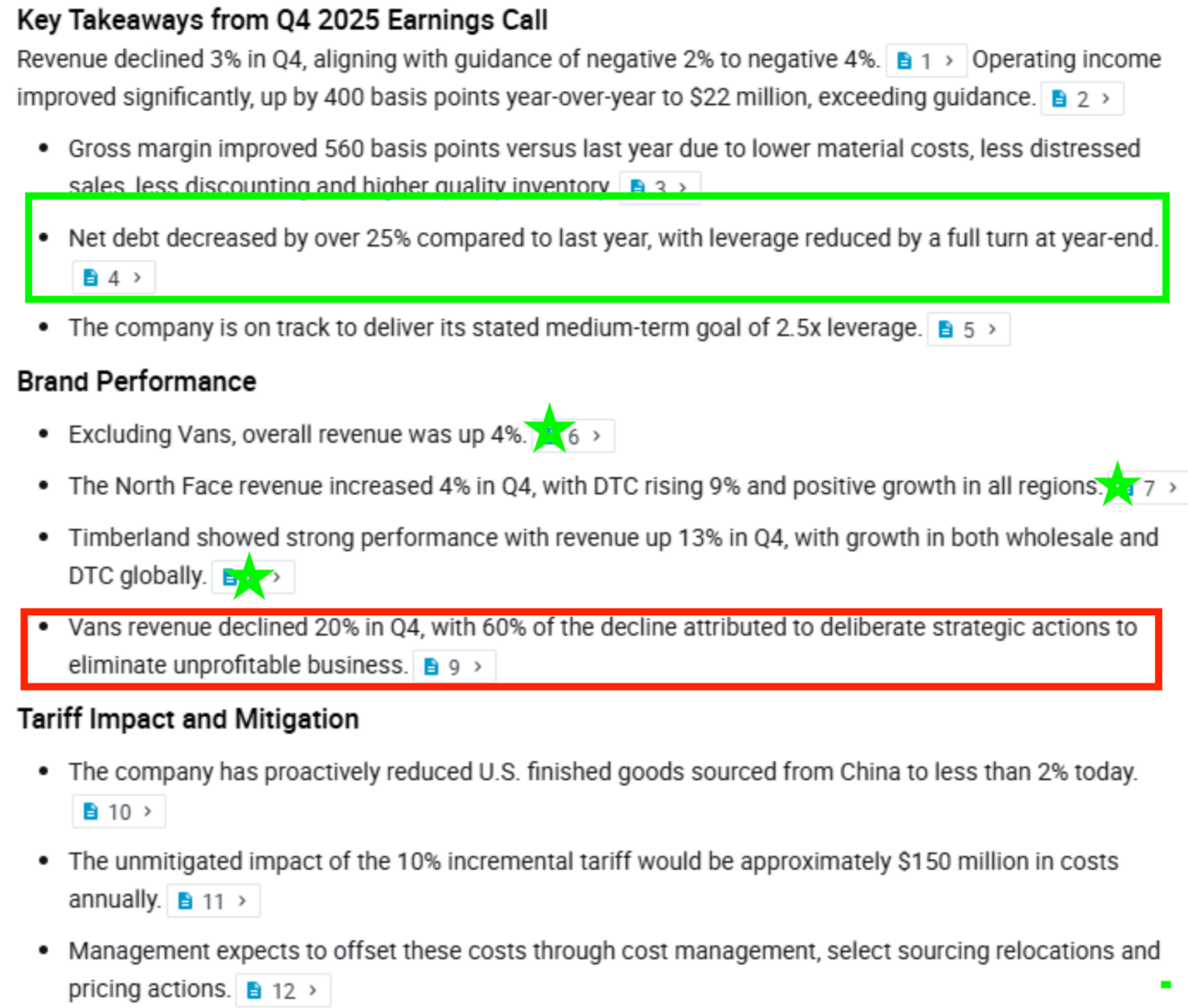

$VFC ( ▲ 0.46% ) reported earnings this week and they’ve done a great job with that balance sheet despite the Vans line still struggling (but optimistic) in the near future.

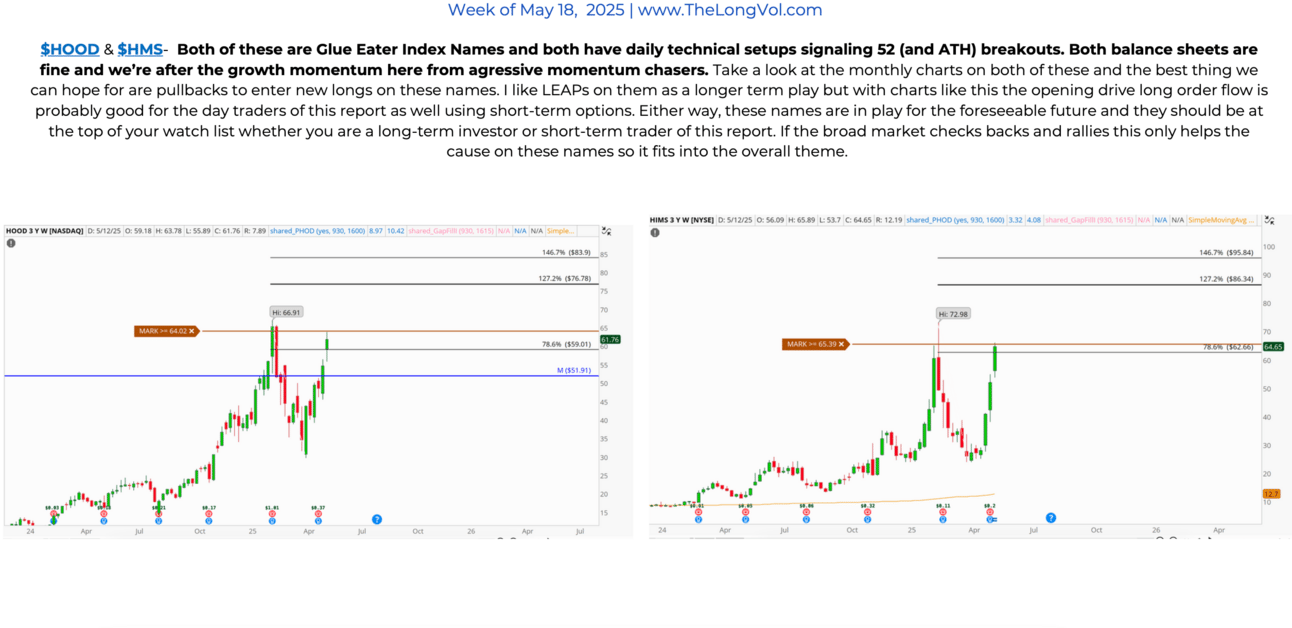

$HOOD ( ▲ 2.2% ) and $HIMS ( ▼ 0.32% ) made it to the highlights this week in the report with technical breakouts, one an ATH breakout and one a 52 week breakout. Both lingered around this levels unable to go but overall still a key spot to watch the technical inflection.

Boeing: retail still is behind the ball on this thing and that’s when you still want to own it but we can’t crack $200 just yet.

A new article from Morningstar here is worth the read - or you could just read the earnings report or if you’ve been reading/watching this show the last 6 months we’ve talked about it over and over.

These names are “Trading Sardines” meaning we trade them NOT invest in them.

DeltaOne Highlights: some highlights this week from DeltaOne on swing ideas.

You can upgrade to DeltaOne here free for 15 days.

✅ @Antrazi $DG ( ▲ 0.69% ) Swing

✅ @Antrazi $AAP ( ▼ 2.87% )

✅ Conclusion:

Markets are in sideways ranges right now until we get closer to a new trading month but hard to add to new net longs here at these highs without a pullback. $VFC ( ▲ 0.46% ) and other names on my list are coming in off highs and we hope they continue to come in to add and/or re-establish some core longs.

🔎If you are a high net worth individual, entrepreneur or investor learn learn more about asset management.

Unlock Your Premium Membership

Get the first 30 days free and unlock the rest of this post as a Premium Member.

Upgrade Now