The LongVol Report Article & Podcast

New Reader?

Welcome. We publish this each and every Thursday with a free & paid section for members covering stocks, broad market news and a weekly Q&A session for readers.

Premium members get access to the following each week:

✅ Premium member posts with Company breakdowns/analysis

✅ Access to Educational content archive (all the way back to 2020)

✅ Ask questions each week on the Podcast/Video cast

✅ Use Our Trading TidBits Playlist Here (NEW)****

There is also podcast/video cast goes out each Saturday and we answer member Q&A at the end each week.

The Swing Trade Alerts are a tool we use with our DeltaOne Membership. We take ideas and structure longs using Deep In The Money Calls as stock replacement.

No new ideas opened or closed this week.

🎟️ You can get access to The Alerts & DeltaOne here Free for 15 Days here.

About me:

✍️ I’m Dan Bustamante, founder of The LongVol Report and Bustamante Capital Management LLC - a L/S hedge fund and investment firm. I began in this business at the age of 20 with Charles Schwab and became a Portfolio Manager by the age of 29. Today I live half of the year in Puerto Rico and half in my hometown, Phoenix. I’ve invested in private companies and even was the CEO of a post-bankruptcy turn around called Jack Grace USA.

Me and my team publish our flagship LongVol PDF Report each Sunday and have done so since 2020. In fact, we were the team that called for Carvana short at $160 in March 2022 before anyone would listen plus many more market calls & research.

Want to connect? Follow us on X @TheLongVol or on LinkedIn here.

Shake Off The Bad News

Issue 21

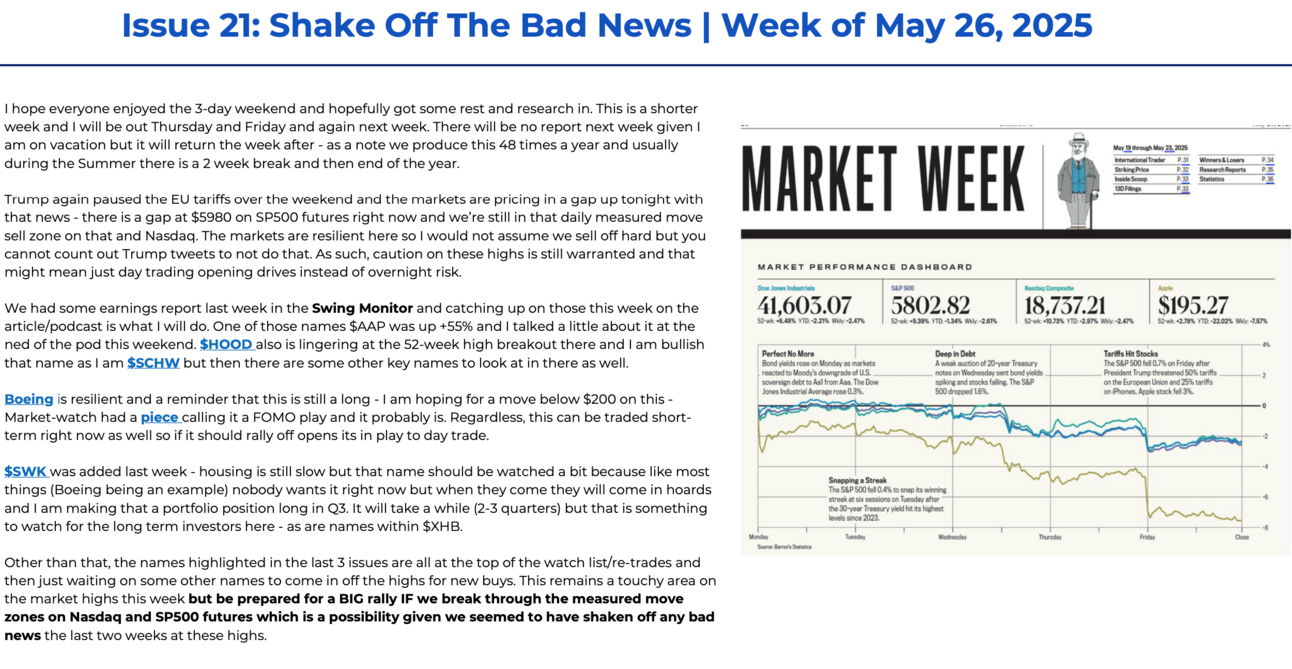

This week was quiet again aside from the $NVDA ( ▲ 0.68% ) earnings and subsequent temporary block of the tariffs which had the market rally a bit on Wednesday night. The rest of the market was testing a key spot on the SP500 and Nasdaq which makes this area a bit questionable given the price action and potential swings and most moves were intraday as we discussed in the report Sunday.

$BA ( ▲ 1.28% ) continues to trade well with the CEO saying they hope to increase production end of year and that gets us close to our $220 soft-target.

Overall this market is holding up well and when we look at the measured move on the $SPY ( ▲ 0.73% ) we talked about a few weeks ago it’s failed to sell.

This usually means the market is strong and an expectation of more of a rally on broad-market names is likely to come.

Moving on….

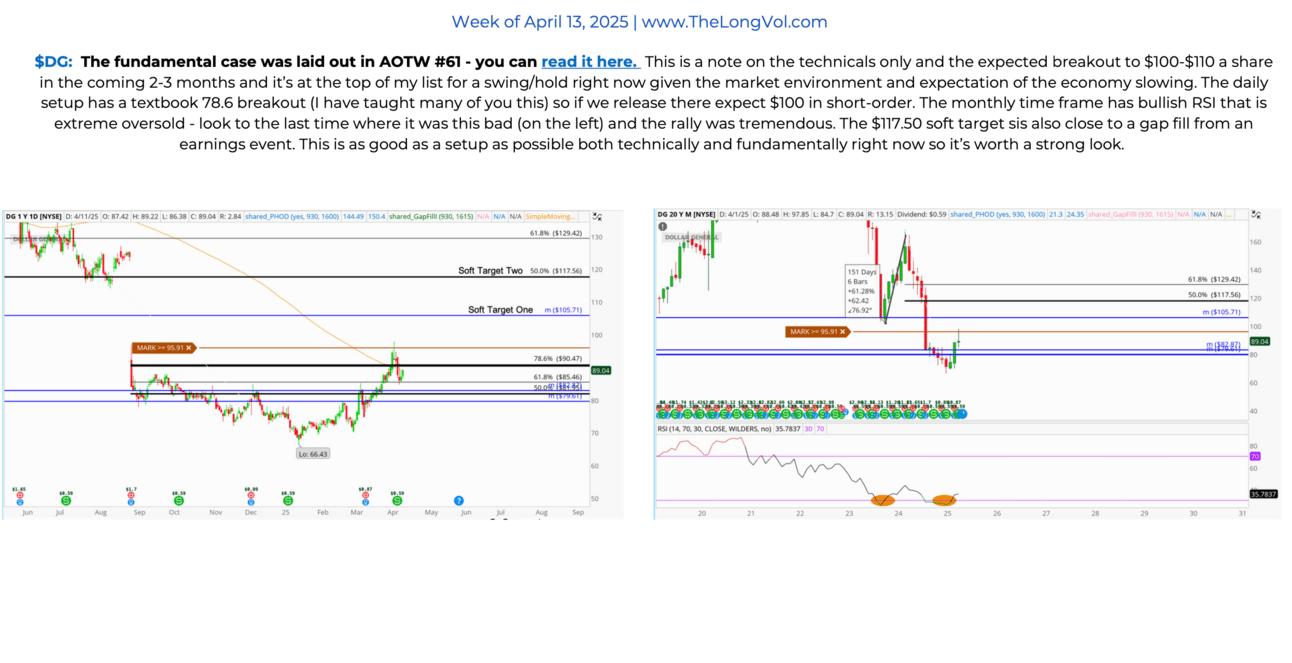

Last month we highlighted one of the Swing Monitor names, $DG ( ▲ 0.69% ) at $89s and we hit $100s last week on the name with earnings around the corner. This is one of the names we talked about earlier this year as well and it also has some larger fundamental catalysts with it including an active share buyback. $117s are the short-term targets still though those with the Swing Portfolio have covered the DITM Calls.

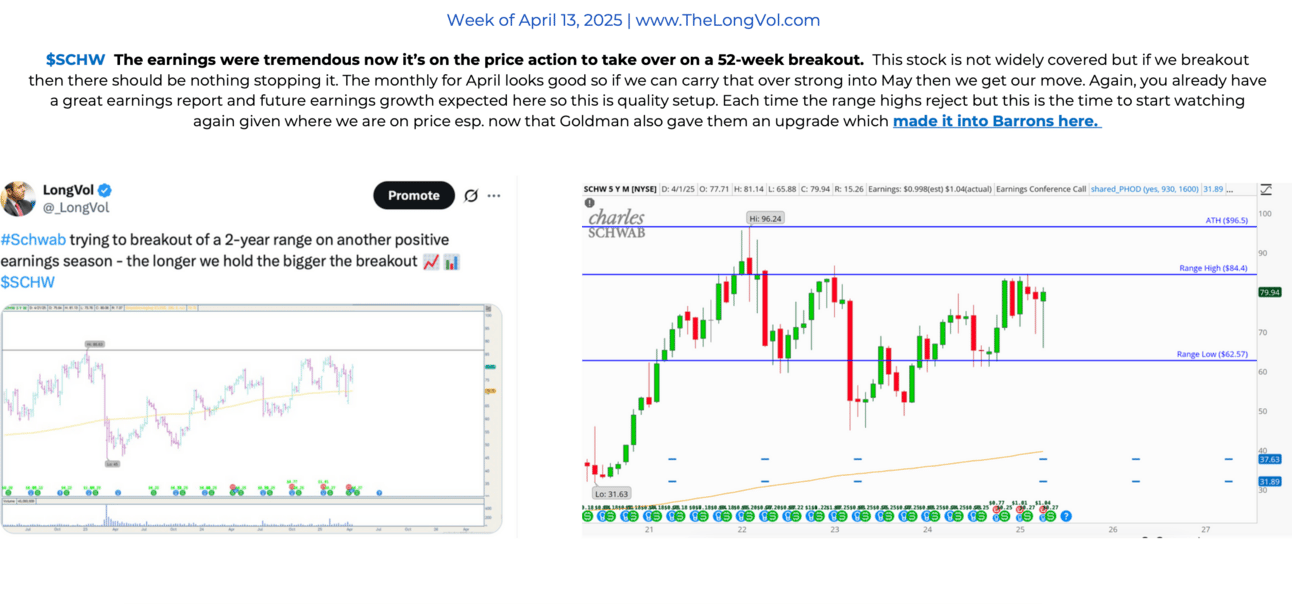

We also talked about $SCHW ( ▲ 0.4% ) (and have been since 2023) recently and they’ve broke out well this month. Soft-targets remain higher and Goldman gave it a $100 P/T recently as well.

DeltaOne Highlights: some highlights this week from DeltaOne on swing ideas.

You can upgrade to DeltaOne here free for 15 days.

✅ ETSY and NTR longs closed

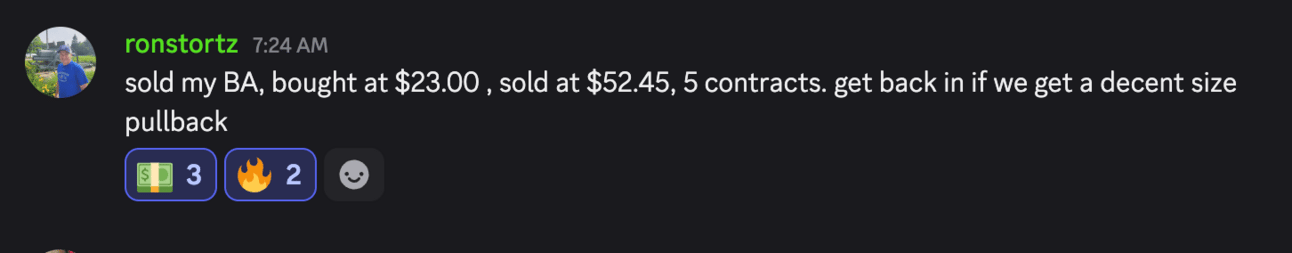

Uncle Ron with the Boeing swing closed. (Good example of longer term options) contrary to your local guru who trades ODTEs like a proper glue eater.

✅ Conclusion:

The broad market remains resilient and many names from the report have performed well this month for readers and as we end earnings season we’re headed into a lower vol environment - tweet news excluded.

🔎If you are a high net worth individual, entrepreneur or investor learn learn more about asset management.

Unlock Your Premium Membership

Get the first 30 days free and unlock the rest of this post as a Premium Member.

Upgrade Now