The LongVol Report Article & Podcast

New Reader?

Welcome. We publish this each and every Thursday with a free & paid section for members covering stocks, broad market news and a weekly Q&A session for readers.

Premium members get access to the following each week:

✅ Premium member posts with Company breakdowns/analysis

✅ Access to Educational content archive (all the way back to 2020)

✅ Ask questions each week on the Podcast/Video cast

✅ Use Our Trading TidBits Playlist Here

There is also podcast/video cast goes out each Saturday and we answer member Q&A at the end each week.

The Swing Trade Alerts are a tool we use with our DeltaOne Membership. We take ideas and structure longs using Deep In The Money Calls as stock replacement.

About me:

✍️ I’m Dan Bustamante, founder of The LongVol Report and Bustamante Capital Management LLC - a L/S hedge fund and investment firm. I began in this business at the age of 20 with Charles Schwab and became a Portfolio Manager by the age of 29. Today I live half of the year in Puerto Rico and half in my hometown, Phoenix. I’ve invested in private companies and even was the CEO of a post-bankruptcy turn around called Jack Grace USA.

Me and my team publish our flagship LongVol PDF Report each Sunday and have done so since 2020. In fact, we were the team that called for Carvana short at $160 in March 2022 before anyone would listen plus many more market calls & research.

Want to connect? Follow us on X @TheLongVol or on LinkedIn here.

Shake Off The Bad News

U.S. stock markets showed mixed performance amid tariff-related developments and economic data releases. The S&P 500 and Nasdaq gained 1.9% and 2%, respectively, while the Dow rose 1.6%, following a strong May where the S&P 500 and Nasdaq posted their best monthly gains since March 2023 (6.2% and 9.6%, respectively). Technology and AI-related stocks, like NVIDIA, Broadcom (AVGO), and Palantir (PLTR), continued to drive gains, supported by strong earnings and AI demand. However, tariff uncertainty, particularly after President Trump accused China of violating trade agreements, dampened sentiment late in the week.

Weak jobs data, with initial jobless claims rising to 247,000 (an eight-month high) and services sector layoffs increasing, raised concerns about economic growth, boosting expectations for a Federal Reserve rate cut in September (75% probability). Consumer staples and utilities outperformed, while consumer discretionary and energy lagged. The S&P 500 traded in a consolidation range between 5,785 and 5,965, with technical support at the 200-day moving average. Overall, markets remained volatile but resilient, with investors focused on upcoming jobs data and trade policy developments.

Moving on….

This week we highlighted 3 ideas from the report that had the potential to be active: $OKLO ( ▲ 3.12% ) $HIMS ( ▼ 0.32% ) $HOOD ( ▲ 2.2% ) and all three did not disappoint. We opened up the week with all three aggressively rallying with $HOOD ( ▲ 2.2% ) being the only one that did not reverse on what’s called an outside day reversal.

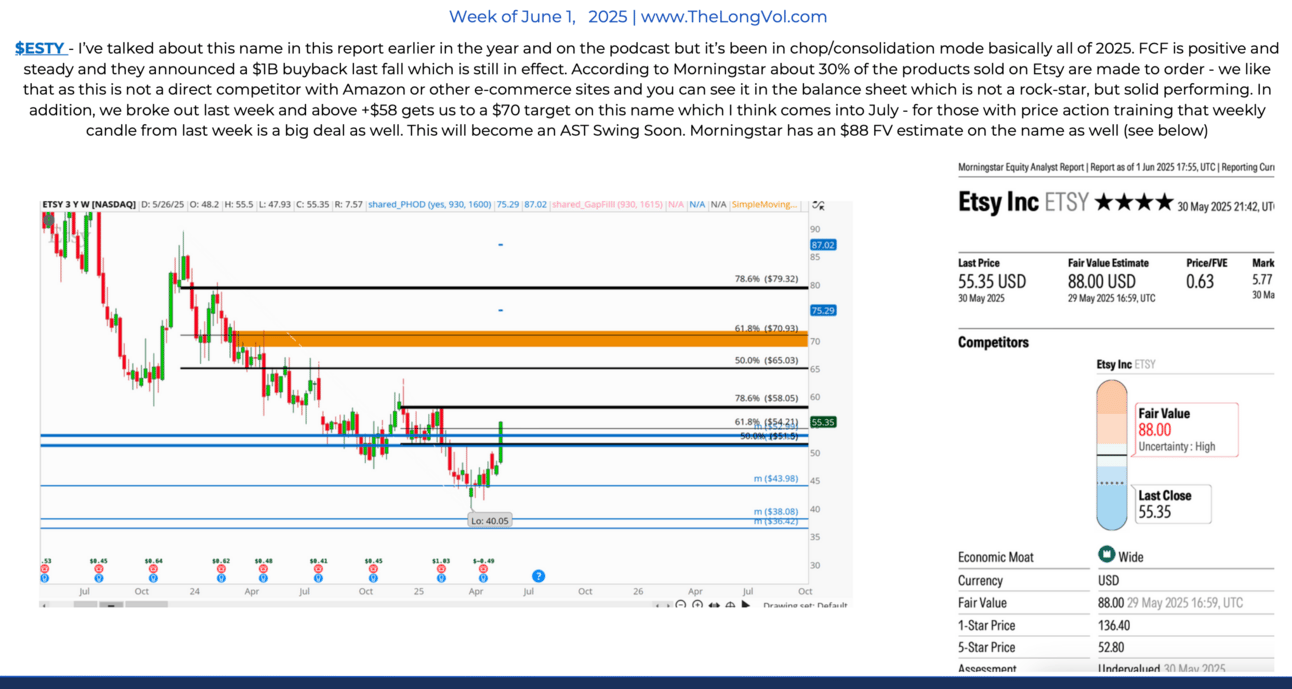

Shares of Etsy $ETSY ( ▲ 3.88% ) had a great week so far and were highlighted in the report this week - they name has been tracked for the last six months and we’re beginning to inflect there.

DeltaOne & Swing Portfolio Highlights:

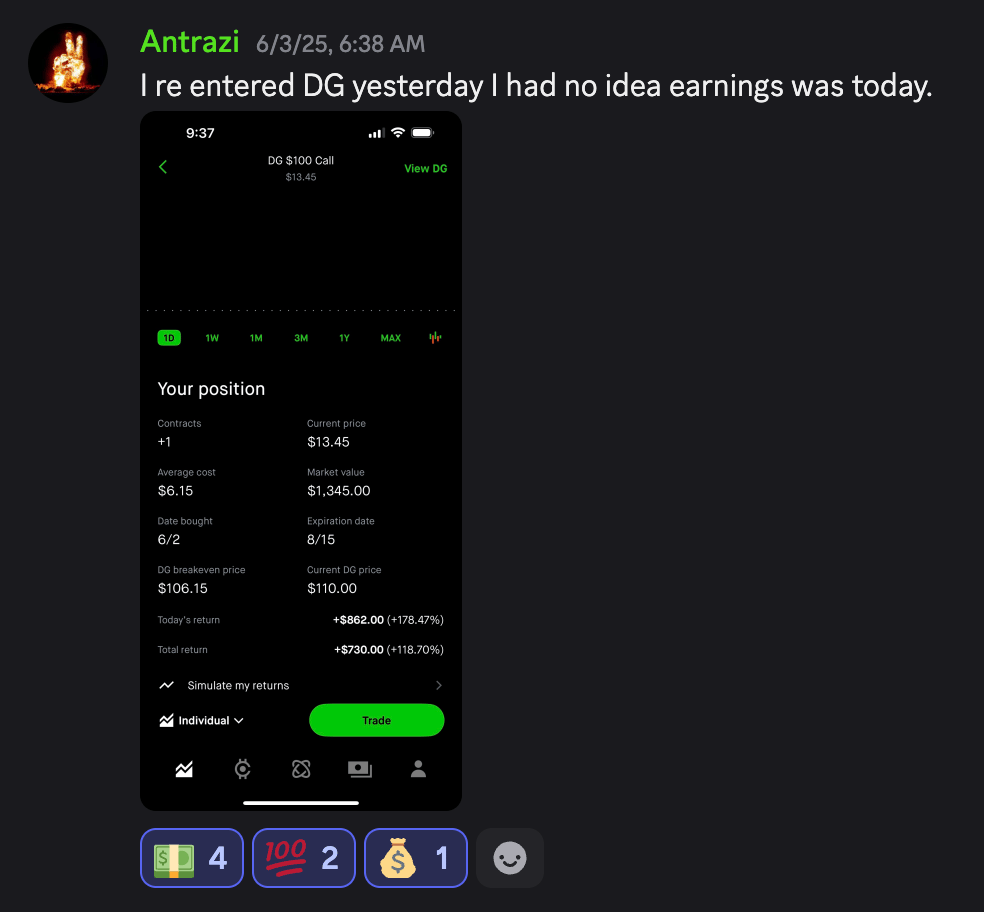

✅ $DG ( ▲ 0.69% ) Long - Covered here a few issues ago.

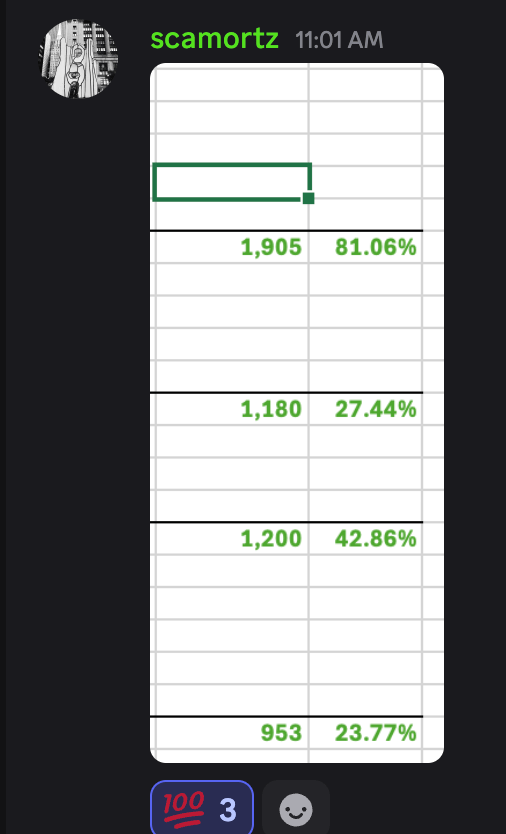

Some trades in $SPY ( ▲ 0.73% ) $TSLA ( ▲ 2.45% ) $HOOD ( ▲ 2.2% ) from @Scamortz

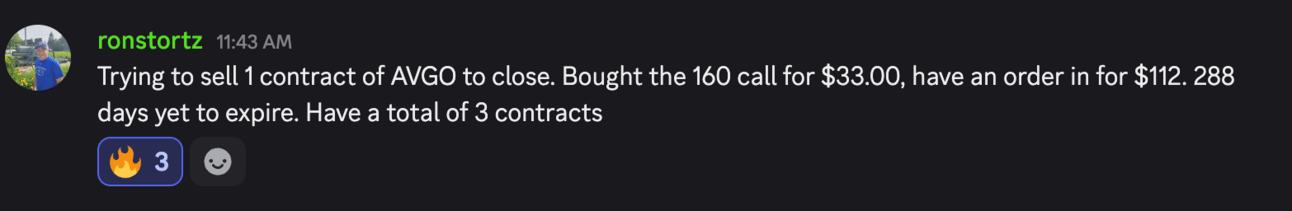

✅ $AVGO ( ▼ 1.47% ) long from @Ronstortz

✅ Conclusion:

NFP Data Friday is still coming out but so far these highs remain resilient and picking the spots here is the key. There were quite a few outside day reversals this week and that’s a bit concerning here on these highs so I am still in the camp that we need to check back a bit across the board and have been booking gains on many names this week in the short-term trading book.

🔎 If you’re an active investor and have a portfolio of size then consider DeltaOne or our Swing Alerts Portfolio. This gives you access to cross-asset trading strategies for any market environment:

✅ Premium DeltaOne Community w/ Investors Globally

✅ Access to In Depth Reports & Research

✅ Access to the AST Swing Alerts Portfolio (Alerts)

✅ Access to Flows Chat (Short-Term Equity & Options Ideas)

Broad Market Snapshot

🇪🇺 JPMorgan CEO Jamie Dimon is warning of cracks in the bond market (Barron’s)

📉Toyota Industries stock tumbled in overnight trading. Shares fell after Toyota Group’s reported $33 billion deal to take the company private, which would include a tender offer of $26 billion. Some analysts say the deal is “unattractive.” (CNBC)

💰 Disney is laying off several hundred employees globally to cut costs (Yahoo Finance)

🏛️ Economists expect the latest estimate for first-quarter GDP will show a decline of 0.3% (Barron’s)

₿Trump Media stock dropped 9% the same day it announced plans to raise $2.5 billion to buy bitcoin (Barron’s)

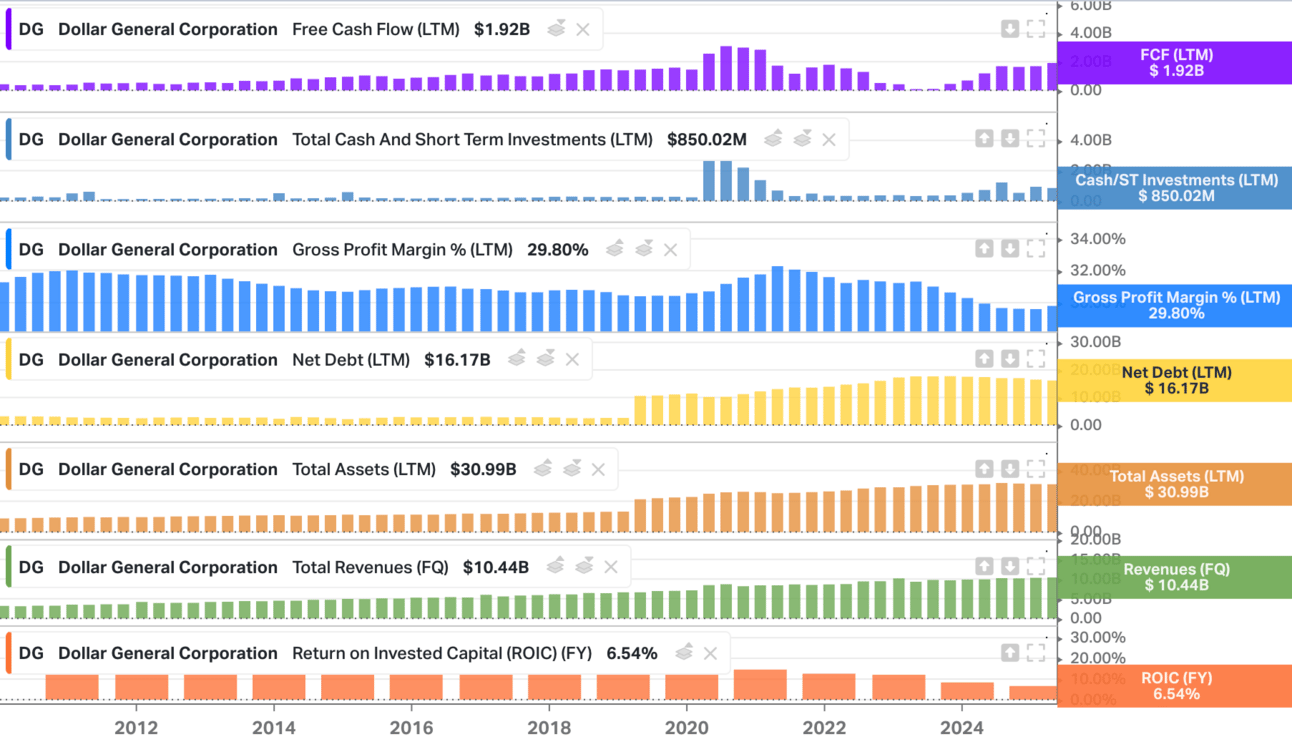

🎯 Dollar General Earnings - Beat & Rally

We added this to the report back in February and discussed it in Episode 61 of this article of the week.

Post Earnings Breakout on Beat-and-Raise Quarter Primary catalyst this week:

Better-than-expected Q1 earnings

(EPS $1.78 vs. $1.59 est)

Revenue $10.44B vs consensus $10.29B

Same-store sales +2.4% (driven by +2.7% avg transaction size)

Gross margin +78bps YoY, operating cash flow +27.6%

Key Fundamental Tailwinds: Prior earnings momentum and improving cash flow are driving stronger institutional demand as a defensive/value play. Motley Fool commentary:

“Stock’s big pop reflects higher expectations going forward.”

+75% from the lows

Conclusion:

Good move so far this year and a name we’ll continue to track here. I sold our position this week and happy to buy it back again in the coming months or so. $120-$123 is going to be a key technical overhead area to watch on this for those in this still.

The last earnings call/report was a good read and signal to pay attention to this so if you missed it I would go back and read through it then look at why the inflection and then go to the charts - BTW we traded this in the AST Alerts Portfolio.

Outside Day Reversals

Let’s talk about some technicals and price action trading this week. Outside day reversals are a concept used primarily for intraday trading but can be used in so many ways as a part of the analysis process when you trade price action.

The concept is simple in that when price breaks above or below yesterdays trading range that it is bullish (if above) and bearish (if below).

This week a lot of names broke above PHOD (prior high of day) at the opening and failed to hold then came back into the range - that is an outside day bearish reversal.

That is a bearish sentiment read on price action for that day and you can take that a few ways and use that data:

If you want to get short you short the break of PHOD and see where price trades too next

You track this over the next few days - does the stock continue to NOT make new prior days high instead failing back into the range?

If you get long a move then PHOD becomes your stop/exit area - so if we breakout then come back and fail then you’re out but at least you tested the move higher on the day.

Price action concepts like this matter for almost any asset class in the world and if you’re a reader of this and actually are serious about making money doing this you’ll dive into it and see how to incorporate this into your traders toolbox.

Here are three ODRs this week:

SPY on Thursday - broke out of the range and came back in then broke PLOD.

NVDA - Thursday broke out of the range then failed violently back into it and back to the range lows.

HIMS - Monday. Pre market gap up and breakout then failed back into the range hard.

✅ Conclusion:

This concept is really good for intraday and swing-trading because it gives you price context which most people don’t have. They tend to get into trades with no idea at all where they are going to exit - or - if you short some of these reversals, where to start shorting the move.

Dive Into The Charts

✅ Each week we look into charts of interest. For new readers here who want to learn about our views on price-action, levels and high time frame technical analysis you can access the lectures here.

At a key spot this week here at $140s. A move below that causes a nice sell signal on this for a few days so something to watch closely, esp. after the ODR today.

🏦 Index Performance YTD

🏦 Tech Names - $XLK ( ▲ 1.3% )

Tech names are exhausted here and I think are due for a nasty sell off into June OPEX.

Members Q&A

Each week we take question from members on the stock market at large including:

Analyzing companies

Price action lessons

Portfolio management

And More

Please submit any questions via DM or email by Friday morning each week.

You can upgrade to DeltaOne and get access to the Swing Alerts Portfolio and +9 other chat rooms with your membership. Start a 15 day free trial here.