Today was what you wanted to see if you are a bull and Dan talked about this in the Sunday report which I want to cover here in the free section today.

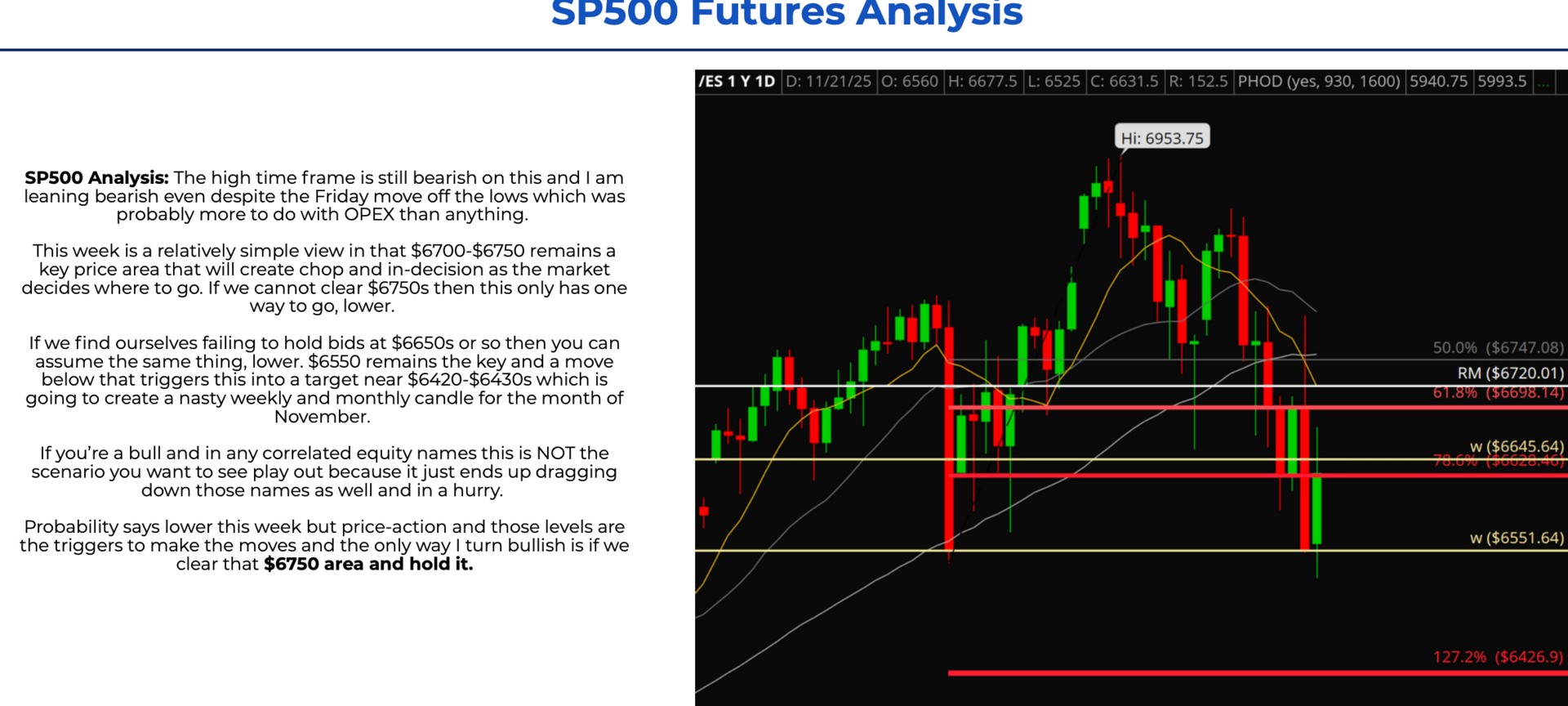

When I look at anything from a price action lens I have to see the high-time frames, I see so many new traders ignore this and it’s deadly because you end up missing moves or getting in when you should be waiting so when I look at this move so far this week it’s exactly what you want to see: you broke $6750s with force, and when you break a zone or level how it’s done matters more than anything.

As long as $6,750s hold here this short-term bottom is in and we should trade higher into next week but that is the key for now.

One of the other things he talked about was OPEX options expiry flushing out the retail call buying and now that we’re done with that you’re starting to see the bids come in a lot of names again which looks like our end-of year rally and right now given the $SPY ( ▲ 0.73% ) close we should be good to go.

A lot of names are close to triggering longs but it’s a short-week so I took the time to add into equity in some and will wait in options on the others but I want to update readers on:

A long I added into today (stock)

The two ideas from Sunday

By the way, all of my paid posts can be found under the “About Me” tab or on the “Options Flows” tab above, there are some website changes being made to make all of the navigation easier.

- Weekly Best Options Ideas

- Options Flows & Price Action Insights

- Real P&L & Market Recaps