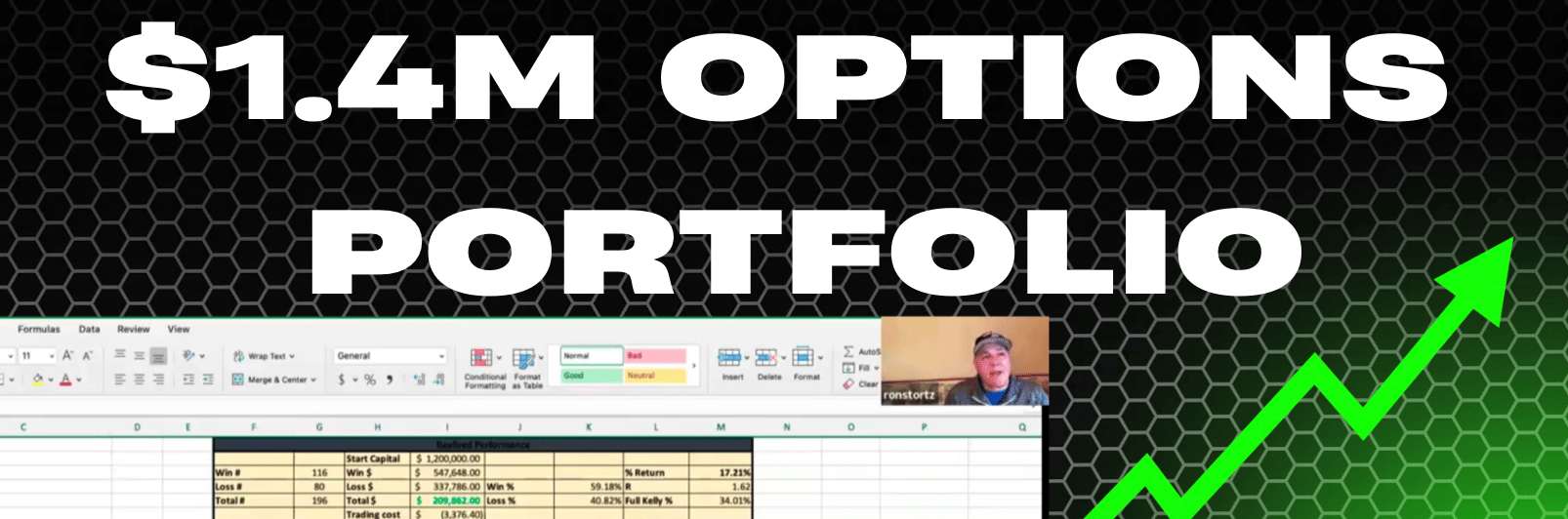

Million Dollar Traders: Ron’s $1.4m Options Portfolio

I have a special webinar this week for everyone as we take a break from the markets and reset a bit before finishing out the trading year.

Ron Stortz, who is a DeltaOne member and long time reader of our weekly stock market newsletter, shares his investing approach while running a $1.4m investment portfolio using options expressions to structure his ideas.

Ron’s story is unique because he and I first met maybe 8-years ago at the education firm that I built and sold and he went on to try to learn other approaches (mainly macro) that didn’t really help and he explains why and more.

He’s had an incredible 3-years in his portfolio beating the market each year and, at one point this year, was up over +30% while being about 30% in cash — so not bad!

As many readers of our report know, we’ve had an incredible year with our recommendations and while many of his ideas came from the report he also dives into other tools he uses to generate ideas.

We talk about that stock selection approach, why he uses price charts for analysis and then we dive into his trading year and discuss why he uses long-term, at-the-money or deep-in-the-money options to express his views.

As you’ll discover, this can be a double edged sword when the markets get nasty like they did in October but he discusses why we use a long/short approach to hedge out portfolio risk, which he discusses.

We get into other topics as well such as why he could never make macro investing work, his story of investing, how he makes his life efficient doing this and then take questions from those of you that sent them in.

There are a lot of take aways from this interview and I think the one thing most viewers may see is that the research and idea generation process, when done this way, leads to a more stress-free approach to portfolio management.

It airs tomorrow at 10:30am EST - click below to be notified when it goes live.

P.S.

We’ll be interviewing some other readers of our stock market newsletter as the year winds down and posting them here so if you’d like to be featured send me message.

Enjoy the interview and we’ll see you Sunday with our final market report of the year.

This is not a solicitation to buy or sell securities.

The LongVol Report is not an Investment Advisor

For full disclosures click here at:

https://longvolreport.com/terms

Futures, Options and Stock trading involves a high degree of risk and may not be suitable for everyone.