IN CASE YOU MISSED IT

The weeks newsletter issue 48 is posted FREE here

There was a new Model Portfolio alert issued yesterday

The 3 Bucket Approach to Portfolio Management (Members Post)

TOP MARKET NEWS THIS WEEK

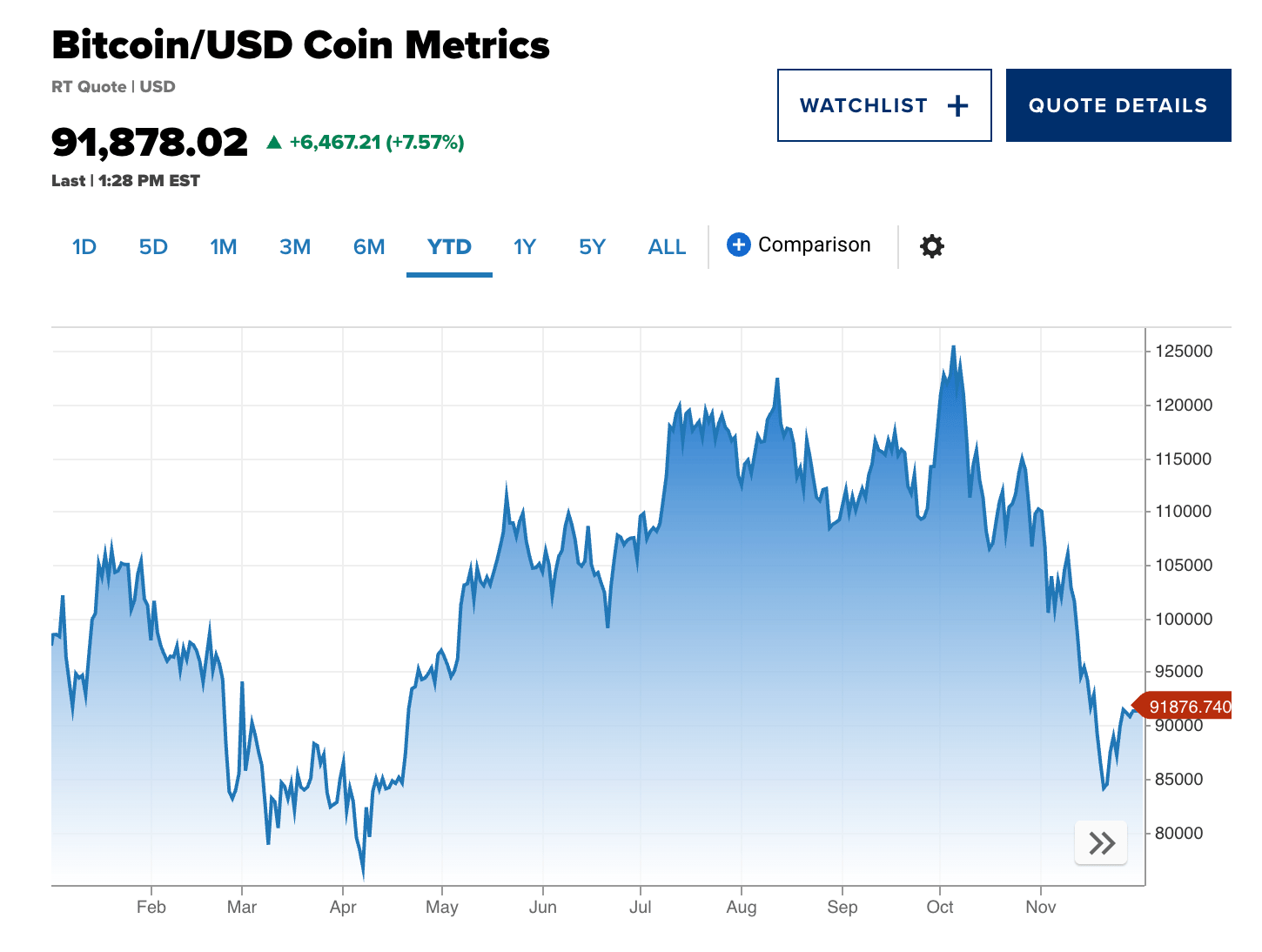

Bitcoin Volatility is Back

This week Bitcoin traded lower dragging down names like $MSTR ( ▲ 6.29% ) and $COIN ( ▲ 5.34% ) before rallying on Tuesday and fears about $MSTR ( ▲ 6.29% ) solvency started to spike back up across the market before Tuesday’s rally.

Michael Burry weighed in on it saying it was “The Tulip Mania” of out time which is right on cue with the rest of his bubble talk the last few weeks.

OUR TAKE

This has been a trading sardine for many years and we’re investors who like actionable trade ideas as well so the flows that we see in Bitcoin and other names that track it are ideal for trading situations.

I know that being a bear on this is not what markets like to see but this is really teetering on key levels so the move this week on the lows was “step one” for bulls to save it.

My personal views on this are below and for better or worse that’s how I view Bitcoin and capital allocation for that matter.

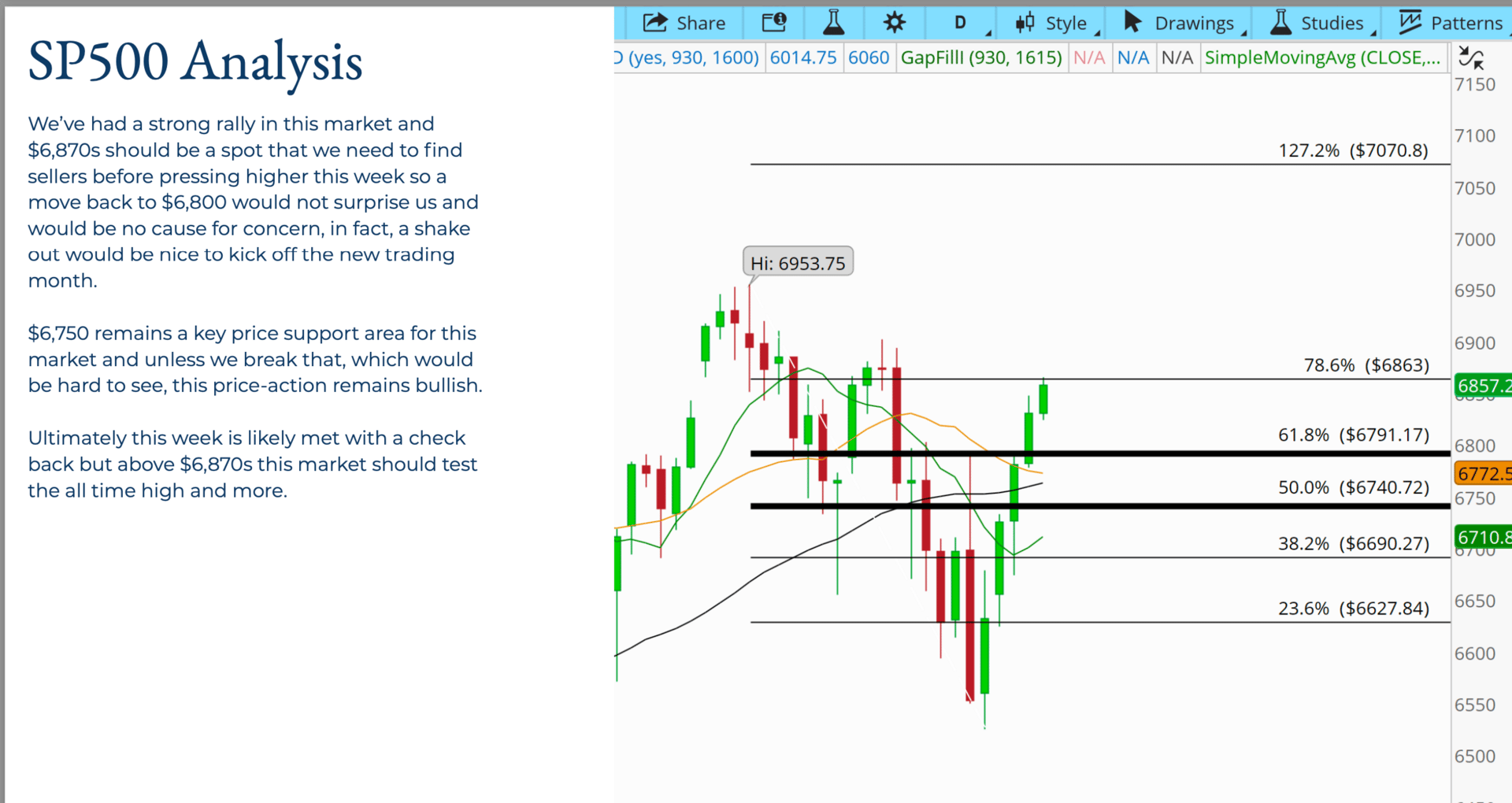

SP500 - New Highs Cometh?

We’re finally through November OPEX and into a new trading month and we’ve seen a nice rally on most of the broad market names with many of them beating during earnings season it begged the question, why the selling?

We covered our views on this in prior webinars and in this weeks newsletter which is free to download as our final issue for 2025.

Meanwhile, we tested those highs twice so far this week only to be met with selling and that’s usual after we get a few days/weeks of positive breadth—and for those underweight, which many are, they are looking to add but may be having a hard time on these highs.

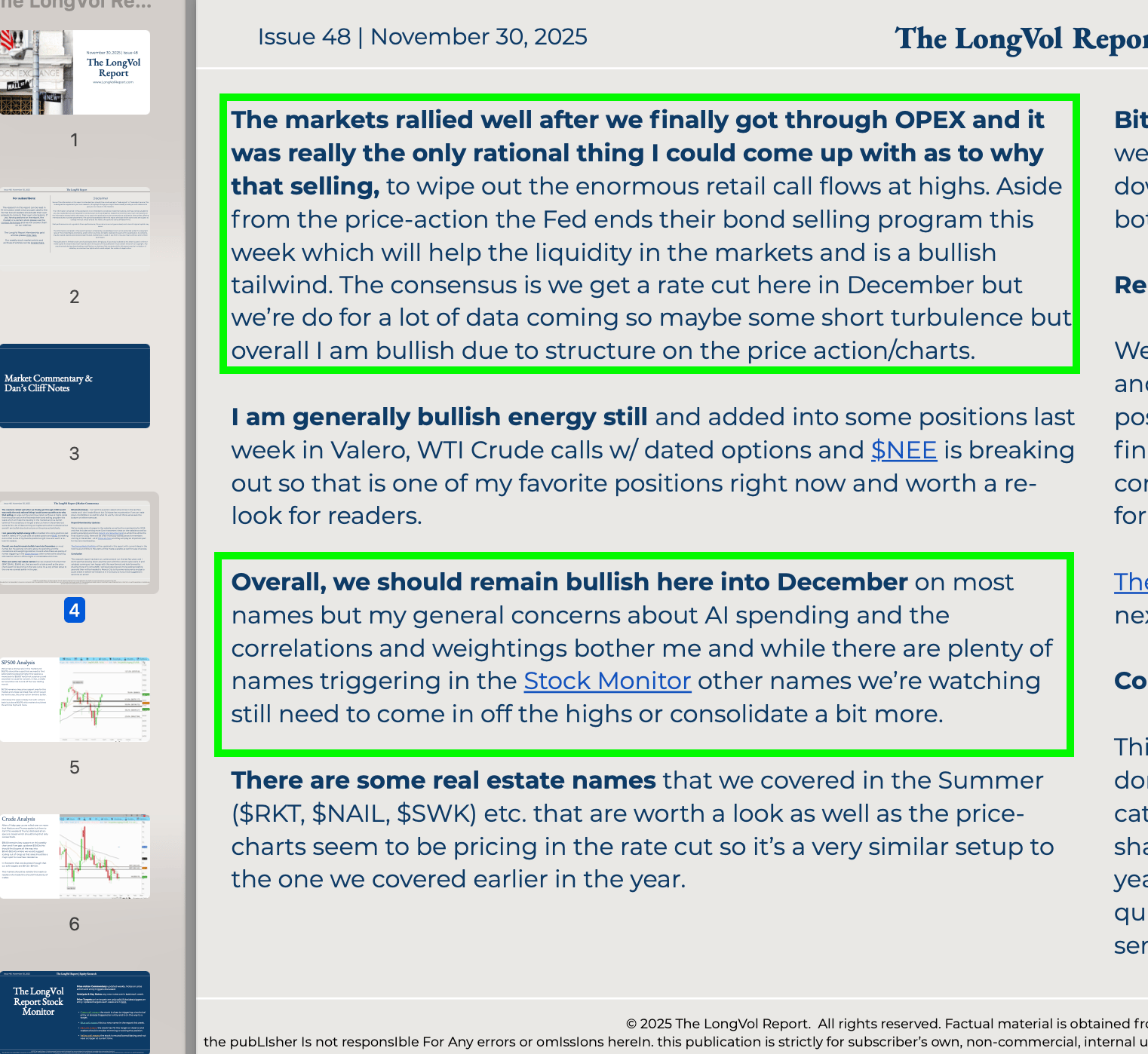

Our Newsletter, 48 | Market Commentary

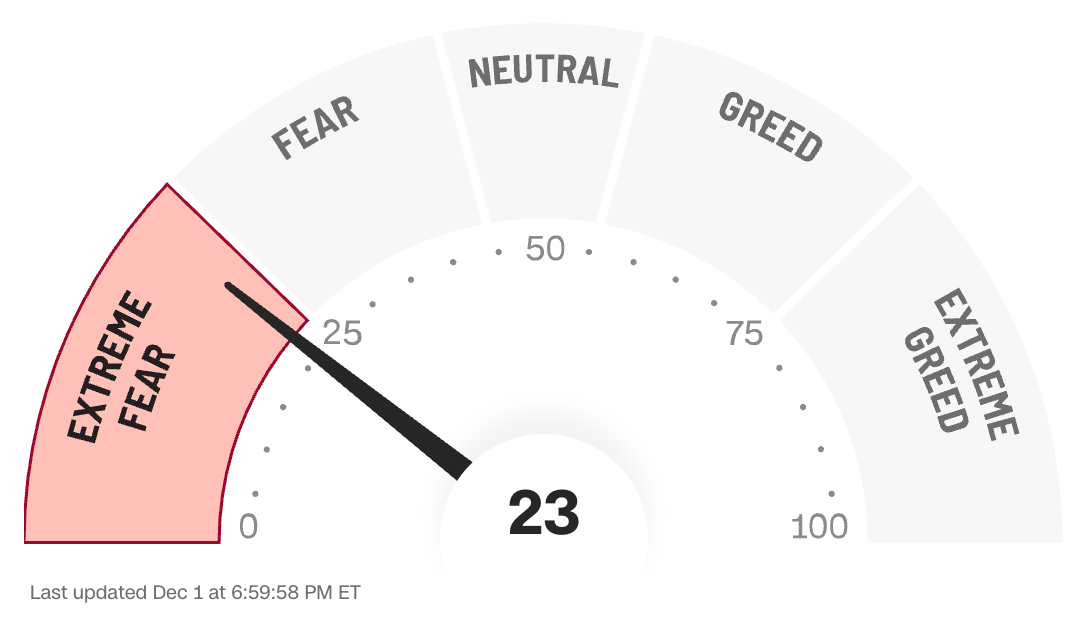

We’ve moved up from extreme fear to start the month yesterday to a standard fear reading — for readers our newsletter you know we avoid this noise and focus on idea flow that is not predicated on the SP500 movement so best to ignore the noise and move on.

OUR TAKE

As we mentioned in this weeks newsletter our views remain consecutively bullish on the SP500 as long as we remain above $6,750s with this sideways chop to start the week something that is expected after that run up we’ve just had.

Above $6750s should trigger more buying into all-time highs as we’re headed into a rate cut here for December which means those who missed the chance to add into key names (still time in some non-popular names) into the end of year.

Personally, I’m allocated for the year and aside from a few other tactical trades I am likely done for the remainder of 2025.

Research Highlights

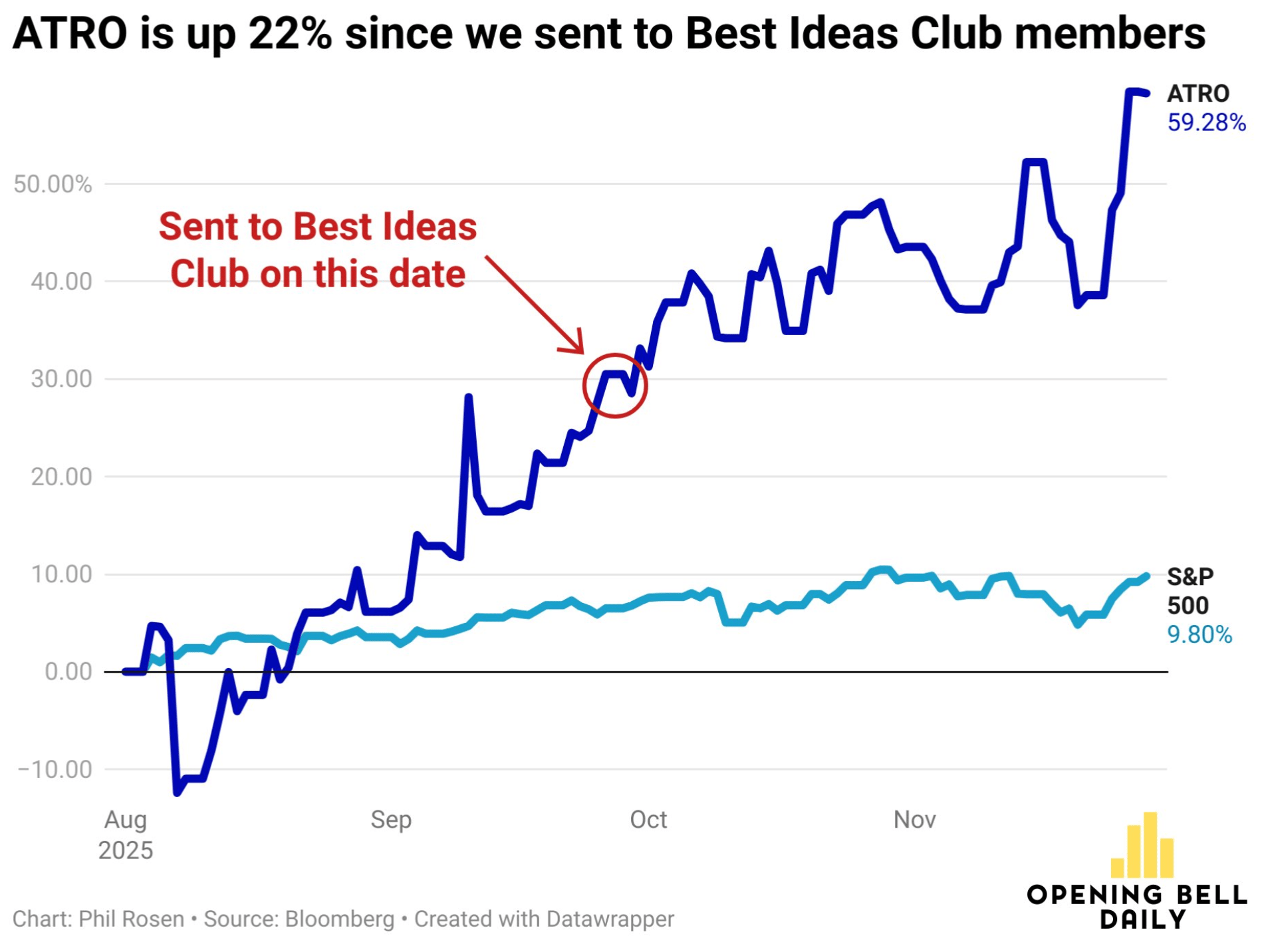

Astronics: A New 52 Week High - $ATRO ( ▲ 0.91% )

Back in August I introduced this name to readers of The LongVol Report Membership as a turn around to growth story and the stock is +70% since then which makes it one of the bigger wins this year.

If you missed that post and are a member you can read it again below.

I also pitched it a few months later to Phil at Opening Bell Daily for his Best Ideas Club and it’s been a winner for them too (yes, even still!)

VF Corp (Vans) - $VFC ( ▼ 2.52% )

This has been a stock we’ve covered for literally the last 1.5 years because it’s a great turn around led by a great team who has continued to do a great job in doing what most CEO and management teams don’t: doing what they say they’re going to do!

I owned a pretty large position the last 1.5 years and traded in and out of it at least 3 separate times with my 2027 LEAPs just being sold into this recent move. For members, the target was $20’s initially on this but I wanted to book some gains and bring it in for the year as we get ready for 2026.

There is a good chance I buy back into it soon on a check back and if we do we’ll update you all in a post.

OTHER NEWS

The new LongVol Report Membership is active for 2026 and you can watch a short-webinar here.

We’ve also made it easier to navigate posts on the site, go to About > Dropdown > Select your membership

We’ve updated our weekly market newsletter for 2026 if you did not get a free copy subscribe to our free email list and it will send.

My plan is to host a public Twitter spaces or webinar here in a few weeks to talk about the 2026 market outlook and take questions about our research report and other market related items so look for an email with information on that.

P.S.

We cover a lot more data and commentary with this exact article in our webinar so make sure to subscribe to the YouTube channel here.

This is not a solicitation to buy or sell securities.

The LongVol Report is not an Investment Advisor

For full disclosures click here at:

https://longvolreport.com/terms

Futures, Options and Stock trading involves a high degree of risk and may not be suitable for everyone.