The Long Vol Report - Weekly Article of The Week

If you’re a new reader here then here are some links to help you get started on what we do here and how we go about generating idea flow for investors and traders.

How to Use The Report (7 min read)

What is The LongVol Report (5 min read)

Trading a Small Account? Read This.

Investing with a Large Account? Read This.

We also put out a weekly video/podcast here.

You can add us on Twitter here or LinkedIn here.

The AST Swing Alerts Portfolio is our alerts portfolio for swing trades using deep-in-the-money calls as stock replacement. We send out 2-5 ideas per month with entry, exit, stop and position size for members. You can upgrade here.

No new positions added this week.

Coming into this week the market fears about tariffs were back on but we shook those off again as we get into earnings season again. Usually Summer months are off season but the volumes are here and with Trump still tweeting away they pick up.

The report this week did not have too many updates in it but the Momentum names in there are and have been in play so that was the majority of the executable idea flow from the report this week.

These were a few of the key names this week I highlighted in the Cliff Notes and reiterated in our DeltaOne community.

$OKLO ( ▲ 3.25% ) - This was in play this week and is in the report. We had a big day Tuesday followed by a check back Wednesday. Readers cashed in and continue to do so here trading the momentum.

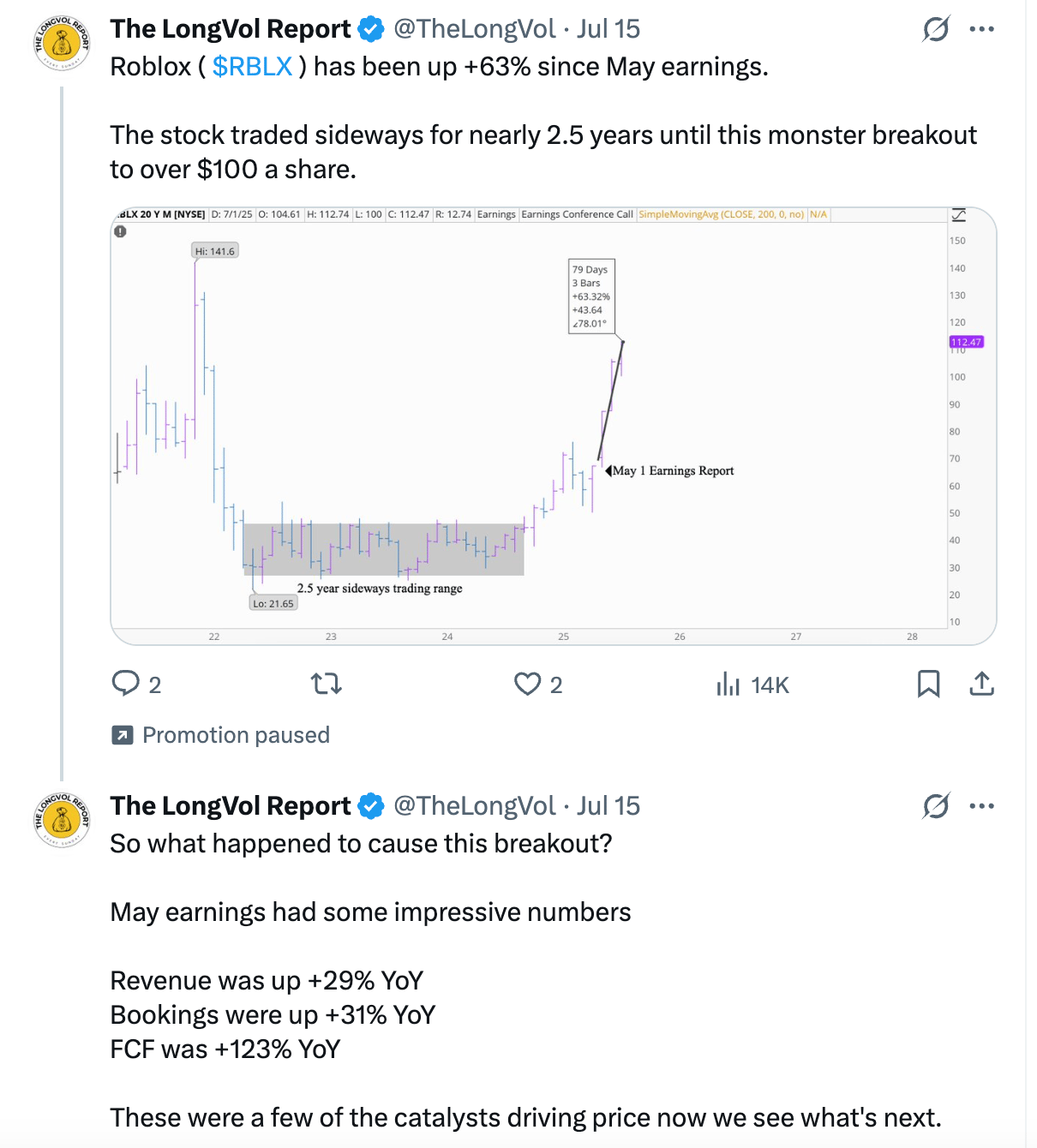

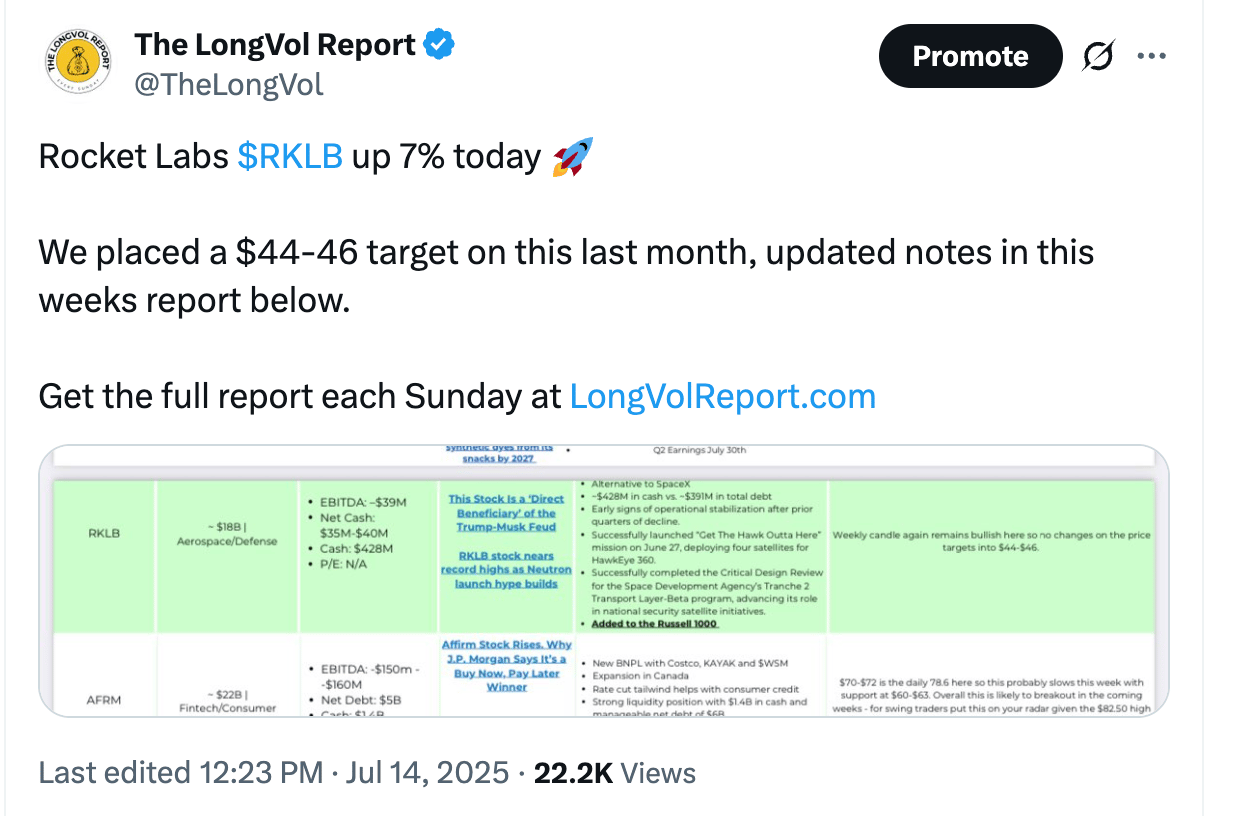

$RKLB ( ▲ 2.54% ) - Another big winner this week and the last few weeks. We highlighted the all-time high breakout with our soft-targets which were hit this week.

$HIMS ( ▲ 2.91% ) - A name we’ve had in The Report since $6/share - this is starting to get going again.

$TSM ( ▲ 1.83% ) - Big earnings this week and a name we’ve traded before and into this breakout.

A lot of you cashed in on those this week as we wait on some of the other coverage in the report to get through earnings season here which is usually a tim where we’re watching current ideas or going through the earnings calls and then adding new names to our Core/Spec Situations monitor.

Have to be a trader of this name. We’ve been after it for the last few months; ignore the valuation and trade the setups is the name of the game here.

I cleared out some of my short-term options structures this morning making this the second big trade I’ve had on it this week (Tuesday was the other one).

You don’t need options flows for this name to tell you it was going to be a machine from last quarter into this quarter. The earnings report was on-point: the quick read notes are above but the earnings report was the source data to tell you all of that.

✅ Everyone on the OKLO flow breakout from the report this week

More Oklo…..

$RKLB ( ▲ 2.54% ) Swing from the report

✅ $RKLB ( ▲ 2.54% ) made it into the report last month: readers trading momo flows on this

Published in PDF Format Each Sunday

🇲🇽 President Trump announced 30% tariffs on Mexico and the EU. He unveiled the letters to the trade partners on Saturday, and said the new levies will begin August 1. If either partner retaliates with higher tariffs, “then whatever the number you choose to raise them by, will be added on to the 30% that we charge,” Trump said. (CNBC)

🖥️ Nvidia said the US will allow it to resume chip sales to China. Shares of Nvidia surged overnight after the company announced it’ll soon be clear to sell its previously restricted H20 GPU chips to clients in China. (Reuters)

🏦 Kevin Hassett is the frontrunner to replace Powell. He’s one of Trump’s longest-serving economic aides, and sources close to the matter say he’s the current favorite for the Fed’s top job. Kevin Warsh is a close second. (Bloomberg

Trading the ranges has never been more profitable….

Source: Opening Bell Daily

September Rate Cuts Basically a Coin Flip Now

We’re still in the view of bullish housing sector names before the rate cuts and into 2026 so this new change does not change that view. We own names in portfolios prepared for this the next 6-18 months but something to watch still.

Interesting

Fund managers are chasing the indices here at the highest pace in history. Does it matter to readers of our report? No, not really. Does it matter for engagement farming for big X accounts? Probably.

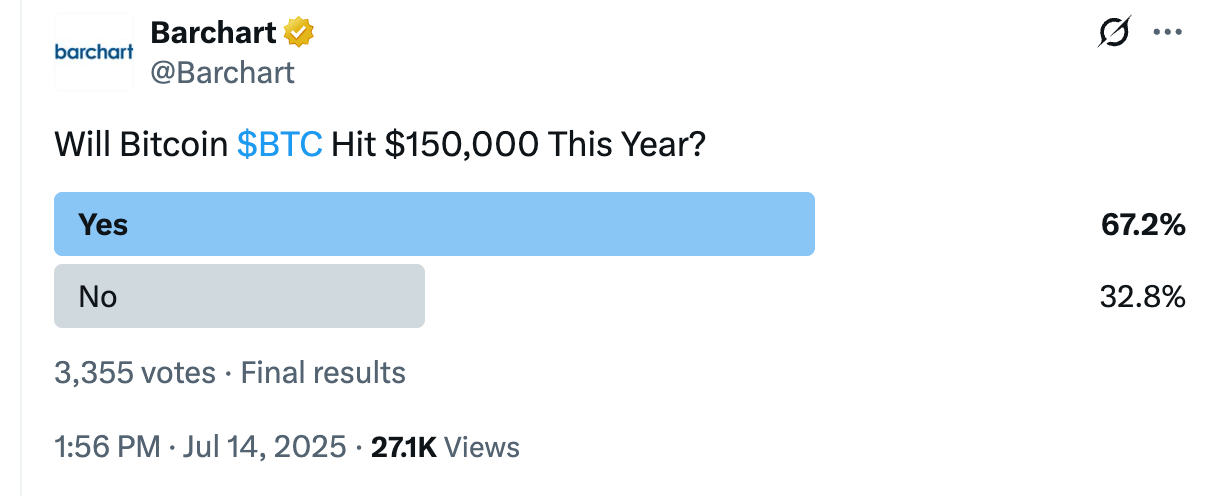

Positive tailwinds here for equity names like $COIN ( ▲ 14.99% ) , $MSTR ( ▲ 10.88% ) and a few others. Not names covered in the report but names some trade in the community based around the Bitcoin correlation and technicals.

Dive Into The Charts

✅ Each week we look into charts of interest. For new readers here who want to learn about our views on price-action, levels and high time frame technical analysis you can access the lectures here.

🏦 $ASTS ( ▲ 13.75% ) new all-time high made this week and new add to The LongVol Report

Breakout coming?

🏦 $PYPL ( ▲ 1.74% ) - Sold off last Friday on news from JP Morgan but key technical levels held and still bullish on the name given fundamental tailwinds.

🏦 $RKLB ( ▲ 2.54% ) a name new to the report last month that has been a big winner for many readers the last few weeks!

Q&A & Miscellaneous

✅ Member/reader Q&A on equity ideas, research and charts. Submit questions in the Discord community and each week we’ll chat them here.

✅ The LongVol Report Investor Conference is still on Nov 10-14th in Phoenix.

A few photos from my NY Trip this week…

Brookville CC - Thanks to Matt

Crab Meadows in Northport - Thanks to Frank for Hosting us

Carnegie Club NYC

Tavern on The Green - One of the best burgers I’ve had globally