The Long Vol Report - Weekly Article of The Week

If you’re a new reader here then here are some links to help you get started on what we do here and how we go about generating idea flow for investors and traders.

How to Use The Report (7 min read)

What is The LongVol Report (5 min read)

Out Swing Alerts Portfolio - Trial Free for 21 Days Here

We also put out a weekly video/podcast here.

Follow on Twitter here.

This week’s title was “Nobody Cares About Macro” and that’s really me saying I don’t care about macro because I don’t. It doesn’t generate idea flow and in my career the folks that usually talk about it care more about sounding right than they do actually making money from it - and if I am being blunt, most of them never make money from it; it just gets them on CNBC, 200K twitter followers and, for some, allows them to sell the alleged smart-money 20K a month subscriptions.

What matters is idea flow and revenue aka P&L - that is if you’re here to actually make money doing this.

I don’t deviate from our process here of generating idea flows and I especially don’t deviate from it in how we run portfolios in the fund. This is one of the reasons why I avoid reading news articles, subscribe to newsletters or worrying about Macro takes; It’s not part of my process for generating idea flow. I even told this to one of my investors on a quarterly call last week as he asked me about Nvidia again; it’s not what we do - we stick to a process.

In Top Gun they called it “Never leave your wingman” - in investing we call it sticking to your process.

There were a few ideas this week that triggered from the report this week so let’s look at two of them here and discuss them.

$OKLO ( ▲ 3.12% ) - this is a momentum driven name we’ve been tracking at it made it to the best ideas section and for good reason: the stock saw new highs this week and some size-able buying on Wednesday with above average volume.

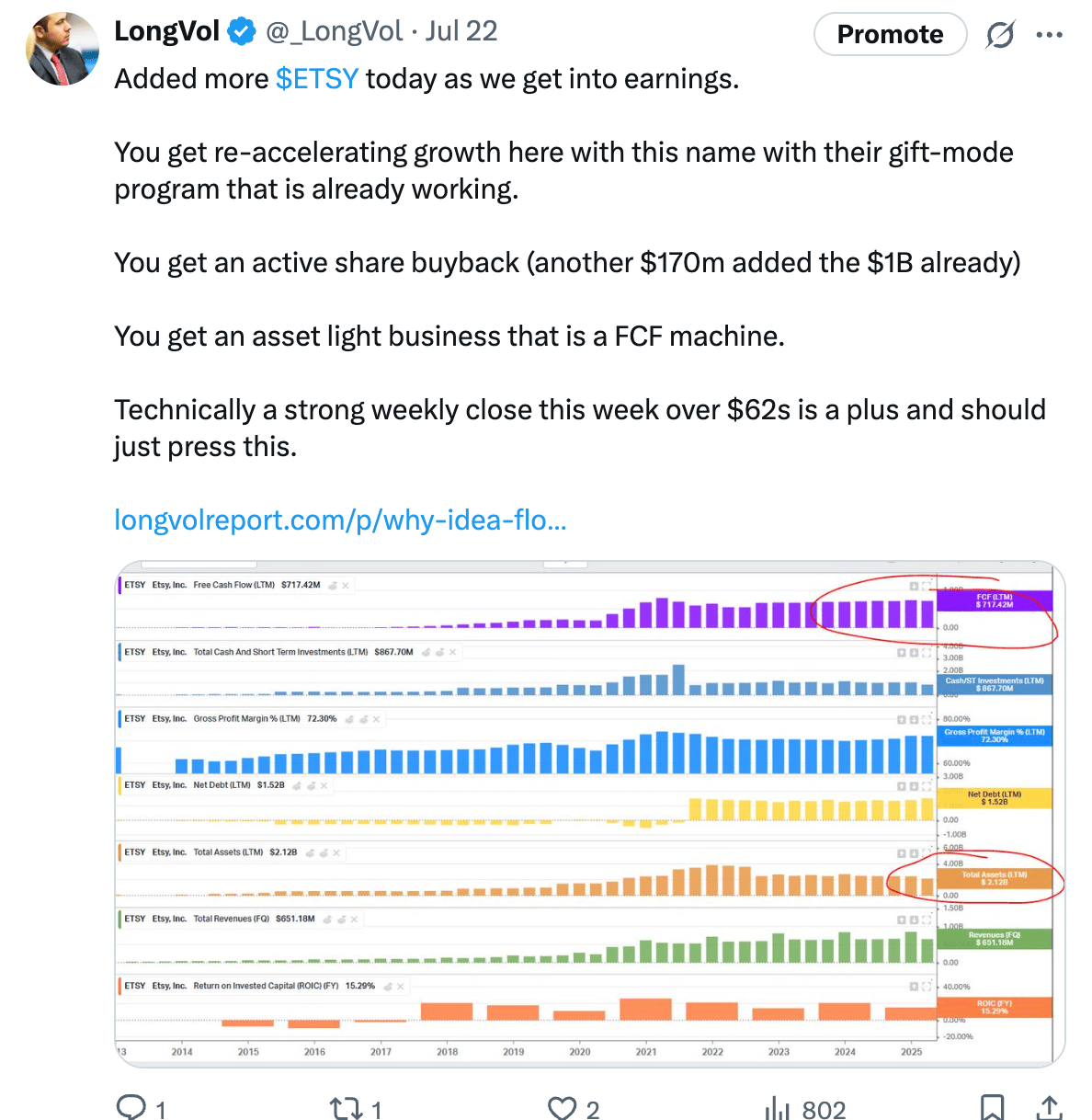

$ETSY ( ▲ 3.88% ) - A bit of a revenue improvement/event-driven buyback situation here with a great chart to match.

By the way, $HIMS ( ▼ 0.32% ) triggered as well and there was a members post here on it before it rallied +16% yesterday.

Issue 29 Notes

You can read Morning Star, Zacks or even a YahooFinance article to see why you should care about this name but none of it matters until you have a process of what YOU look for. This week it was highlighted as a top idea to watch to trigger from the Swing Monitor and it did trigger in - full disclosure I’ve been long but did add into it.

From The LongVol Report

Last week….Cantor Upgrade

$OKLO ( ▲ 3.12% ) was momentum, price-action and an all-time breakout setup. That’s it. Nothing about the financials make sense to me (for now) but that doesn’t matter when you get a technical set-up with those characteristics in play - it also didn’t hurt that it had an upgrade last week and general sentiment that is bullish in this sector.

But, trading a name like this is not that easy unless you buy it and leave it be because you have long-term conviction, I don’t so it’s just a technical trade.

But what really matters? Is it finding net nets, macro flows, breakouts? The answer is that it’s subjective to each investor. You already know my views here and our views in the report is that we provide idea flow of all sorts.

Whether that’s $OKLO ( ▲ 3.12% ) momentum or $ETSY ( ▲ 3.88% ) buybacks and revenue increase expectations it’s idea flow that counts.

This was another tweet this week (telling you how I really feel) about just taking one point of view when it comes to idea flows. He could have easily traded the equity on that name with a $1.1m portfolio but he levered the idea with deep-in-the-money options.

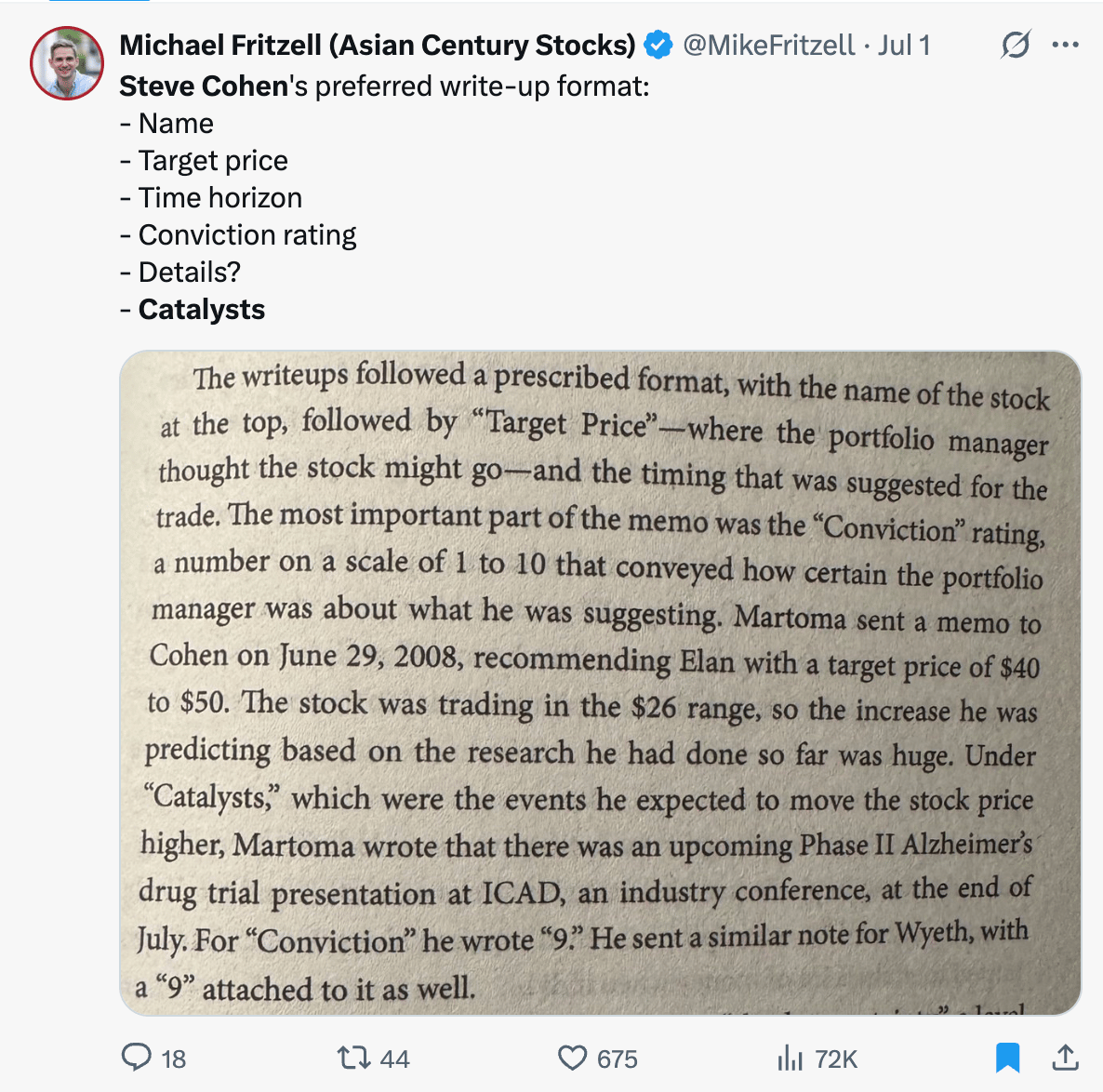

And whether it’s $ETSY ( ▲ 3.88% ) or $OKLO ( ▲ 3.12% ) the idea process stays the same: target price, expected hold time, catalysts or tailwinds driving the idea and then notes on the general price chart.

That’s process and the longer you do it the easier it get’s….just like riding a bike.

A comment about how portfolio mangers at SAC Capital were asked to present potential trade ideas the same way, each time.

While he may get a bad wrap for insider trading the point is that there’s a process here for developing idea flow and that process is the same approach that I’ve taken in my career and the same approach we take in the report when we generate idea flow.

You can ask any of the folks you see on the P&L highlights here each week to give you a trade idea and they could articulate it in this matter in less than 2 minutes, each time, every time - even if they take most of it from the report.

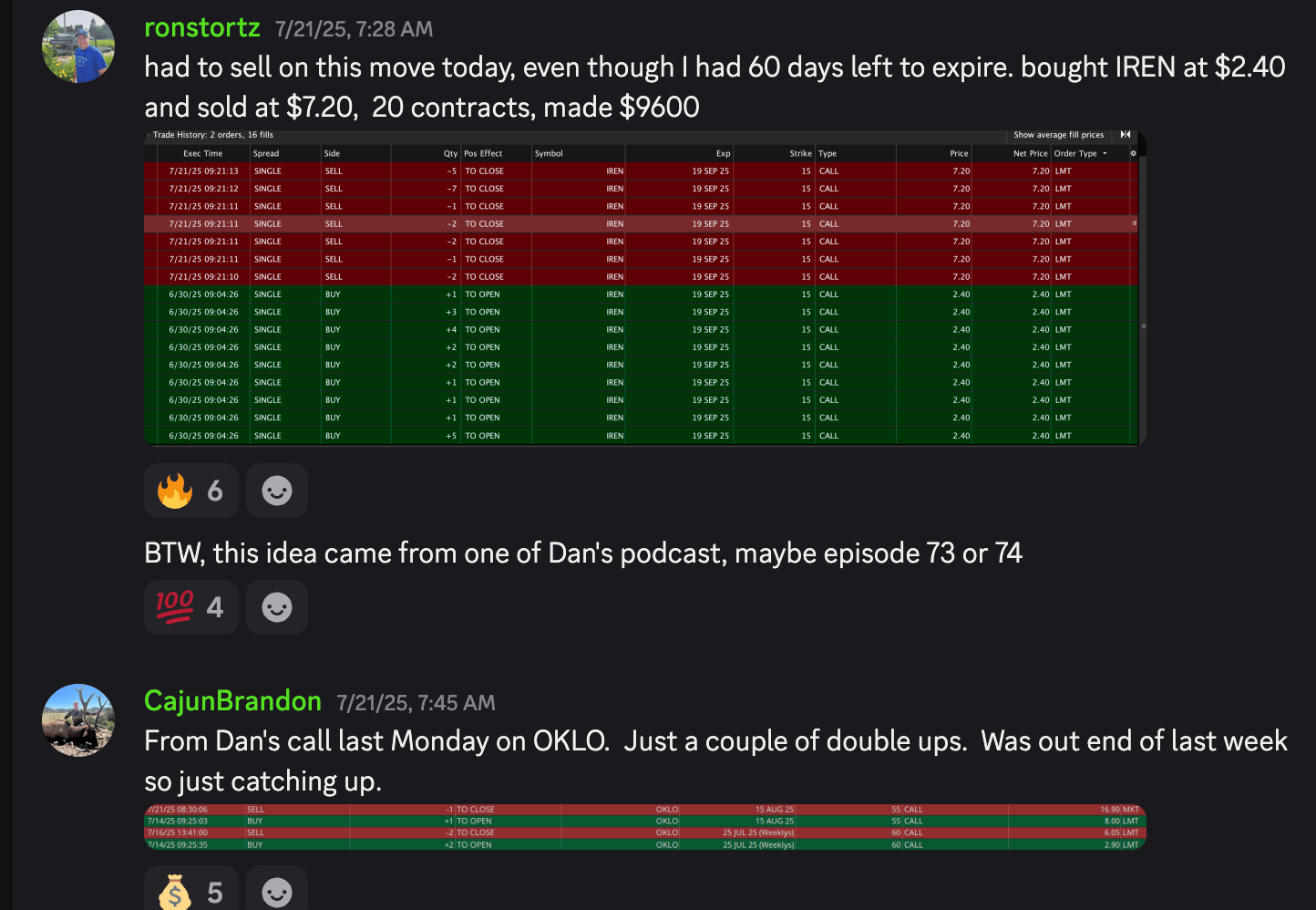

✅ $OKLO ( ▲ 3.12% ) and $IREN ( ▲ 7.25% ) from Cajun Brandon and Ron

✅ $ETSY ( ▲ 3.88% ) from Matt

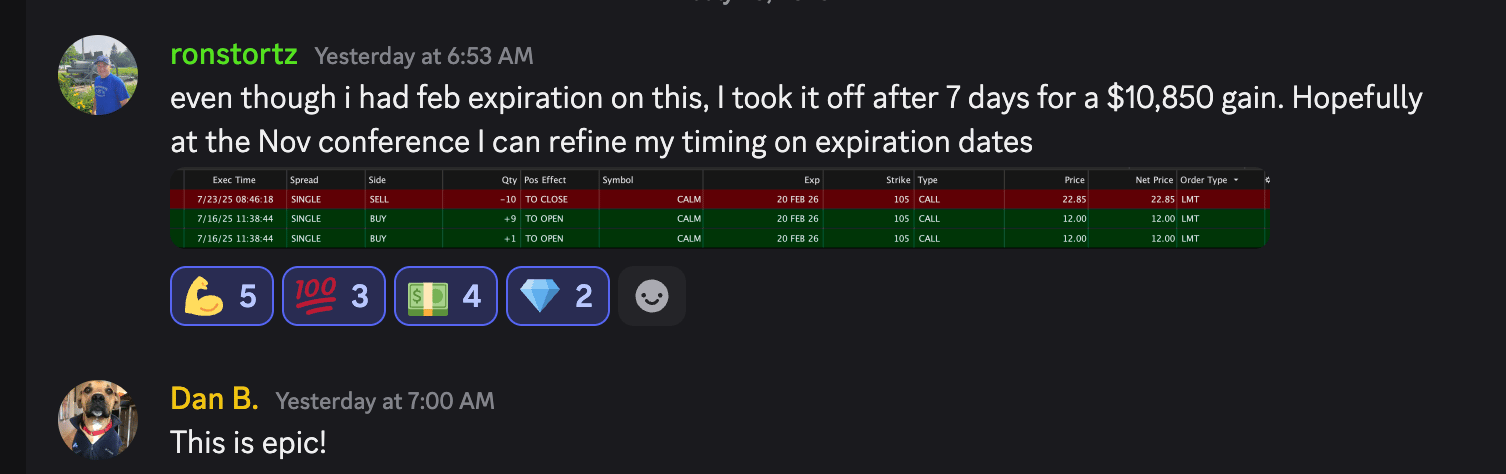

✅ $CALM ( ▲ 0.89% ) Swing Trade from Ron

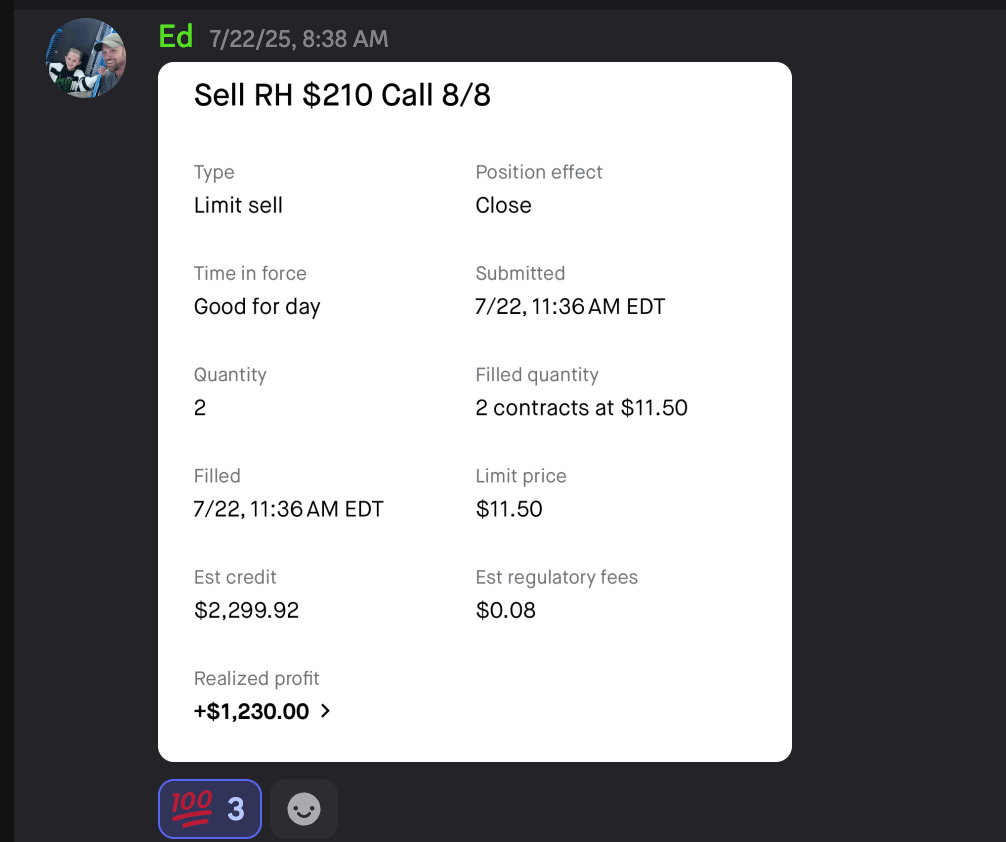

✅ $RH ( ▲ 0.41% ) from Ed

📈Consumers are ramping up spending. Fears of an economic downturn have eased in the last several months, and major financial institutions are pulling back their recession calls. Small-business owners are increasingly optimistic, and consumer confidence is suddenly bouncing back. (WSJ)

📈 TSMC stock joined the trillion-dollar club. Taiwan Semiconductor Manufacturing surged over the last week on continued optimism for AI demand and innovation. It’s up roughly 50% from its April lows, and it now rivals Berkshire Hathaway in total market cap. (Bloomberg)

🏦 Kevin Hassett is the frontrunner to replace Powell. He’s one of Trump’s longest-serving economic aides, and sources close to the matter say he’s the current favorite for the Fed’s top job. Kevin Warsh is a close second. (Bloomberg)

Interesting

This was expected as rates remain high.

Builders are probably good from a trade but when rates drop they’re competing with all of the other inventory that is going to come on the market as well. It’s not an issue of housing will not perform but an issue of how do we make money from the housing sector at large? From there we can look at new ideas and we have….

A quick update on $VFC ( ▲ 0.46% ) corporation ahead of earnings.

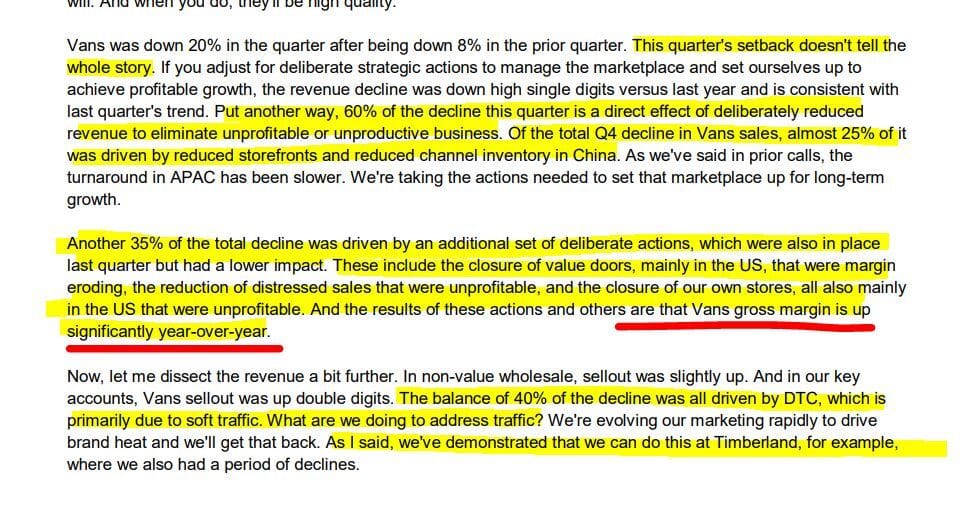

From the last earnings report

The Van’s outlook an plan

From the last earnings report

As I’ve said in past video casts (and this week in DeltaOne) this is a longer-term play and one that is lagging a bit. What it needs is a “sign of life” from Vans this earnings report and if we can get that we get some momentum higher.

For those skeptical on turn-arounds go and look at $AAP ( ▼ 2.87% ) or $BA ( ▲ 1.28% ) and see how long it usually takes which means it’s for the investors here, not the traders.

I continue to own long term 2027 and 2026 LEAPS on this name as well as the shares and will be looking forward to the earnings report coming up.

The AST Swing Alerts Portfolio - updates for members here each week.

Two new positions opened this week

One closed position - $HIMS ( ▼ 0.32% )