The Long Vol Report - Weekly Article of The Week

If you’re a new reader here then here are some links to help you get started on what we do here and how we go about generating idea flow for investors and traders.

How to Use The Report (7 min read)

What is The LongVol Report (5 min read)

Out Swing Alerts Portfolio - Trial Free for 21 Days Here

We also put out a weekly video/podcast here.

Follow on Twitter here.

Reminder: The Fall 2025 Phoenix Investing Conference tickets are here.

There was no video-cast/article last week. This is #79 and we’re covering a recap of some of the earnings we’ve had the last few weeks, ideas from the report, a few notes on the September rate cut, housing and then a quick recap from my Q2 letter to my clients and partners.

Earnings season has been busy and usually, for me, these are the times to not only get updates on portfolio positions but to see what names make it to the tracking phase for potential new ideas.

I personally do not bet on earnings trades as a strategy-set but if we’re tracking a name we like because of the financials/fundamentals we certainly pay more attention to the earnings event to get more data.

This was this weeks report outlook, a bit short given I have been at the hospital for a week with some health issues with my Dad but the notes are below.

Issue 31 Notes

$AFRM ( ▲ 1.57% ) - breakout swing trade.

We’ve tracked this for a month or so in the report with some tailwinds/catalysts driving it. The notes the last few weeks in the price action & commentary section had readers looking for a breakout, which we got.

This was also an AST Alert from a few weeks ago which hit the target.

Technical breakout setup with other fundamental tailwinds. Many readers this week booked gains but also have been trading it into the breakout.

Nice breakout into Friday with a reversal at the open.

$OKLO ( ▲ 3.12% ) - Momentum long into soft targets at $83-85.

This has been a name we’ve covered for the last 3-months as a “trading sardine” because of how it moves. Many readers have made nice gains long and short this. This week the $85 target was noted with a potential reversal which we had as we head into earnings next week.

OKLO $85 targets hit and sell-off

$EXPE ( ▲ 5.1% ) - Another name in the Swing Monitor that broke out to new all-time highs this week with a double beat from earnings.

We noted some key catalysts driving the name a few months ago then updated the technical breakout potential which we got with earnings being the catalyst.

Notes from The Report

✅ Vinny Nasdaq Short (Last week from report discussed outside day reversals)

✅ Franco trading Momo Beta

✅ Matt with $AFRM ( ▲ 1.57% ) swing trade closed and $OKLO ( ▲ 3.12% ) momo beta

✅ Sandy with $AFRM ( ▲ 1.57% ) $OKLO ( ▲ 3.12% ) $BABA ( ▲ 0.22% ) and other ideas for a $5K week

📈Trade Desk Stock Crashes 38% After Earnings. What’s Causing the Selloff. Trade Desk investors were fleeing en masse after the ad-tech company reported second-quarter earnings and guidance more or less in line with expectations but said its revenue growth is expected to slow down in the third quarter.

📈 PayPal Earnings Top Estimates. The Stock Falls. Things are looking up for PayPal Holdings, as the company announced last week that it had achieved its sixth consecutive quarter of profitable growth. The market was slightly less upbeat.

🏦 M&A Is Back. These Stocks Could Be Targets. Mergers and acquisitions are back in a big way, and stocks—big and small—should benefit.

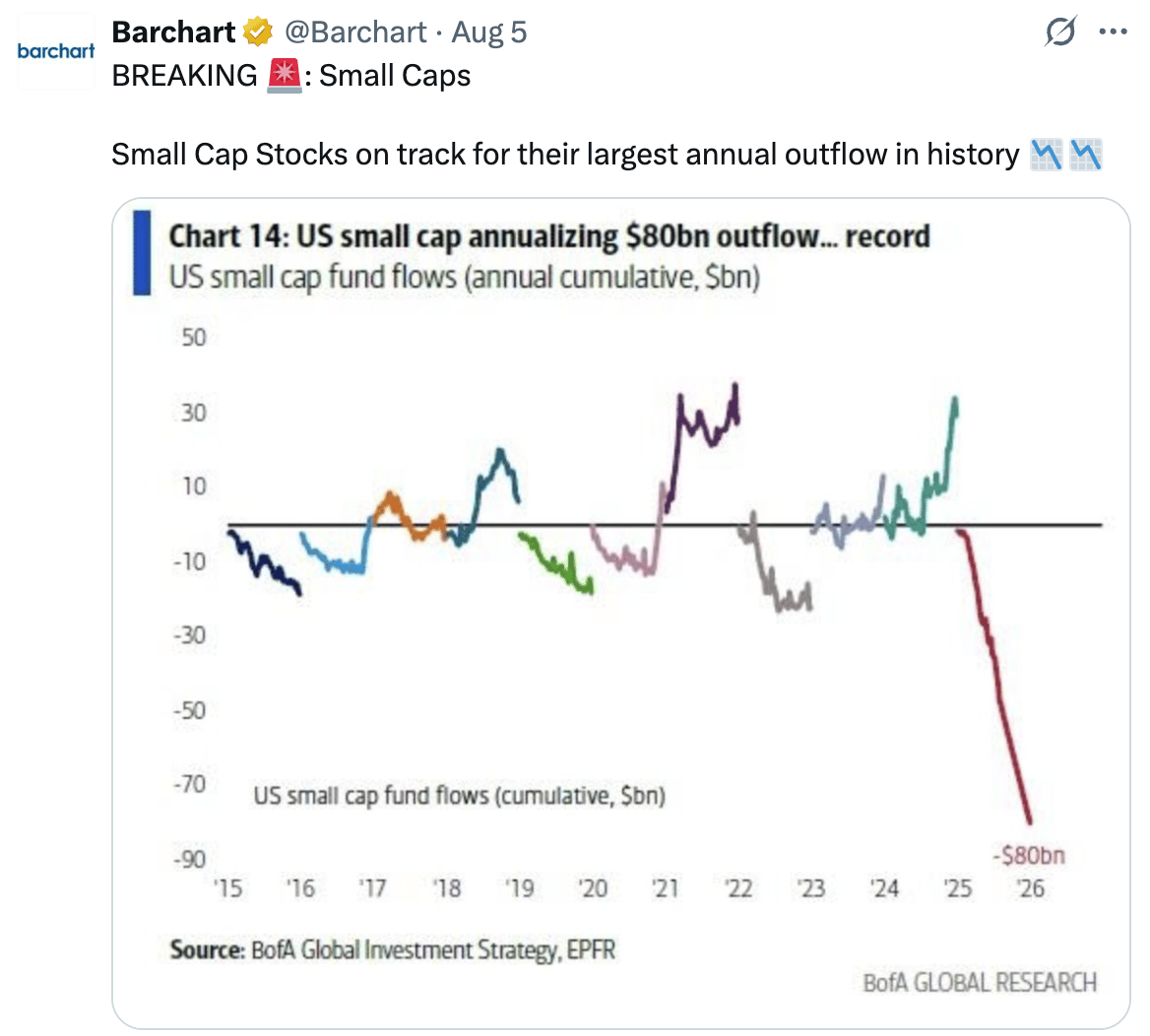

No concern here from me - still actively waiting to get into a few select small cap names into the end of the year and already in a few as is…..

September Rate cut now back at 82%

This is important for the next 24-36 months. Plenty of back log of buyers who are first time buyers coming in, I think we see a price decrease NOT increase when rates drop due to this supply making it a buyers market. As such, the home builders will be competing against each other for sales driving margins lower.

M&A is back! I talked about this last December as an outlook for 2025 and in the back half of the year we should see more of this.

Q2 Investor Letter Review/Discussion

Some quick notes this week I want to share with readers here. For those that are aware I launched the hedge fund (private partnership) back in 2020 then our RIA which is just a big word for advisor/financial advisor in 2024.

While we are not a traditional “financial advisor” doing planning, estates, etc. it is required for us to manage money outside of a limited-partnership structure so that’s why we completed it.

Some of you readers are clients and know the structure but for those new here we run what’s called an SMA (Separately Managed Account) structure which allows the assets to remain in your name which is different from a limited partnership structure - to be clear, both have their benefits.

I am in the process of trying to purchase a CPA firm (a few of them) to roll them up so that we can build our our wealth management side into 2026 - BTW, this is similar to what Brad Jacobs has done with $GXO ( ▼ 0.03% ) and $QXO ( ▲ 1.7% ) just in a different space! So, now that you know that let’s cover a bit of the Q2 letter that I sent out to clients.

For those new, hedge funds usually send these out but they’re usually obnoxious, reading material for wannabes to criticize and writing material for journalists so they can meet their word quota! And, yes, this is how I really feel!

So, let’s go over what some of my views were from Q2, my thoughts on the broad market end of year and then cover some of our ideas (not all, some stay private) for the remainder of the year.

From The Letter

The AST Swing Alerts Portfolio - updates for members here each week.

No new positions opened this week.

Will get a video out this weekend on July positions.