🚀 Options Flows w/ Trader X

Best Options Setups Weekly w/ Price Action Notes

Trader X’s Top 3 Options Setups Weekly: Sent out every Sunday with price-action notes and charts.

Options Flows Insights Weekly: Notable options flows, trade reviews, real P&L trade logs and education on his process and more.

Subscriber Only Posts: Access the full LongVolReport.com subscriber only posts with other investing insights.

Quick Note for Members:

For new members, I am working on sorting out the welcome email but when you sign up you can just click on any post or here and the 3 Best Ideas and my locked posts will pop up. I realize that the members are is a little confusing to use but this is a software from Beehiiv not us and they are making improvements for users but all of the posts are there for you to use.

The $SPY ( ▲ 0.73% ) and $QQQ ( ▲ 1.07% ) are elevated here and what I can say is that there are no moves there to be made given the amount of stocks within them that report so trying to even analyze them right now is pointless because the weightings of the stocks inside them. However, I do think once we get toward the end of the week that we are going to get some index shorts to maybe trade so if you are a subscriber then I will notify you on a trade in these that I may put on toward end of week.

Over +20% of the SP500 companies report this week and what that means is that the index ETFs are going to be choppy until the earnings after the market.

Usually when we get into the heart of earnings season I don’t do too much because of this but there are still trades to be made and then once some companies report, new trades emerge - like $DECK ( ▲ 2.27% ) last week.

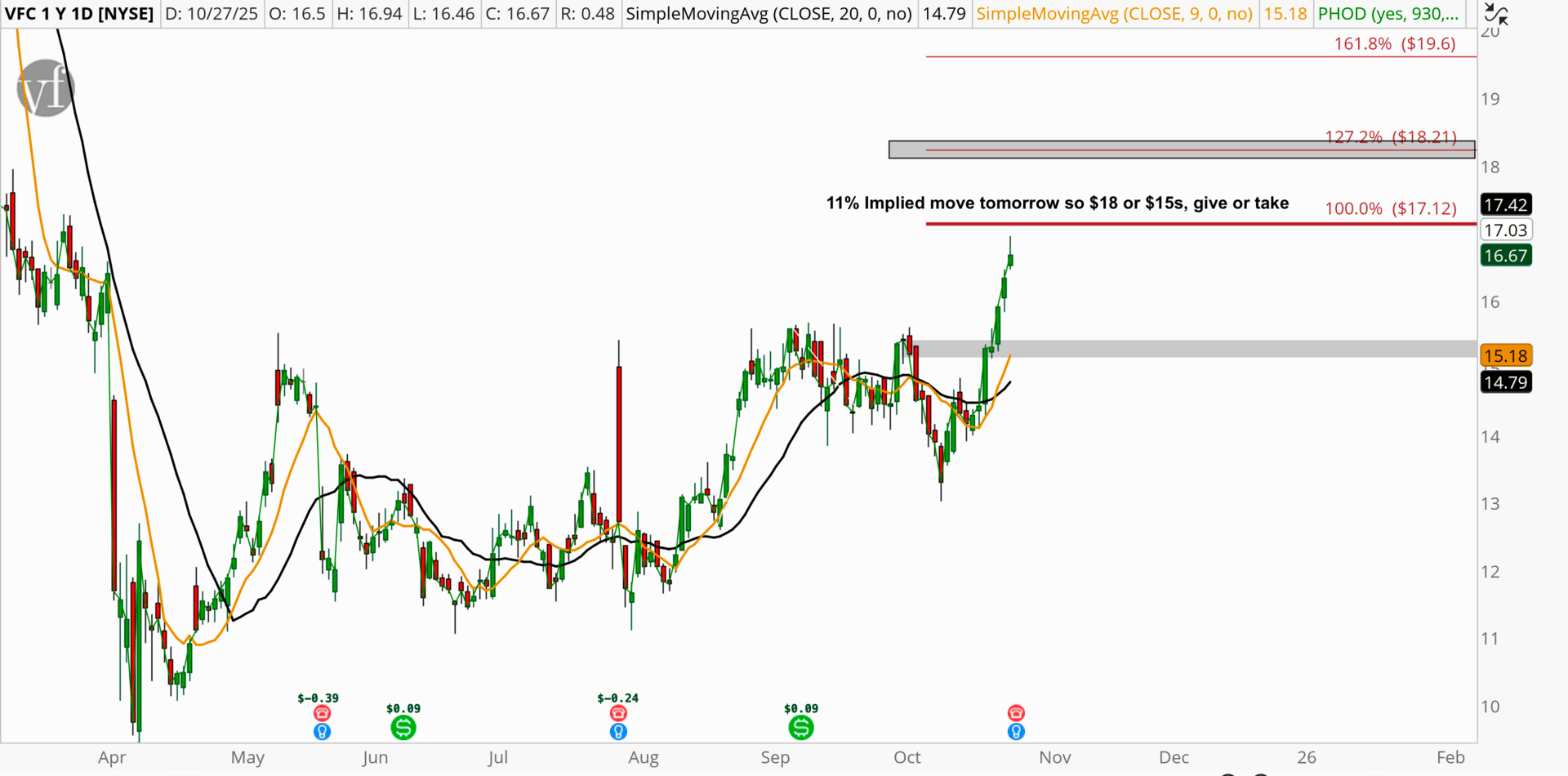

One of the names that I own $VFC ( ▲ 0.46% ) reports tomorrow and this is a turn-around stock that Dan flagged last year and this year that we have traded in and out of and I want to give readers a quick trading-note here because I saw a discussion in the Discord on it today.

I own calls and shares on this and when we get to earnings I just look at the implied move to get a an idea of what the stock should do. In this case the implied move on $VFC ( ▲ 0.46% ) is about ± 11% so that means $2 or so either way. This really only matters to me not because I put a trade on the day of but because when I come into earnings with a position I already own I can make the decision to trim or exit the entire thing.

In this case the expectations are really slim for this to just magically run to $25 a share (I mean it could) so you just want to take the sure money then I can re-position on this next week which I plan to do so just as a heads up to all of you here this will be a new trade here soon. This took me a few years of learning with Dan to understand but it helped me to manage positions so I just wanted to share this with all of you here in this post today and hope it helps you too!

I took on one of the positions I talked about yesterday in the Best Ideas post so I am going to cover that and just go over quickly a few updates to the other ideas we’re waiting on.

- Trader X's Top 3 Trade Ideas Weekly

- Trader X's Insights for Trading Options

- Real P&L Trades Posted w/ Fills

- Subscriber Only Posts